We all want more trades because…

More Trades = More Money…right?

That’s true as long as you stick with quality setups.

However, things get complicated when you limit yourself to just one stock or index.

You end up forcing trades on setups that aren’t there without a clear edge.

At best, you’re getting a coin flip.

I prefer to wait for ideal setups to form on battle-tested patterns like my 7-Step Penny Stock Framework.

Not only does it make my trading simpler, but it’s more reliable.

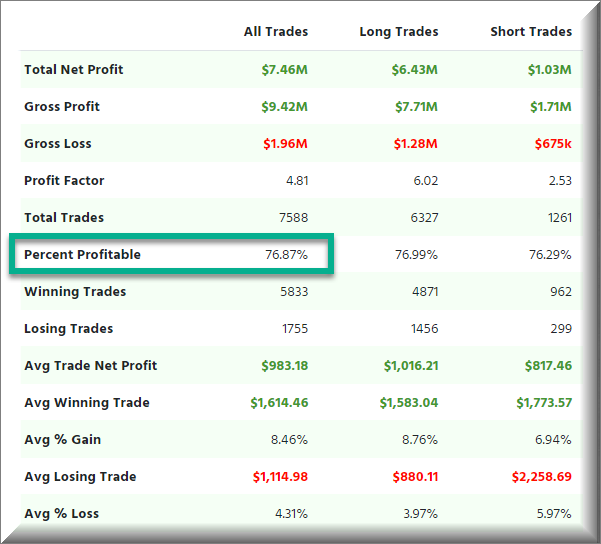

That’s how I achieved a +75% Win Rate and helped more than 30 MILLIONAIRE CHALLENGE students become millionaire traders.

All my trades are posted HERE on Profitly for anyone to see.

Now, it’s not enough to know the 7-Step Penny Stock Framework.

To turn it into trades, you need to:

- Determine where a stock sits in the framework

- Select an appropriate setup

- Execute the trade with proper risk management

That might sound complicated, but it’s much simpler than you might think.

Let me walk you through some examples of trades I took and how I applied this process.

AMTD Digital Inc. (NYSE: HKD)

2026 Millionaire Media, LLCThis little known stock blanketed trading blogs this summer with an epic post-IPO run that sent shares up almost 13,000% in a matter of days.

As I mentioned in Friday’s blog post, former runners are great stocks to find trades.

HKD is a perfect example.

After its summer sizzle, shares hung around $12 until the middle of last week.

That’s when shares caught fire in the premarket, though without any specific news behind it, just pure pump action.

This caused a lot of shorts to get squeezed, doubling shares in less than 24 hours.

Although there weren’t any headlines, our Breaking News Chat Room alerted traders, including me, to the price action.

Every penny stock that goes Supernova, following the 7-Step Penny Stock Framework, starts with the initial run.

The ‘pump’ is the first phase, followed by the ‘ramp.’

During this time, I look for breakout trades and morning panic dip buys.

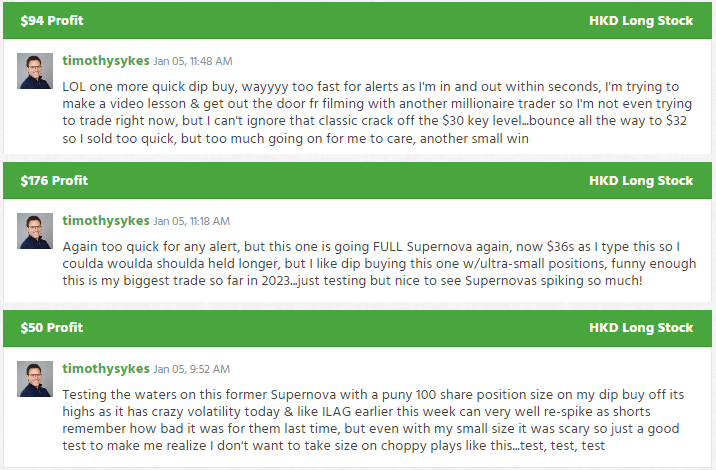

Although my gains weren’t huge, I captured two morning dip buys and a breakout trade.

Here’s what they looked like on the chart:

Morning panic dip buys are the easiest for newer traders and those with small accounts to learn.

They take some practice, but are fairly easy to identify.

I like them because they work on both the front side of a stock going Supernova and the back side when they crash.

Let’s move on to another former runner that didn’t work out as well, but provides some great lessons.

Intelligent Living Application Group Inc. (NASDAQ: ILAG)

2026 Millionaire Media, LLCAround the same time as HKD’s summer run, ILAG had its moment, burning a lot of short sellers in a quick and violent squeeze.

To start the New Year, this former runner caught a bid around mid-morning and began its 100% climb.

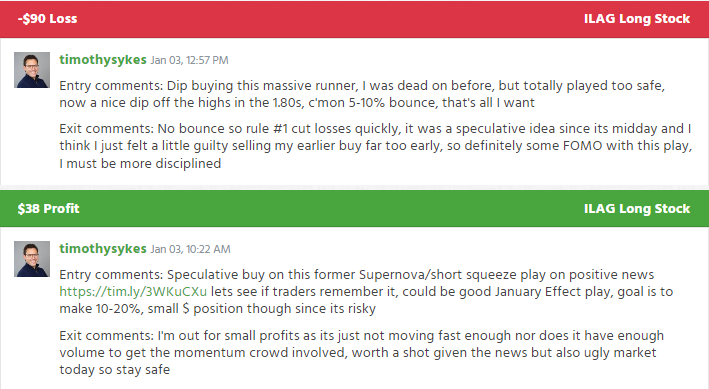

I went for two dip buys on the stock, neither of which really worked.

The first one didn’t move fast enough for me and the second wasn’t well-timed.

However, this is where the execution piece comes into play.

In both trades I wanted to see the bounce happen quickly. Otherwise, I would cut them loose, which is exactly what I did.

In the first instance, you can see the bounce was slow to materialize.

The second simply didn’t bounce and I ended up with a small loss.

ILAG’s run created the conditions for the setups to form.

Once I saw them, I only traded the ones I liked best.

You could argue that a breakout trade shortly after my first dip buy would have been better…

…or that I should have waited for better pullbacks.

Both are valid points.

As you’ll see in the notes below, I kept my positions very small, effectively testing the waters after coming off a great run at the end of last year.

More Breaking News

- Coty Anticipates Revenue Decline Amid Market Challenges

- China SXT Pharma Launches AI Supply Chain Overhaul for TCMs

- White House, Regulatory Moves Stir Cryptocurrency Market Talks

- Sezzle Inc. Sets New CFO, Anticipates Financial Empowerment Initiatives

Making The Frame-Work For You

I encourage newer traders and those with small accounts to stick with cleaner setups.

While both of these stocks provided the conditions for trades, morning panic dip buys are easier to do on the backside of a runner once a stock has fallen +10% or more – ideally as much as 50%.

The more obvious the setup, the greater the chance of success.

I teach my students the 7-Step Penny Stock Framework so they don’t have to force trades.

With enough practice and study, most can find several quality trades each week that are simple and straightforward.

In my opinion, that’s a lot easier than trying to forecast where the S&P 500 is headed.

—Tim

Leave a reply