Jack Schwarze’s Story: Key Takeaways

- Jack lost for YEARS — this is how he turned it all around…

- Learn Jack’s favorite strategies and patterns that helped him grow his account to over $2.6 million.

- Get inspired to never give up on your dreams…

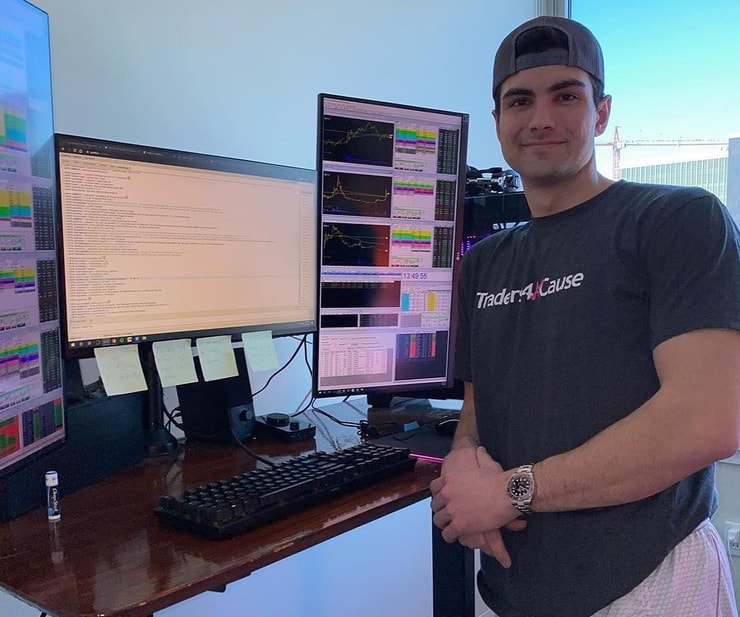

In July 2015, I got a DM from a high-school kid named Jack Schwarze (I now call him Jack #2 since I already have another multi-millionaire student named Jack), and you’ve gotta see this to believe it…

It said, “Please teach me! I’m on vacation and just woke up. I have about 30 minutes free.” It came with a dark, blurry — and frankly, creepy — selfie. He’s lucky I didn’t see it until years later, or I probably would’ve blocked him. Check it out…

View this post on Instagram

This kid thought he could learn everything about trading in 30 minutes! He was in for a harsh reality check — and he definitely received it. Read on to learn how he beat the odds, stayed in the game, and became a multi-millionaire. Prepare to get inspired…

Table of Contents

Jack #2: The Lowdown

Here are some key stats from Jack’s trading journey…

Jack’s Go-To Trading Patterns

- Dip buys. Jack doesn’t go long often, but he’ll dip-buys panics on the first red day of a multi-day runner. He says it offers good risk/reward.

- Short selling multi-day runners is Jack’s favorite strategy. His shorting patterns include failed multi-day spikes, overextended gap downs, and the first red day.

- Longing short squeezes. Jack took what he’s learned from shorting and adapted to take advantage of short squeezes on the long side.

Jack’s Trading Stats

- Trading superpower: Spotting blowoff volume that traps bag holders in multi-day runners

- Favorite Trading Challenge resources: Jack watched all the DVDs, video lessons, and webinars on Profit.ly. But his favorites are Tim Grittani’s video lessons, webinars, and DVDs. That’s how he refined his shorting strategies.

- Win rate: 53%

- Biggest win: $124,000

- Biggest loss: $184,000

- Biggest monthly profit: July 2021 $572,000

- Biggest splurge purchase: An Audi R8

Jack’s Trading Timeline

- 2015: Jack found me on Instagram and sent me the creepy DM. He watched my YouTube videos and was eager to learn.

- 2016: He subscribed to Pennystocking Silver and started trading with a $2,000 account.

- 2017: Had his first big win on a long trade. Shortly after, he joined my Trading Challenge.

- 2018: Found consistency and small gains started to add up.

- Early 2019: Started shorting and finally broke even. After some big wins, he got sloppy…

- May 2019: Jack started getting caught in short squeezes. His emotions got the best of him and he kept making bad trades. Many mistakes led to $60,000 in losses. He stepped away from trading for a few months to mentally recover.

- February 2020: Got back in a groove shorting overextended mask stocks and hasn’t looked back since.

- June 2020: Crossed $100,000 in profits.

- February 2021: Crossed $1 million in profits.

- July 2021: Jack’s made over $2.6 million.

More Breaking News

- ALAB Stock Climbs Amid Strategic Moves and Strong Financial Indicators

- Jumia Faces Market Headwinds Amid Rising Costs and Strategic Challenges

- AZI Stock Slips as Investors Eye Key Developments

- Spotify’s Royalty Growth and Stock Upgrade Create Buzz

Jack’s Favorite Scans & Watchlist Tips

Jack runs a premarket scan to find listed stocks that are:

- Under $80

- Big percent gainers — minimum 3%

- Stocks with at least 1000 trades

- Stocks trading at least 50,000–100,000 shares in volume.

Even if Jack doesn’t trade most of the stocks on his scan, he wants to see everything moving. That gives him an idea of how hot the overall market is.

He focuses on multi-day runners because they’re the most volatile. Like me, he aims to catch a small piece of the move.

Jack’s advice for building a watchlist? Keep big percent gainers on your watchlist for three to four days. They offer the most potential for trades.

Jack’s Trading Journey

There’s a reason most of my students take years to master trading — there’s a steep learning curve. But Jack believed if other traders could do it, he could too. And he stuck with it. Here’s how it played out…

Humble Beginnings

Jack subscribed to Pennystocking Silver when he was a senior in high school. He says it was one the smartest things he ever did. He became obsessed with studying. He skipped lacrosse practices and senior parties to watch video lessons.

He started longing hot sector stocks but would chase entries and didn’t understand what moved stocks. When the hot sectors cooled off, he took a series of small losses that bled his $2,000 account down to roughly $400.

Then Jack got his first big win…

He made $676 on a $297 position.

That’s a 230%+ gain! It showed him the potential of penny stocks and motivated him to keep studying.

How Jack Beat the Odds and Stayed in the Game

Jack blew up multiple small accounts over a few years before he found consistency.

But he was always disciplined about cutting losses quickly.

Sometimes he’d cut them too quickly. Then the stock would play out just like he thought. So he changed his approach…

He studied Roland Wolf’s gap-and-crap reversal strategy for long trades. This helped Jack refine his entries, risk management, and patience. He doubled down on discipline and started to string small wins together.

“Although I always cut my losses quickly, I never had rules on when to walk away,” Jack says. “It’s not only about cutting losses quickly — it’s about knowing yourself and having the discipline to do what’s best for your trading account.”

Jack’s biggest losses were always a result of breaking his rules. In 2019, he had what he calls his first real blowup — a roughly $60,000 drawdown. He got chopped up in the wrong trades and kept losing.

That’s when he decided to take a few months off. When he came back, he sized down and focused on the process over profits.

“We can’t define ourselves by our losses or gains,” he says. “Trading is simply making a plan and executing it. Whether we make or lose money, that’s not up to us. The only thing we can actually control is the potential loss.”

Well said, Jack!

How to Learn From Losses and Refine Your Edge

It took years for Jack to refine his short-selling edge. Now he can see a short squeeze move coming a mile away…

He says the biggest short squeezes happen when shorts are on top of each other in a stock that doesn’t go down. Then when the liquidity dries up, only the shorts are left to buy to cover. He adapted to take advantage of that volatility on the long side.

Jack’s made millions by finding trading opportunities where his reward is greater than his potential losses. He figures he could lose 75% of the time, but if his wins are bigger than his losses then he’ll be profitable over time.

Whether you go long or short, risk management is key…

Jack’s advice: “Think of everything that could possibly go wrong before taking a trade.”

Learn From Jack Here

I love celebrating my students’ accomplishments. To celebrate Jack’s million-dollar profit milestone, I announced the new Schwarze school in Bali.

I am so proud to announce the official grand opening of the 87th @karmagawa school, The Schwarze School in Bali in honor of one of my newest millionaire students @jackdan_no7 who’s now closing in on $3 million in trading profits in just a few years despite still being in college! pic.twitter.com/TVNyGfEt8a

— Timothy Sykes (@timothysykes) October 5, 2021

Jack admits his growth seems unreal. But his early losses were all part of his learning process. They taught him his limitations and where he could capitalize on his setups.

Now Jack’s a top Trading Challenge student and has made over $2.6 million in trading profits — all before completing his university studies!

Jack says learning the strategies behind successful traders helped him refine his edge…

In my Trading Challenge, he learned from Roland’s trades and he watched all Tim Grittani’s webinars to learn and refine his short-selling strategies.

Now Jack gives his own webinars to Challenge students. To celebrate his birthday and passing $2 million in profits, I surprised him with a visit and we did a Challenge webinar together. (Watch the replay here.)

Then he dressed as my elf and we donated money to charity…

View this post on Instagram

Here’s how you can learn from Jack:

- Another $1 Million Trading Profits Milestone: Challenge Student Jack S. Tells All

- Meet Jack #2: One of My Newest Millionaire Students!

- SteadyTrade Podcast Ep 225: $80K Losses to $2 Million+ Profits: Jack Schwarze’s Incredible Trading Journey

- TWIST: Special Guest Jack Daniel (No7)

- Learn from all Jack’s trades on Profit.ly

- He’s a Challenge chat room moderator. Apply for access here.

- Follow him on Instagram and Twitter

My Trading Challenge is where you can learn from multiple millionaire traders just like Jack.

Ready to take your trading to the next level? Apply for my Trading Challenge today!

What do you think of Jack’s story? Are you inspired? Let me know in the comments and congratulate Jack on his success!

Leave a reply