When it comes to penny stocks, expect the worst and you won’t be disappointed. Solid advice in a world of shady companies with bad fundamentals. I say it often. Trade the price action, but don’t hold penny stocks as investments. It’s a losing proposition.

Sadly, today I have to tell you about another case of ‘expect the worst.’

Pay attention, because what I’m about to share with you could save you thousands of dollars.

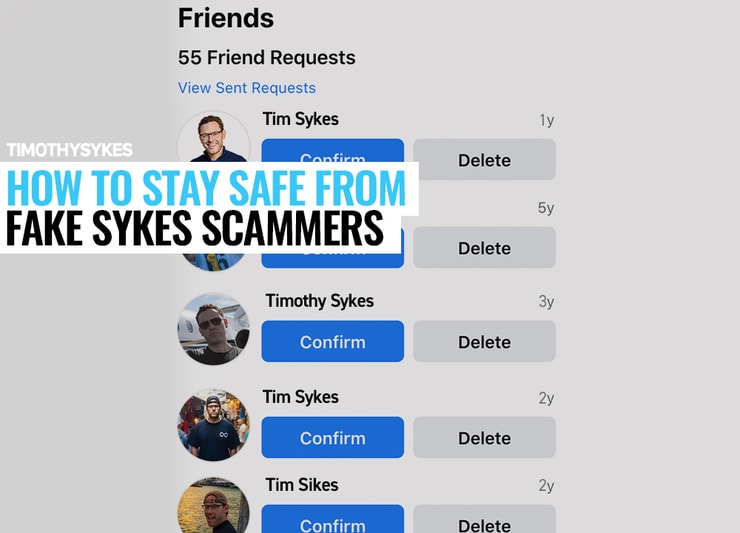

Con artists are trying to scam my followers out of their hard-earned money. In some cases, they get away with it. And even though my team is working hard to stop these scum-of-the-earth crooks, it’s getting worse. We’ve seen an uptick in scam related activity in recent months.

These slimeballs deserve to go to prison for what they’ve done. I’m mad as hell … because they’re using my good name and reputation to hurt people.

The con artists go about their business in more than one way. But one of the most popular means of separating the mark from their money is through fake social media accounts. All my social media accounts are verified. That includes Twitter, Facebook, and Instagram. If you don’t see the verified account designation … it’s not from me.

They come at you posing as me. Then, they use clever persuasion techniques to gain your trust. Once they have you in the right state of mind…

… they close the deal by asking you to send them money. Unfortunately, some unsuspecting souls get caught out by this.

Table of Contents

Warning: Watch Out for These Scam Tactics

One of the main problems is the crooks lead you to believe I do certain things. Things I don’t do. To keep it believable they stay within the bounds of finance, investing, or trading. A false sense of security is created through the ‘halo’ effect — where the scammer seems trustworthy and even likeable.

Below is a list of things I DON’T do. Study this list so you don’t get led into a false sense of security. Use it to protect yourself…

Tim Sykes Does NOT…

#1: Manage Other People’s Money

Never. Ever. I don’t manage other people’s money.

If someone approaches you in my name and offers to manage your money … they’re a fake! Yes, I started a hedge fund when I was still in college. I closed it down years ago. If any con man tries to tell you different, contact admin@timothysykes.com and give them all the details.

#2: Trade For Others

I do NOT trade for others.

Sorry … I only teach others to become self-sufficient traders. I provide educational content like DVDs and video lessons based on my two decades of trading. I’m the founder of the social trading platform Profit.ly — where all the educational materials are hosted.

If you’re approached by someone…

… claiming to be me…

… who offers to trade for you…

… they are a swindler attempting to take your money.

More Breaking News

- Needham Upgrades Ichor Holdings to Buy Amid Positive Forecasts

- GTM Stock Experiences Notable Fluctuations Amid Recent Financial Developments

- Datadog Battles Price Target Reductions Amid Growth Hopes

- Coca-Cola’s CEO Sells Shares: Market Reactions and Financial Insights

#3: Ask For Investment Money

Never. I don’t need your money to invest. I don’t ask others for investment money. And I certainly wouldn’t approach people the way these hustlers do even if I needed investment money. Don’t be fooled.

If someone approaches you asking for money while posing as me, they’re engaging in investment fraud.

#4: Contact You Via DM

Seriously … this is tragic. But it happens. If someone DMs you saying they‘re me … it’s not me. Not unless you’re one of my top Trading Challenge students. Even then it’s rare.

So if you get an invitation to my ‘private chat page’ or the opportunity to connect with me on an encrypted platform such as WhatsApp … it’s all a lie. I don’t — and won’t — do that.

#5: Refer You To Money Management or Account Management Services

If you receive communication regarding such programs, it’s not from me.

This is the slimy practice of using my name and reputation to get victims to hand over their accounts to another party. Once they get your money, they ghost you. You’re left with nothing. I will never refer you to any money management service. Ever.

All I do is teach. That’s it.

Scammers Are Everywhere: Stay Safe

Now you have a short list of things I don’t do. Here’s the thing … these crooks are clever. You zig and they zag. Just when one scam starts to come unraveled, they come up with another. Or they create a variation on something old.

Below is a list of informational resources to help you. Before you dig in, a word of advice…

If something seems suspicious, too good to be true, or doesn’t sit right with you for any reason, be careful. Better yet, walk away.

Remember, if you think a scammer has contacted you using my name, please contact admin@timothysykes.com.

WARNING: Fake Sykes Scammers Want Your Money. In this post I pointed out five red flags to look for if you’re contacted on social media from someone claiming to be me. I used an actual conversation between one of my followers and a con artist who tried to scam him — pointing out the exact techniques these bastards employ.

Remember, if you have any doubts, contact admin@timothysykes.com. Not only will you be protecting yourself, you’ll be doing me a big favor. Help me to shut these villains down.

My Business Is Trading Education

I will never attempt to rush you into anything. The tricksters will. They’ll say things like, “This is your only chance to work with me. Blah, blah, blah…”

That’s not me.

I get it. You might not be ready to join the Trading Challenge. You might need more time to decide if I’m the right teacher for you. And you might need to shift your personal circumstances first. Wherever you are in the process, I won’t pressure you into joining my programs or buying my DVDs. Frankly, I don’t want more students. I want better students.

Do I hope you join the Trading Challenge? That depends on you. I don’t want students who aren’t willing to do the work. I won’t blow sunshine up your behind telling you you’re gonna be rich. (That’s up to you. If you want to be rich you have to put in the effort — do what it takes.)

I’m only looking for students willing to learn the necessary skills to become a self-sufficient trader. It takes time — sometimes years — to get there. What I teach is not a get rich quick scheme. It’s not easy. And I don’t do it for you. I share my trades and my experience for you to study. But you have to do it.

No matter what, don’t let these shysters trick you into giving them money.

Protect Your Hard-Earned Money

Please, protect yourself. I teach my students to protect their trading capital through conservative risk-management. But if you’ve given your money to a scammer, you’re out of the game before you even get started. It’s too late. So protect your capital before you begin this journey. Help me to stamp out this awful practice. Be vigilant and stay safe.

If you’ve been a victim of a scam, your story could help others. Please comment below so we can all learn from your experience.

Leave a reply