Many traders like trading cheap stocks — and sub-penny stocks are another level of cheap.

I like cheap stocks too. Penny stocks helped me make over $6.9 million in my 20-plus years of trading.*

Feeling skeptical? I don’t blame you. In fact, I want to take a minute to clear something up…

Most penny stocks suck. And that’s 10 times truer for penny stocks under 1 cent. I will never invest in a sub-penny stock. I’ll only trade these stocks.

Cheap penny stocks can be great for traders with small accounts … but with a process and rules. Like my #1 rule — cut losses quickly.

Falling in love with a penny stock is a good way to blow up your account.

You need to think differently about trading if you want to trade sub-penny stocks. Don’t think of it as a lottery with one golden ticket. Think of it instead as your job, where you have to clock in every day … even on weekends.

And seriously use the weekend to STUDY HAAAARD! Go study my FREE https://t.co/KON0UFjulH guide, my FREE https://t.co/ZB6EtRjpli rules & FREE https://t.co/LZD2YySd0U guide & FREE https://t.co/SKdarBd9IK book & FREE https://t.co/6oLl0jlfuv videos, knowledge truly is power so get it

— Timothy Sykes (@timothysykes) February 7, 2021

You can start building your knowledge account with my FREE penny stock guide. If you’re serious about trading, this should only be the beginning.

The market’s a battlefield. Anyone who tells you otherwise probably isn’t on your side.

(*Please note: My results are far from typical. Individual results will vary. Most traders lose money. I have the benefit of years of hard work, dedication, and experience. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

Table of Contents

- 1 What Are Sub-Penny Stocks?

- 2 Sub-Penny Stocks: Rules and Regulations

- 3 Pros and Cons of Sub-Penny Stocks

- 4 Where Can I Buy Sub-Penny Stocks?

- 5 Sub-Penny Stocks That Have Made It Big

- 6 Sub-Penny Stocks With Potential in 2021

- 7 Trading Sub-Penny Stocks: 4 Tips for Beginners

- 8 Should You Trade Sub-Penny Stocks?

- 9 The Bottom Line on Sub-Penny Stocks

What Are Sub-Penny Stocks?

document.write(new Date().getFullYear()); Millionaire Media, LLCSo you know that penny stocks aren’t to be trusted … I wouldn’t turn my back on sub-penny stocks.

Most of these companies are companies in name only. All too often they’re fronts for promoters and insider trading.

Attaching a sub-penny stock to a hot sector gives it some credibility. Issue one press release and its share price could go supernova.

Sketchy sub-penny stocks do this often. It makes sense when you consider that most of these companies don’t sell real products. Their product is their stock.

But I want you to think about it. Will a penny stock be first to market with a new drug… Or will it be a bigger company with heavy R&D investment?

Don’t believe me? Look at the earnings reports. Many of these ‘companies’ don’t have real sales, assets, or anything that gives a company value.

But it doesn’t matter if you want to trade these stocks.

Look at Ozop Energy Solutions Inc. (OTCPK: OZSC), for example. It used to make surgical equipment. Now it evidently makes battery chargers for nuclear submarines.

Whatever kind of company it is, it’s been one of my favorite plays over the past few months.

It was a sub-penny stock in 2020 … In 2021, it had a few big trading days on news catalysts.

Are any of these stories for real? Who knows. And honestly, I don’t care. What’s real is the $44,000 I’ve locked in going long on this stock.*

Sub-Penny Stocks: Rules and Regulations

document.write(new Date().getFullYear()); Millionaire Media, LLCSub-penny regulations don’t actually refer to sub-penny stocks.

‘Sub-pennying’ refers to sketchy bids floated by brokers, dealers, and high-frequency traders.

Ever read the Michael Lewis book “Flash Boys?” If not, I recommend it if you want to trade this niche. It helps explain why I prefer penny stock trading to competing with Wall Street.

Basically, the system is rigged. And sub-pennying is a part of it.

High-frequency trading firms and shady dark pools are the big culprits. They’ll swoop in on a limit order with a hidden bid that is a fraction of a penny better.

By doing this, they get their transactions executed first. This gives these bidders the best chance to capture the spread.

(As an Amazon Associate, we earn from qualifying purchases.)

Pros and Cons of Sub-Penny Stocks

document.write(new Date().getFullYear()); Millionaire Media, LLCSub-penny stocks are like penny stocks on caffeine. What I mean is that the best qualities of penny stocks can be multiplied in sub-penny stocks…

And they can be much riskier!

I love trading penny stocks for their volatility. This sounds scary … and it’s one of the reasons that penny stocks have such a bad reputation.

But volatility can be a good thing. Especially if you focus on limiting risk.

I put out a no-cost “Volatility Survival Guide” to teach traders the upside of volatility. I made this four-part video series to educate traders on the potential of penny stocks.

And you need to invest in your education if you want to trade these stocks successfully.

So much of the financial media hates these stocks. And they’re right about the big picture — most of these stocks really suck. Even when a sub-penny stock posts big gains, it’s usually temporary.

There’s simply no good way to invest in sub-penny stocks.

But that’s OK. I’ll never invest in one of these stocks … or any penny stock. And neither should you.

Short-term trading is a different story. If you understand how to trade them you can potentially build your account.

Where Can I Buy Sub-Penny Stocks?

document.write(new Date().getFullYear()); Millionaire Media, LLCYou won’t find much buzz about sub-penny stocks on Reddit. That’s because a lot of Redditors trade with Robinhood. Access to the OTC markets isn’t available through some brokers, including Robinhood.

Robinhood traders have access to listed stocks. And exchanges like the NYSE and Nasdaq enforce a minimum share price of $1. If a stock trades below the dollar level for a set amount of time, it will be delisted.

The majority of sub-penny stocks never make it to that level.

The other listing requirements these exchanges have? The ones that ensure listed stocks are connected to real businesses?

Forget about it. You’ll find these stocks on the OTC market boards. This is where the sketchiest stocks trade.

Sub-penny stocks can’t trade on the highest OTC market tiers. Even they have too many listing requirements. The pink sheets is where you’ll find these stocks.

Pink sheets are the Wild West of the trading world. There isn’t a lot of accountability here. A lot of these companies are small and illiquid. There’s no requirement to disclose financial information.

You can buy pink sheet stocks through most major brokers. Do your due diligence before signing up to make sure you can trade OTC stocks if that’s part of your strategy.

Sub-Penny Stocks That Have Made It Big

document.write(new Date().getFullYear()); Millionaire Media, LLCSo you want to see big gains?

Despite everything, there are some sub-penny stocks that soared in 2020.

These gains aren’t the kind that you see in ‘penny stocks done good’ articles. Even the best former sub-penny stocks still trade under 10 cents.

But if you caught any of these stocks on the way up (or shorted them on the way down) you would have done well.

HUMBL Inc. (OTCPK: TSNPD)

HUMBL Inc. is the product of a reverse merger between HUMBL and 2020 sub-penny star Tesoro Enterprises, Inc. (formerly OTCPK: TSNP). Both companies clawed their way out of the sub-penny ranks in 2020 on the strength of insane volume.

TSNP got as high as 35 cents.

TSNPD was almost at $8 in February 2021.

TSNP went from construction materials to blockchain trading … At least that’s what they said when they merged with HUMBL in December 2020.

Look at all that volume pour in.

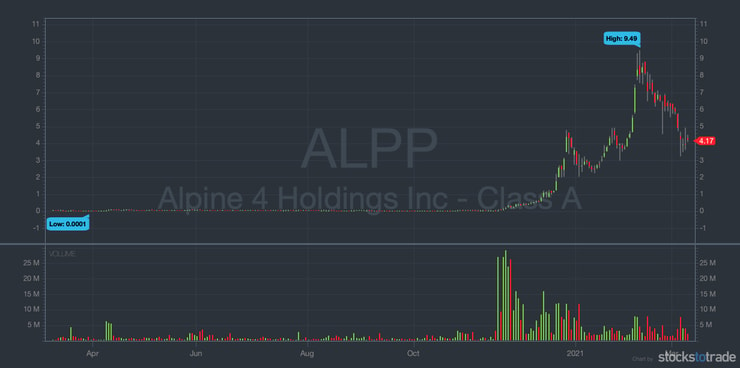

Alpine 4 Technologies, Ltd. (OTCQB: ALPP)

ALPP is a holding company that has its fingers in a number of sectors.

It entered the drone market in November 2020 when it acquired Impossible Aerospace Corporation. Defense is a hot sector, and this news was one of the catalysts for a gain of nearly 9,000% by the end of the year.

Its rise wasn’t done. It announced EV contracts for one of its subsidiaries and hit another high. Then news of a patent for a ‘rear-end avoidance collision product.

Now it’s become one of the largest sheet metal manufacturers in the Midwest.

What business is it in? Is it a real company?

I don’t know. But I do know that it can run on news. And that’s enough to keep me watching this stock.

Sub-Penny Stocks With Potential in 2021

document.write(new Date().getFullYear()); Millionaire Media, LLCI hope I haven’t built up your expectations for these stocks.

It’s easy to look back at an ALPP or a TSNPD and think, ‘If I’d bought it then…’

You’re only deceiving yourself if you think it’s that easy. You need tools if you want to be able to trade penny stocks.

If you want a crash course on penny stock trading, get into my 30-Day Bootcamp. It’s 30 days of videos and lessons to help you build a solid foundation for trading penny stocks.

You need to be able to think fast if you want to ride the momentum of these stocks. You need to know when to ride a breakout and when you’re buying at the top.

If you chase these stocks, you WILL get burned. And I don’t want to see that.

I don’t want to see more casualties in the penny stock world. That gives these stocks a bad name. It puts off the people who can benefit most from trading these stocks.

So consider this my disclaimer. These are not stock picks. They’re opportunities to watch and learn from.

Sub-Penny Stocks to Watch #1: Charlie’s Holdings, Inc. (OTCPK: CHUC)

CHUC spiked from 0.5 cents to 4.5 cents in January, on the strength of never-before-seen volume.

It fell from there, but stayed above 1 cent for the month … Then it rallied again in February, for a gain of almost 100%.

Now it’s back under a cent.

The company is in the e-cigarette business. They make vaping products, hemp-derived CBD, and an energy drink.

Why did the stock spike on no news? It may have been a pump.

I still traded it. I dip bought it on an intraday panic off its high. I got out after it had a small bounce… Taking singles like this is a big part of the discipline needed to trade these stocks*.

I’m still watching it. It’s a former runner … There may be more plays in its future.

Sub-Penny Stocks to Watch #2: Santo Mining Corp (OTCPK: SANP)

This is a sub-penny stock that’s been showing some signs of life.

It specializes in gold mining in the Dominican Republic. But lately, it’s been doing another kind of mining — Ethereum.

Crypto plays are always hot, but now they’ve reached another level. The volume’s there. Look at the number of billion-plus days SANP has in 2021!

I dip bought this in February for a solid single.* I’ll monitor this stock for future spikes.

Sub-Penny Stocks to Watch #3: Saddle Ranch Media Inc (OTCPK: SRMX)

This is another wannabe conglomerate with its fingers in a number of pies.

It produces questionable-sounding documentaries like “Getting to the Point: The Truth about Vaccines.” It provides ‘interactive and dynamic digital technology.’ It’s got something to do with the Internet of Things.

That’s enough for the chat rooms to send this stock up nearly 5,000%!

It failed to spike quite as high on the last surge. But I’m still keeping it on my radar.

Trading Sub-Penny Stocks: 4 Tips for Beginners

document.write(new Date().getFullYear()); Millionaire Media, LLCTrading sub-penny stocks can be tricky. I wouldn’t recommend them for beginners, but the following tips are useful in trading any penny stock.

Look for Volume

This is the biggest thing.

It’s easy to look at a sub-penny stock’s trend, and think it has potential. You may like its chart. It may be a former runner.

None of this means a thing without volume. Without liquidity, you can get stuck in a position. All the planning in the world doesn’t mean a thing if you can’t exit a trade when the time is right.

This is true for all stocks, but it’s especially true for sub-penny stocks. If a normal stock trades over one million shares in a day, that might be enough liquidity to trade. But sub-pennies can shift one million shares in one transaction!

This might move the price, but it doesn’t do much for liquidity.

Beware the Skull-and-Crossbones

Another risk of these stocks is they can implode at any time. OTC Markets tries to make sure that the stocks it lists aren’t out-and-out frauds…

But with no required financial disclosure it’s not always possible. So they do the next best thing and tell you when one of their pink sheet stocks is suspected of something shady.

They slap it with a ‘caveat emptor’ designation, aka as the dreaded skull-and-crossbones.

After this happens, it’s pretty hard to trade. And the stock price will fall correspondingly.

Don’t Hold Onto These Stocks

You should think twice about holding onto any sketchy stock. But these ones will reliably fail.

I’ve seen so many traders buy into the BS. They see a sub-penny with big news and think that catching it at the right time.

Let me tell you something — this is highly unlikely. Don’t stay in sub-penny positions too long and take profits when you can.

Should You Trade Sub-Penny Stocks?

document.write(new Date().getFullYear()); Millionaire Media, LLCFull disclosure: I’m not crazy about sub-penny stocks.

I’ll trade them if the price action is right. But I’ll get out quick at the first sign of trouble.

If you want to trade sub-penny stocks, it’s important to have the right tools. And the best tool? Your knowledge base.

In my Trading Challenge, I teach skills for volatile stocks like sub-pennies. If you apply and are accepted, you’ll get access to thousands of lessons that cover every area of the penny stock world. You can even see me trade.

But if you’re looking to make easy money trading stocks, the Challenge is the wrong place for you. And honestly, so is the market.

I want my students to study hard. Because your work ethic is the only thing you can count on in the market.

What Are the Cheapest Penny Stocks?

The lowest a stock can go is $0 … which means its shares are worthless. Be careful with cheap stocks.

What Is the Most a Penny Stock Has Gone Up?

Ever heard of a company called Amazon.com Inc. (NASDAQ: AMZN)? Back at its 1997 IPO, it traded for under $2. Now? It’s north of $3,000 per share.

What Are the Best Stocks Under $1?

If you want to find cheap penny stocks, you’ve got to screen for them. I look for high volume, big percent gain, a good chart, and a news catalyst.

Can I Find Sub-Penny Stocks on Robinhood?

Since Robinhood doesn’t have OTC market access, you won’t find sub-penny stocks through this broker. This is because of the share price minimums that official exchanges have, which start at $1. When a company falls beneath this mark, it’s in danger of being delisted.

The Bottom Line on Sub-Penny Stocks

document.write(new Date().getFullYear()); Millionaire Media, LLCI would never recommend a sub-penny stock or any penny stock. Never blindly follow tips or alerts — even mine. Learn to think for yourself and find YOUR strategy.

Remember that most of these stocks are junk and will eventually be worth nothing.

You’re playing with fire when you trade sub-penny stocks.

That said, there can be trading opportunities with these stocks. But go into it with your eyes open.

Build your knowledge account before you wade into the deep end of penny stocking. I’ll be waiting for you when you’re ready to level up.

What do YOU think about sub-penny stocks? Did I scare you off trading them? Let me know in the comments — I love hearing from my readers!

Leave a reply