Right now, everyone on CNBC is talking about the January effect.

They parade pundits day after day – so-called ‘analysts’ who display pretty charts and make wild proclamations…

…Stocks are cheap…

…Tax loss selling is over…

…The Fed will cut rates…

These ‘experts’ are nothing more than glorified promoters.

One look at a chart of the S&P 500 should tell you everything you need to know.

Do you think this looks like it’s ready for a bull run?

I’m not going to try and forecast where the broader markets are headed in the near-term.

Instead, I’m focused on the one area EVERYONE continues to overlook…

As I explained in THIS blog post, the January Effect isn’t necessarily about big cap names or broad-based buying.

It’s about stocks like Intelligent Living Group (NASDAQ: ILAG)…

It’s about stocks like AMTD Digital Inc. (NYSE: HKD), one of the BIGGEST runners of 2022, climbing an eye-popping +12,000% from its IPO.

Please retweet/congratulate this hardworking https://t.co/occ8wKmT5U student as ALLL her studying is paying off with this awesome former Supernova coming back now! Remember https://t.co/1nS6lhMK6E ALWAYS! sandrapanditcook: $HKD 20.52-33.00. One of my biggest gains so far. Whew!

— Timothy Sykes (@timothysykes) January 5, 2023

These are the names I’m locked in on.

My Millionaire Challenge students get my daily game plan, highlighting the stocks I’m watching that day.

But that’s just the end result of the training.

The main course is the ‘how’ and ‘why’ these stocks made my list.

I want to give you a peek behind the curtain and walk you through my process to identify and trade these stocks.

That way, you can prove to yourself just how powerful the Millionaire Challenge coursework really is.

Table of Contents

See What I Traded

Want to make things really easy on yourself?

All of my trades are posted here on Profitly.

You can see every stock, every trade, every P&L from my trading.

In 2022, I took over 400 trades.

But many of these happened on the same stocks.

Look at what the hottest ones were, the ones I trade the most, and put them on your list.

Study the 7-Step Penny Stock Framework

A trader could find a lifetime of opportunities using my 7-Step Penny Stock Framework.

It’s the blueprint that walks you through the different phases of a penny stocks lifecycle.

But here’s the secret…

It works again and again!

Just because a stock went Supernova in the past doesn’t mean it won’t in the future.

In fact, those are the best stocks to look for in January.

This image can occur when a stock is $5 and when it’s $0.50.

More Breaking News

- China SXT Pharma Launches AI Supply Chain Overhaul for TCMs

- Bitcoin Crash Sparks Sharp Decline in Cryptocurrency Stocks

- Key Takeaways

- Bombardier’s Strategic Moves Propel Stock Amid Competitive Landscape

In THIS blogpost, I run through an example of a former OTC runner that netted a tidy +$6,000 profit (my starting stakes were $23,712).

Keep Up With The News

Now, I don’t want you to think that stocks just start popping off out of nowhere.

As with their original ramp, the majority of these stocks rely on a news catalyst to get them going.

From there, promoters take over and help drive shares higher.

Now, you could scour Twitter and try to track all this information.

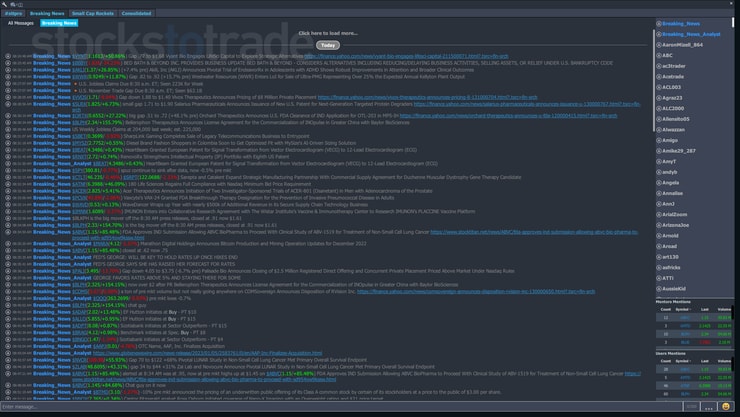

We make it easy with our StocksToTrade Breaking News Chat Room.

I can’t tell you how much time this has saved me.

Rather than looking for the stocks and then backing into the news, the Breaking News team delivers the headlines along with the price action.

Click here to try out our Breaking News Chat room.

Quite simply, once I see a headline that catches my eye, I double check the stock’s chart history to verify it was a former Supernova.

That’s how I locked in on HKD for a couple of trades to start the new year.

Work Backwards

The best stocks to trade are multi-day runners.

So, I don’t need to catch the first day.

In fact, I prefer to wait until a stock has risen a decent amount before looking for breakout trades or morning panic dip buys.

That’s why I run a scan every day after the close or the following morning for stocks:

- That gained +20%

- Saw a large increase in volume

- Are priced below $5.00

Our StocksToTrade Platform makes it easy to setup and screen for these parameters.

From there, I add stocks to my watchlist, only removing them if they fade back to their breakout areas.

Select the Appropriate Setup

Once I’ve identified a stock, I watch the price action at the open.

That’s where I shine, taking trades like my morning panic dip buy.

What’s key here is that the pattern only creates the opportunity.

I still need the setup to form before I take a trade.

The more stocks that run, the more chances you’ll find a quality setup.

But remember, don’t force the trade.

Not all patterns lead to setups.

Wait for both to align before putting your hard-earned money to work.

—Tim

Leave a reply