If you’re like me, you keep seeing a lot of stories about NFTs and the potential in this explosive market.

It seems like so many average Americans are getting rich off NFT mania…

But where there’s hype and money … you better believe scammers are lurking around the corner.

Don’t worry. After more than two decades in the markets, I know a scam when I see one.

I’m not saying all NFTs are junk. There are legitimate opportunities. Check out one of my students …

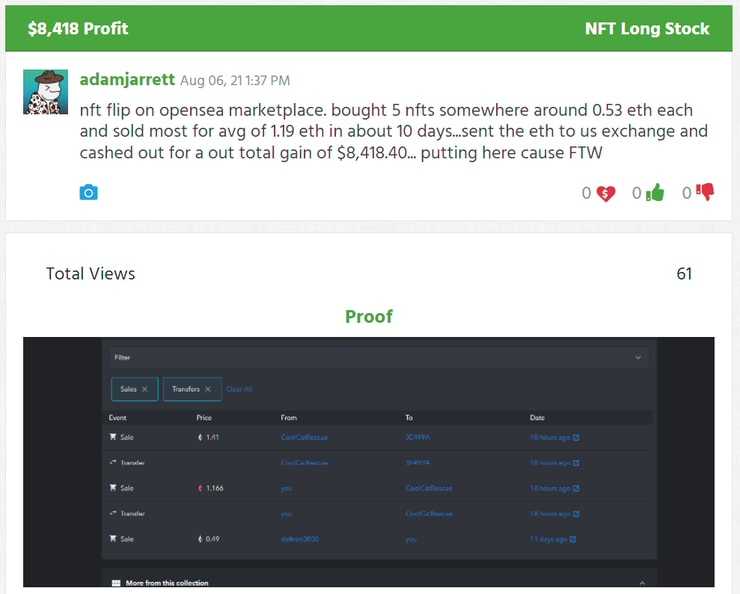

Adam Jarrett joined my Trading Challenge in 2020. After day trading his way to +$100,000 in profits, he switched to trading NFTs.

Here’s a trade he posted…

There’s money in NFTs. But where do you learn how to navigate this world? Who’s sharing great opportunities and who’s just looking to scam people?

Let’s break it down…

Discord Scams

Most NFT discussions happen over the chat app Discord. This app is home to plenty of trading chat rooms where people share information, ‘hot’ stocks, and strategies.

It reminds me a lot of chat pumps from the meme stonk days — back when GameStop Corp. (NYSE: GME) launched to the moon.

Fake trading gurus would claim to know the next Reddit spiker and a slew of gullible newbies would believe them.

I’ve seen it happen too many times to count. Unfortunately, that’s how I find a lot of my students. They hear about the Trading Challenge after an online scammer takes all their cash. It’s too late for me to help.

If that hasn’t happened to you, count your blessings.

That’s why I created a chat room full of dedicated students that learn to trade the right way. And in order to keep the jokers out, there’s an application process.

That’s not to say that you can’t find legit chat rooms on Discord. But you must know how to stay safe. So say you’re looking to join a Discord channel for NFTs. Here are some smart rules to follow…

- Be wary of suspicious DMs. If you don’t know the person messaging you, alarm bells sound.

- Never give away private details. All crypto wallets require some form of password/secret code. These are unique to your account. Treat them like a Social Security number.

- Investigate the developers of potential investments. This is a lot like stock trading. It’s hard to profit if the project creators have a poor track record or are scammers themselves. Check out this story.

There’s the potential to make money in this niche. But you have to stay alert and aware.

Trading NFTs

I love to trade penny stocks — it’s been my go-to niche for well over 20 years.

But they’re not always hot. Right now there are a few opportunities, but I’m itching to find more volatility

The NFT market could be exactly what I’m looking for. And students like Adam Jarrett and Matthew Monaco have shown me this niche is legit.

Speaking of which … on March 30th at 8 p.m. Eastern I’m going live — with Adam — to help all my students get a jumpstart on NFT trading.

You don’t want to miss this. The first one to the opportunity is the first to profit. This is your chance…

Do you see the potential for this niche to explode? What further questions do you have? I can help you, leave a comment!

Leave a reply