Traders are getting beat up in the stock market. Don’t let the last few green days of the S&P 500 ETF TRUST ETF (NYSE: SPY) fool you…

The overall market sentiment is still pretty grim. Here’s what the news says about stocks and the bear market…

But I’ve been through bear markets before. And there’s always volatility out there to trade.

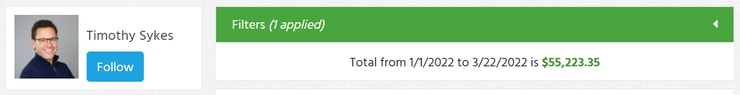

For example … I’ve locked in +$55,000 in profits so far this year, despite all the nastiness. Here’s a screenshot of my Profit.ly account…

As a day trader, I’ve learned to go where the money is. That’s what I teach all my students.

For example, Matthew Monaco joined my challenge in 2017. He passed $1 million in profits trading OTCs in 2021, but then the markets slowed down. That’s when he switched to crypto to follow the volatility.

That’s what this business is all about. Developing the skills and applying them to volatile markets.

Today we need to talk about a new market with huge opportunities. Just look at this headline…

I can’t cover everything you need to know, but this is a perfect place to start.

Non-Fungible Tokens (NFTs)

Let me explain this as simply as possible. Think about an NFT like a stock that only has one share.

In reality, it’s a unit of data that anyone can buy, sell, and trade.

NFTs are usually digital artwork. For example, that 12-year-old who made almost +$6 million … She sold her art as NFTs online. Here’s one…

All NFTs operate on blockchain technology that keeps transactions secure.

Imagine if there was a ledger that tracked each owner of Leonardo da Vinci’s Mona Lisa and how much they paid for it.

That’s what the blockchain does. It simultaneously acts as proof of legitimacy and overall value.

How to Trade NFTs

You can’t use a regular broker to trade NFTs.

And because this market’s so new, there isn’t a lot of information on how to get started.

Luckily, one of my Challenge students has a strategy that he’s using to trade NFTs. STAY TUNED FOR MORE ON THIS.

Remember, NFTs are similar to stocks. That means they can trade similarly. And that means more opportunity for you to potentially profit.

After a while, you’ll realize all these markets are the same at the center. It’s just supply and demand. Keep an eye out for my big NFT announcement…

Have you bought an NFT? Is this the first time you’ve heard of it? Leave a comment and get engaged.

Leave a reply