Hey. I’m in South Africa for my Millionaire Mentor Update and this week I’m working on two important projects. Pay attention and get involved. We need to spread the word…

I flew with the team from Seychelles to Cape Town. We’re here staying in a ridiculous villa with a view, doing a bunch of charity work.

2025 Millionaire Media, LLCTable of Contents

- 1 Lion Bones Are NOT Medicinal

- 2 Shark-Fin Soup Is Stupid and Increases Your Risk of Dementia

- 3 My Worst Trade and the Lesson I Learned

- 4 Questions from My Inbox

- 4.1 What Is the Most Common Character Trait You See in Successful Students?

- 4.2 What Characteristics Are Common in Students Who Fail?

- 4.3 Tim, is it possible the 100%+ bounce on EDXC on April 23 was the result of market maker manipulation?

- 4.4 What’s the number-one thing you want students to figure out right now?

- 5 Millionaire Mentor Market Wrap

Lion Bones Are NOT Medicinal

We’re working with Drakenstein Lion Park. Drakenstein provides sanctuary to captive-born lions. These lions are bred factory style and the cubs removed from their mother soon after birth. This is so she can reproduce another litter fast — sometimes within six months. The natural time for a mother lion is two years between litters.

The sad fact is, the perpetrators breed these lions for human pleasure. The cubs are used for taking pictures. They’re imprinted with human interaction. When they’ve outgrown this purpose, they’re used for canned trophy hunts. Why? Because they can’t rehabilitate them and release them into the wild. They don’t have the same social group imprinting as wild lions.

This is tragic. But it gets worse. The government of South Africa allows the export of 1,500 lion skeletons each year. The market is primarily Southeast Asia for traditional medicine practices. In 2018 the government raised the number from 800 to 1,500 skeletons legally exported. Almost double.

Let’s make this crystal clear: There is ZERO PROOF of any medicinal value in lion bones. None. The South African government is complicit in propagating a mumbo-jumbo hoax. They say it’s to “draw down growing stockpiles of lion bones at captive facilities.” In other words, they want to cover up the horrendous practices of the facilities.

Yes, I’m pissed off about this. Lions are down from 200,000 to just 20,000 left in the wild — so 90% in the past few decades. They’ll go extinct if we don’t do something. Lion-bone wine won’t make you vigorous or more manly; it only proves your lack of understanding of the real world, losers. Spread the word.

Shark-Fin Soup Is Stupid and Increases Your Risk of Dementia

This pisses me off, as well. Somewhere between 10,000 and 30,000 sharks are being killed every hour so some a-hole can eat shark fin soup. It’s considered a delicacy in China. Again, they wrongly believe there are medicinal qualities. They think shark fins will increase your qi energy and help with rejuvenation.

Here’s a fun fact for you stupid shark-fin soup eaters…

… sharks biomagnify toxins. Look it up. Eating shark may raise the risk of dementia and heavy metal poisoning. Stupid, stupid, stupid people. So, we’re working with the Shark Conservancy here in South Africa. Give them some love and support.

We need to stop the shark-fin soup and alert the world that there’s no medicine in lion bones.

I’m proud to drop a hint about a big upcoming partnership with a major fashion brand. I can’t discuss it publicly, yet. But it’s got to do with saving the sharks and lions. Stay tuned…

I’m still trading in South Africa. Maybe even over-trading a little because I have access to good wifi.

My Worst Trade and the Lesson I Learned

I thought I’d turn this around this week and discuss the worst trade instead of the best. It’s important you understand and accept that you will have losses as a trader. You need to learn how to take losses. You need to learn how to cut losses.

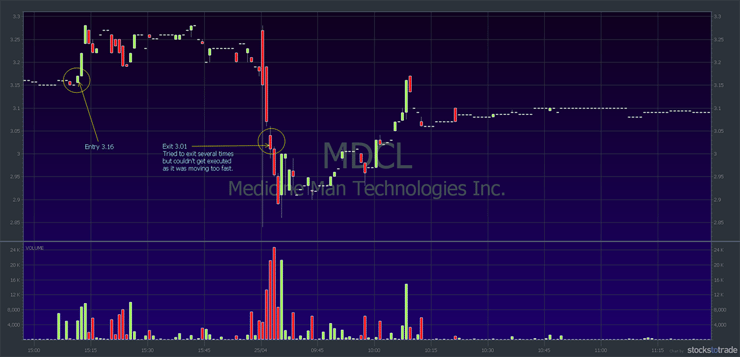

My worst loss was a $745 loss on Medicine Man Technologies (OTCQX: MDCL). I bought near the end of the day on a first green day, recent runner. My goal was to make 5% to 10% as an overnight play. Or, ideally, as a strong finisher into the close.

Here’s the chart:

(MDCL chart: first green day followed by day-two morning panic)

As you can see, MDCL didn’t finish as strong as I’d hoped so I waited for a morning gap up or morning spike. There was a small gap up followed by a morning panic. Sometimes trades go against you. The reason I’m sharing the trade with you is because I learned a lesson from it.

It was all captured live on a Trading Challenge webinar. That’s a good thing as my students were able to see how conservative I trade. They saw how I’m ready to get out of the position right away when things aren’t going well.

I tried to sell several times as the stock dropped. I couldn’t get my sell order executed so ended up having to change my ask price several times. The big lesson: When you have fast moving, less liquid stocks you can’t always get out on time. Be prepared. Be nimble. This was a good reminder for me.

In past Millionaire Mentor Updates I’ve reported in on what my students are doing. You can check on my Twitter feed for a lot of that information. So I decided to answer a couple of basic questions today about mindset.

Questions from My Inbox

What Is the Most Common Character Trait You See in Successful Students?

Dedication and patience. I believe anybody can become a great trader and can become wealthy over time. Too many people don’t take the process seriously. They don’t give themselves enough time.

My top student, Tim Grittani, might have passed $8 million in profits after starting with $1,500.* But he started 7 years ago. He made nothing his first 9 months while he studied and tested.

2025 Millionaire Media, LLCToo many people don’t even give themselves 9 months to learn the process … let alone trying to match some of the’s world’s greatest penny stock traders.

What Characteristics Are Common in Students Who Fail?

Yeah, it’s a lack of patience. It’s thinking you can force trades whenever you want — like the money should come to you. It doesn’t work that way. The market doesn’t give a crap about you. You have to wait for the best trades. You have to wait for the best setups.

Trading is not like a normal 9-to-5 job where you can count on specific amounts of money weekly or twice a month. Sometimes there are no trades for a week. When there are no great trades, you need to have patience.

Instead, people want to earn money without putting in time studying. They grow impatient investing time and not getting paid for it. I have to change their mindset. If you think that way I want to change your mindset. Learn to focus on outcomes instead of how much you make an hour. I work insane hours. It allows me to live a life of freedom.

More Breaking News

- Quantum Leap for Rigetti: Time to Buy?

- SoFi’s Bold Moves: Growth or Gamble?

- ClearOne’s Financial Maneuver: One-Time Dividend Sparks Investor Interest

Tim, is it possible the 100%+ bounce on EDXC on April 23 was the result of market maker manipulation?

NO! So many people want to try to pin these kinds of moves on market makers or conspiracy theories. It’s just a classic bounce off a morning panic. That’s what happens with these stocks.

You have a multi-week runner, a morning panic crash due to stop-losses, and then it bounces. Not market maker manipulation.

Take a look at the chart because the bounce was beautiful and lasted all day:

(EDXC chart: beautiful bounce off morning panic that lasted all day)

More important to you as a trader …

Who cares? Does it do you any good to concern yourself over something you can’t control? Becoming a successful trader is about focusing on the patterns. Recognize the patterns and be grateful for them. Forget about the conspiracy theory BS.

Any bets on whoever asked that question disregarding rule #1 and doing a hold-and-hope? Think they lost money because they broke the rules? I wonder…

What’s the number-one thing you want students to figure out right now?

Again, it’s that perfect plays are going to build your account over time. You don’t know when the perfect play is. So you have to prepare. Sadly, most people don’t prepare. They don’t know the right patterns. They don’t have the right broker. They don’t know the right position size and they don’t know how to cut losses quickly.

You can’t force trades. You can’t force perfect setups. But you can be prepared. Too few students are prepared. I don’t think you can over prepare. Watch every single one of my 6,000 video lessons. Watch every single one of my and my top students’ webinars.

It’s insane how people don’t want to put in the time to study the past. They just want hot picks. Stop it!

Millionaire Mentor Market Wrap

Your takeaways from this edition:

- Support lion and shark conservation. If you aren’t sure how to do that, start by following Karmagawa on Instagram.

- Pay attention to the lessons I’m trying to teach you. You need to learn patterns, position sizing, and how to cut losses fast. If you’re brand new and don’t know where to start — please read The Complete Penny Stock Course by my student Jamil. All the basics are there

- Stop looking for conspiracies or someone else to point the blame on when you lose on a trade. Review the trade, see what you did wrong, put it in your trading journal, and move on.

- Develop patience and dedication. Who do you think is going to change your life? Who do you think is going to save the oceans and the elephants? I’ll tell you who, YOU if you take action, stay patient, and burn dedication into your brain.

Have a great week and study like crazy! See you in the chat room. If you’re not in the chat room … time to apply for the Trading Challenge now.

Are you a trader? What are you doing to help with some of the pressing issues of our time — like nature conservancy? I urge more millionaires to put resources into charity. How are you doing?

Leave a comment below if something in this post helped you today. I love to hear from all my readers. Let’s get this conversation going.

Leave a reply