Happy Holidays 2020 to everyone! Chanukah has come and gone, Christmas is in a few days, and the new year is almost here. I know 2020 has been tough for a lot of people. So whatever you celebrate, I hope you find some joy during this season.

I admit to having conflicted feelings about 2020. It’s been my best year ever as a trader. And several students have had a breakthrough year. But the pandemic and all the issues we face across the world make it bittersweet.

So I hope you’ll join me in finding gratitude for all that’s good in the world. And also make a commitment to be better in 2021. We MUST do better at protecting the environment and animals. And we should do better at helping those who are suffering in times of need.

As always, I’m donating 100% of my trading profits to charity. But the past couple of weeks I’ve been doing it in holiday style…

Table of Contents

It’s My Honor to Give Back

There are two reasons I donate my trading profits to charity.

First, I prioritize my students over profits. Most of my students start with small accounts. To help them learn, I start each year with a small account, too. Then I donate the profits so my focus is on teaching.

Second, it’s my honor to give back. Especially right now to help bring a little 2020 holiday cheer. I’ve been going from charity to charity dressed as Santa. All my December profits are getting donated to animal sanctuaries.

So I’m proud to announce Karmagawa’s latest $50,000 donation to Rancho Relaxo animal sanctuary in New Jersey.

I'm proud to announce my charity's latest $50,000 donation to Rancho Relaxo Animal Sanctuary in NJ, check them out @ https://t.co/p0xSNtq27d as they help rescue. care for so many animals in need, it's my honor to give back! See https://t.co/3laoy39kL7 for my holiday gift for you! pic.twitter.com/01K2wvZwwc

— Timothy Sykes (@timothysykes) December 17, 2020

Wherever you are in your journey, make a commitment to make a difference in the world. When I got involved with charity, I had no idea how fulfilling it would be. Find something you’re passionate about and help. Even if it’s just sharing on social media to bring attention to deserving charities.

Let’s talk trading…

Trading Mentor: Holiday Trading Guide

The first few weeks of December were like the height of euphoria for traders. Everything was working. Charts were clean. We saw perfect panics with perfect bounces.

Then last week it suddenly changed. The market shifted.

The $DIA $SPY $QQQ markets are now dropping hard, remember we had max euphoria last week then choppiness most of this week, now comes the downfall, just as I said in last night's video lesson, you MUST adapt to the market environment always! #adaptorperish

— Timothy Sykes (@timothysykes) December 18, 2020

It was a rude awakening for anyone who thought the market would just keep going up. That’s not realistic. The market ebbs and flows, so you have to adapt. But the market is still near all-time highs as I write.

If you don’t learn to adapt to the market, it will eventually catch up with you. You might get lucky sometimes, but chances are you’ll learn the wrong lessons.

And that’s one reason I want to give you my new Holiday Trading Guide — at no cost. Consider it my 2020 holiday gift to you.

GET MY BRAND-NEW HOLIDAY TRADING GUIDE HERE

In the 2020 Holiday Trading Guide, I’ll go over the good, the bad, and the ugly. I’ll share all the tips, tricks, lessons, patterns, and rules I utilized to make 2020 my best year ever.

But you also need to understand what it’s like to be a real trader. It’s not like a regular job — there are a lot of counterintuitive lessons. You have to follow certain rules to do well. (Like these rules.)

But no matter how well you follow rules, there’s always a risk of loss. There’s always a risk of danger. The moment you get too comfortable is the moment the market reminds you this is not a normal job.

So click the link and put in your email. When the guide is finished, I’ll send you the link. Again, it’s no cost to you. But I want you to make a commitment to study it. If you’re willing to put in time over the holidays, also click the link to share it on Twitter.

(Even if you’re too shy to share it, make the commitment to yourself. This is about YOU taking steps to make YOUR 2021 a year of growth.)

GET MY BRAND-NEW HOLIDAY TRADING GUIDE HERE

Remember, share if you promise to study hard. And then do it: study hard!

Now let’s take a look at why last week made me so ready for the weekend…

Trade Review: 2020 Holiday Trading Frazzle

Again, the two weeks starting November 30 were crazy. Nearly every day I was trying to figure out why this market is so amazing.

When things shifted last week, I did some of my worst trading of 2020. The single worst day was December 16 when I lost $7,077 during my all-day live trading webinar. If you’re a Market Mastery student, I encourage you to watch the replay over and over.

I’m not gonna sugar coat it. I was frazzled last week. I’m burned out from this incredible year and the craziness we’ve seen in the market. And recently, there have been so many plays that I can’t keep up. Trading isn’t easy, and sometimes it’s mind-numbingly frustrating.

Watch this video and you’ll see what I mean…

Smart Lessons From 3 Rough Days of Trading for Me

Now let’s review my biggest win last week. As I said in the video, this trade was frustrating and even scary.

Bitwise 10 Crypto Index Fund (OTCQX: BITW)

On December 9, BITW became the first publicly traded crypto index fund. Even though it trades OTC, it’s not a penny stock. It’s officially penny stock exempt as defined by the SEC.

(If you’re brand new to penny stocks, start with this FREE penny stock guide.)

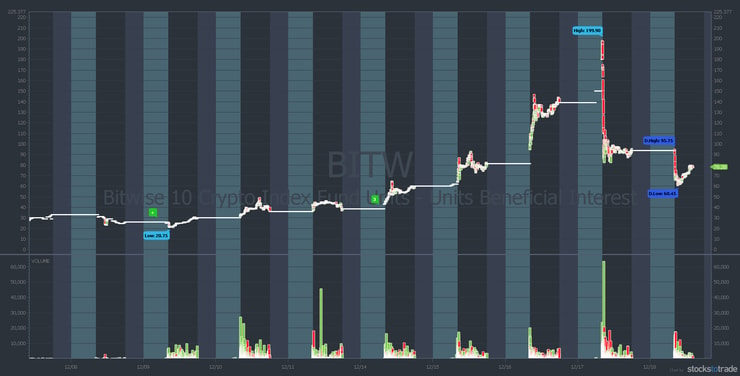

Bitcoin is up over 100% in the last three months. There have been a lot of sympathy plays in the crypto sector. So it’s no surprise BITW had a crazy start. But nobody could’ve predicted it would run from $20.75 to $199.90 in seven trading days.

Here’s the BITW chart from December 8, when it started trading, to December 18…

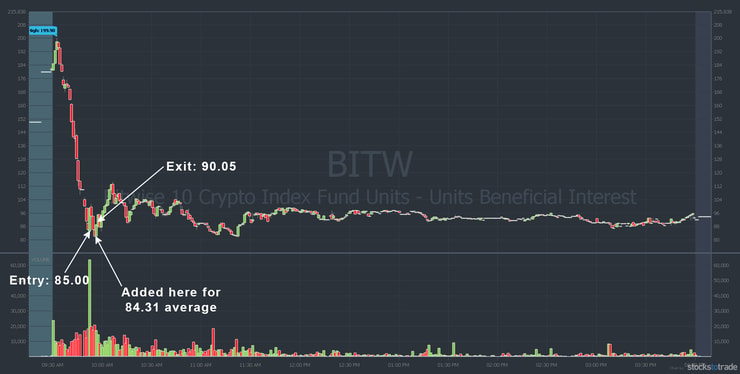

This was a very high-priced play for me. But it was behaving like a penny stock, so I gave it a shot. Here’s the intraday chart from December 17 showing my entries and exit:

More Breaking News

- Bitmine Immersion Technologies Secures Strategic Edge with $14 Billion Crypto Holdings

- Supreme Court Greenlights New Gold’s Game-Changing Acquisition by Coeur Mining

- Robinhood Appointed Trustee for Trump Accounts, Stock Rises

- GGB Stock Hovers as Market Reactions Vary Amid Market Speculation

When to Try Speculative Trades

I don’t mind trying higher-priced stocks, especially if one of my favorite patterns is playing out. Again, BITW was behaving like a penny stock. My first buy was right at the bottom of the panic. It moved so fast I didn’t even have time to alert the Trading Challenge chat room.

I tried to sell at $93 and again at $94 and $95 to lock in profits but couldn’t. My sell order wouldn’t execute. It came back down just as fast. I was still trying to sell all the way down. Again, I couldn’t get my order executed. I think I tried five times.

Once it dropped to a new low and knowing it was down 50% on low volume, I added 250 shares. Some Challenge students asked why I didn’t sell sooner or just get out. Again, it was my perfect pattern so I was more aggressive.

I finally got out on the second bounce at $90.05. It bounced all the way to $112 per share, so it could have been a huge win for me. But it was moving SO fast. As it was tough to get orders filled, I was happy to be out for a $7,175 win.*

(*Please note that these kinds of trading results are not typical. Most traders lose money. It takes years of dedication, hard work, and discipline to learn how to trade. Individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose.)

Let’s wrap this up so you can get back to studying and spending time with your family…

Millionaire Mentor Market Wrap

The 2020 holidays are a great time to do two things…

First, spend time with loved ones. This year, more than most, we all need each other. That said, stay safe. Let’s all do our part to help bring this pandemic to an end.

Second, use your spare time to study. Nobody can predict how long this market will last. Now is the time to push your studying to prepare for what happens tomorrow, next week, and in the months to come.

Finally, the stock market closes early on December 24 at 1 p.m Eastern. Then it’s closed on Christmas day. 2020 holiday trading is still ON when the market is open. Remember, tomorrow is when the Santa Claus rally could kick off. Take advantage of it whether you’re studying or already trading.

One more time…

Get My No-Cost Holiday Trading Guide Here

Now go study.

What are you doing (or what have you done) to celebrate this 2020 holiday season? Comment below, I love to hear from all my readers!

Leave a reply