Penny stock volatility is key to my trading strategy. But it’s also counterintuitive…

On one hand, it increases risk. But volatility also opens up opportunities. It lets me trade more conservatively and still take the meat of the move.

In this edition, I’ll compare three volatile plays from last week. And I’ll review my biggest winning trade — an extremely volatile supernova with a twist.

Keep reading to see what I mean. First…

Table of Contents

- 1 Karmagawa Proudly Announces Two New Schools

- 2 Trading Mentor: Embrace Penny Stock Volatility

- 3 Trade Review

- 4 Millionaire Mentor Market Wrap

Karmagawa Proudly Announces Two New Schools

When Mat Abad and I teamed up to create Karmagawa, we agreed education should be a priority. The opportunity for an education made everything we do possible.

Many children in Bali don’t own even one book. The libraries are often run down and in need of work. The books are old. It’s uninspiring. Which is why I’m SO proud to announce the opening of Karmagawa’s 25th and 26th projects with the Bali Children’s Project.

These schools will inspire hundreds of children to learn. And that will expand their future opportunities.

Trading Mentor: Embrace Penny Stock Volatility

Right now there aren’t as many volatile OTCs as January and February. But there are big spikers and plenty of opportunities if you hunt for the most volatile penny stocks. Volatility is the name of the game.

This brings up an interesting question I got from a student last week. He asked why I didn’t trade a certain stock on my watchlist. (Sign up for my weekly watchlist here.)

It seems obvious to me … a watchlist is a watchlist. NOT a buy list. But there was another very important lesson some newbies might not understand…

Volatility Is Your Friend

Without volatility, there’s nothing in it for day traders. You might as well change to long-term value investing if you don’t like volatility. Yes, it can be scary at first…

Funny how many people are comparing this video to trading volatile assets like #Bitcoin and #pennystocks as it's most terrifying at the start, but then you get used to the seemingly insane volatility & after a while you start to really enjoy it…do you agree? https://t.co/n9SJRmKhux

— Timothy Sykes (@timothysykes) April 19, 2021

So let’s get some perspective. Before I go any further, a little review…

What Is Volatility?

The simplest definition of market volatility is the range between the highs and lows. The first thing I look for when I make a watchlist is big percent gainers. In other words, I hunt for volatility.

More Breaking News

- Oracle’s $50B Cloud Expansion Plans Fuel Stock Surge

- Valterra Platinum’s Q4 Forecast Drives Anticipation Amidst Earnings Surge

- Strategic Moves Propel CCH Holdings: Stock Soars

- AZI Stock Slips as Investors Eye Key Developments

Penny Stock Volatility

The potential for high volatility is one reason I love penny stocks. They can make huge runs compared to big/real companies. The beautiful thing is that when the moves happen it’s the same patterns over and over again. It’s that big-picture pattern I love and teach.

But too many newbies still think penny stocks are investments. They’re not. Hold-and-hope tweets about pumped stocks make one thing very clear…

Newbies have NO IDEA how to take advantage of volatility.

Whenever any promoter or newbie says to hold onto any pumped up OTC play, remember the horrendous longterm charts of $OZSC $ENZC $HMBL $ALPP $OPTI $ALYI $ASTI $VPER $GTLL $INVU $HQGE ALL of which I bought but also which I sold into strength before their 70-95% crashes #studyhard

— Timothy Sykes (@timothysykes) April 15, 2021

Sadly, bag holders still believe in these stocks. They post about due diligence when their stock is down 70% off its highs. They don’t understand…

Opportunity and Risk: The Double-Edged Sword of Volatility

Big price swings create opportunity. But they also increase risk. That’s the double-edged sword of volatility.

The goal is to take advantage of the opportunity while keeping risk small. It’s not easy. That’s why you need to study, practice, and study more. Make it your goal to stay in the game, NOT to get rich quick.

Promoters want you to believe it’s all about hot picks. Or that holding and hoping will work in the long run. They say, “It’s going to the moon. Only weak hands sell.” But that’s BS.

That said, you should look for, embrace, and learn to trade volatility. One lesson from last week is that volatility comes in different levels. I made a video lesson for students comparing volatile plays. If you’re a Trading Challenge or Pennystocking Silver member, watch the video for a deep lesson.

If not, this will give you the basics…

Comparing Volatile Penny Stock Plays

Again, this lesson started during my Trading Challenge Q&A webinar last week. A student asked why I focused on one stock instead of another. He wanted to know why I didn’t buy a stock even though it did what I was watching for.

This is a valuable lesson, so pay attention.

Given a choice between two or three stocks, I will always trade the one I think has the most potential. I’m not one to take several positions at once. It’s not wrong, and sometimes I do it. But I’m not comfortable with it. I’d rather focus on the one play I think is best.

And I don’t always pick the right stock. So I’m not saying my way is the only way.

But in my experience, the most volatile stocks following my framework with the most range, are the least stressful to trade.

Let’s look at three charts. All these stocks made my watchlist last week. And all are at various stages of my framework. Let’s start with a stock with a multi-month setup.

BIGG Digital Assets, Inc. (OTCQX: BBKCF)

This is the BBKCF three-month chart…

As you can see, BBKCF went from 29 cents a share to $4 per share over a three-month period. That’s 1,281% — or roughly 13 times your money. That’s impressive. And it sped up, going from $1.85 to $4 in eight days.

This is a classic example of the front side of a supernova. But compare it to the next two stocks…

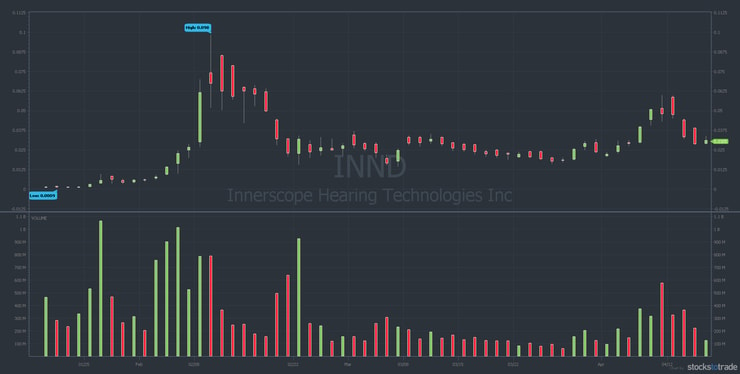

Innerscope Hearing Technologies, Inc. (OTCPK: INND)

This is the INND three-month chart…

INND went supernova in January/February, running 1,078% over a three-week period. Then, in early April, it bounced for a few days when the company teased a press release with a tweet.

Notice the difference in volume and price range between the February and April spikes. That doesn’t mean it’s a bad play. But if there’s something with more volatility and liquidity — more range and volume — I’ll always look to trade that first. Check it out…

Regen Biopharma, Inc. (OTCPK: RGBP)

Here’s the RGBP three-month chart…

RGBP spiked 2,630% in three days. It’s the single biggest runner in the markets in April. And it’s following the classic 7-step framework.

RGBP was my top overall play last week — at least in part — because of the volatility.

A word of warning…

Avoid the One-Indicator Trap

Many new traders make this BIG mistake. They recognize one indicator and forget the other six on my Sykes Sliding Scale. So, while I focused on the stock with the most volatility last week, it wasn’t only about volatility.

I also considered the catalyst.

Innerscope Hearing teased a product launch with a Fortune 250 retailer in its tweet. It became an upcoming news play. The date came and went, and the news was pretty boring.

RGBP’s catalyst was a licensing agreement with Oncology Pharma (OTCPK: ONPH). That’s a huge legitimizer because ONPH is a bigger company.

So one catalyst was upcoming news with a specific date. The other was a licensing agreement with a big company that will pay in the future. One didn’t move the stock much. The other spiked the stock a massive amount.

But I watched to see how the market reacted. I focused on the stock that gave me the biggest opportunity that day.

It’s not an exact science. I traded INND after the tweet on April 5.* But by the time the student asked the question, the news had come and gone.

(*These kinds of trading results aren’t typical and don’t reflect the experience of the majority of individuals using our products. From January 1, 2020, to December 31, 2020, typical users of the products and services offered by this website reported earning, on average, an estimated $49.91 in profit. This figure is taken from tracking user accounts on Profit.ly, a trading community platform. It takes years of dedication, hard work, and discipline to learn how to trade. Individual results will vary. Trading is inherently risky. Before making any trades, do your due diligence and never risk more than you can afford to lose.)

So why was I still watching INND?

Part of the Learning Process

It boils down to screen time. It’s part of the learning process. It’s OK to NOT take a trade and just watch what happens with a stock. Pay attention to how the market reacts to news. Learn how a stock trades. Go through my trades and check how often I trade a stock multiple times during a run. It’s not a coincidence.

Let’s take a look at another high-volatility stock from last week. This was my biggest percent and dollar win of the week…*

Trade Review

This spike shows how crazy things can get when there are multiple catalysts. It’s a great intraday example of the 7-step framework. And it’s also an example of why it’s important to stay focused and take singles.

Sysorex Inc. (OTCQB: SYSX)

Sysorex Inc. was one of the most volatile stocks in the market last week. On April 14, it ran from $1.61 to $15. It closed at $7.55 after going through several wild swings.

The catalysts? There were two…

First, Inpixon (NASDAQ: INPX) announced it converted a note receivable into Sysorex shares. Then, Sysorex announced a reverse merger with TTM Digital Assets & Technologies. TTM Digital Assets is an Ethereum mining and blockchain company. With bitcoin hitting new highs last week, the combo catalysts made for a CRAZY spike.

First, check out the SYSX three-month chart…

As you can see, SYSX was trading at 40 cents a share three months ago. Keep that in perspective as you check out the April 14 intraday chart with my buy and sell alerts…

Notice I didn’t chase the big spike. Instead, I waited for the dip buy opportunity. My goal was to make 50–75 cents a share. It was so fast I made nearly $2 a share.*

My Favorite Pattern for Small Accounts

This is an example of the classic panic dip buy pattern. But in this case, the previous steps in the framework happened in under two hours instead of days.

That’s a highly volatile stock — at least for the day. The trade was a 26% win for $6,697 in profits.* This kind of play is beautiful if you’re prepared. But for anyone chasing the spikes, it could be a nightmare.

(*My results are far from typical. Individual results will vary. Most traders lose money. I have the benefit of years of hard work, dedication, and experience. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

There are a few important points on this trade…

First, I didn’t go very big because historically it isn’t the most liquid stock. Second, I underestimated it. But I took the single when it more than met my goals.

Was there potential to make more? Yes. But remember…

There's NOTHING wrong with buying OTC plays, promoters can often spike them the most in any market environment, see $RGBP $VENAR $SYSX this week as examples, but you must also remember how they ALL crash & burn so it's crucial to sell into strength, even if you underestimate them

— Timothy Sykes (@timothysykes) April 15, 2021

Again, it’s the double-edged sword of volatility. Study up.

Millionaire Mentor Market Wrap

Penny stocks aren’t going as crazy in April as they were in January or February. But there are still opportunities. Hunt for volatility. Look for the big percent gainers with a lot of volume. Watch for familiar patterns.

Remember, sometimes the best trade is no trade. You might need to just watch for a while. That’s what Jack Kellogg did in the beginning. He tried to figure out why the top traders in the Trading Challenge chat room took certain trades. So he studied them. He watched the same stocks to see how they traded.

So embrace penny stock volatility and make it your friend. But don’t get stuck in the pumps. Sell into strength and when in doubt, get out. And ALWAYS follow rule #1: cut losses quickly.

Last Chance Birthday Sale

Last week was my birthday. Thank you to all the well-wishers. I can’t believe another year has gone by. It was a year of milestones and insane trading.

Check out my birthday sale on Profit.ly. It’s running for a few more days. Get serious about your penny stock education and take advantage of big savings.

Comment below with “I will embrace penny stock volatility!” I love to hear from all my readers, so comment below.

Leave a reply