Kyle William’s Trading Strategy: Key Takeaways

- 99% of trading is THIS — see how Kyle puts that into action…

- The smart steps Kyle took to cut down on early losses…

- How learning short selling can make you a better long-biased trader…

Join Kyle, Jack, And Mari In Breakouts & Breakdowns Room Every Day!

You’d be forgiven for thinking million-dollar trader Kyle Williams was always a superstar.

- He’s made over $2.3 million in the last 21 months.

- He hosts the TWIST podcast alongside $8 million trader Jack Kellogg and rising star Mariana Hincapie…

- Plus, he’s one of StocksToTrade’s top breakout experts He shares a trading room called Breakouts & Breakdowns with Jack and Mariana.

But what you’re seeing is just the tip of the iceberg. It took Kyle five years to get to this point. Here’s how he’s worked to get to this level.

Table of Contents

Start Low, Go Slow

Kyle’s big trades get the headlines. Yeah, he made over $100,000 on a single trade back in February…

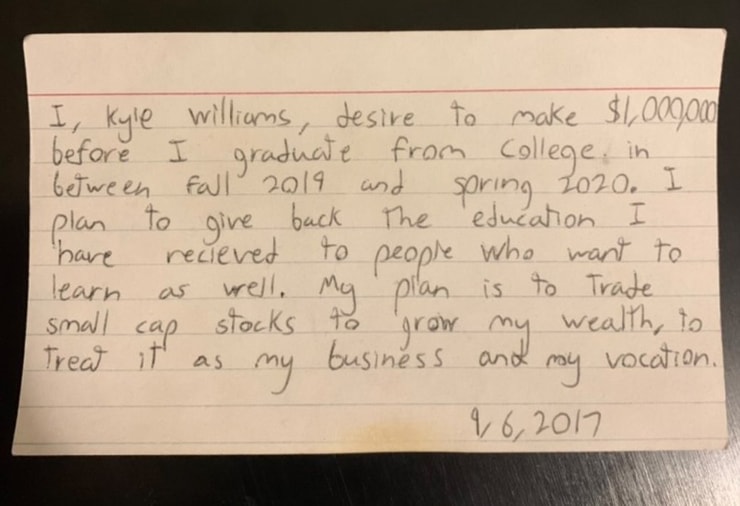

That’s the goal. That’s why he got into trading. Here’s a note he wrote to himself in 2017.

But big trades aren’t HOW he got here.

You have to go back to the first 18 months of his trading career.

Like many beginning traders, Kyle put his trading account before his knowledge account.

He lost more than half of his $6,000 starting balance in his first year of trading…

But he was already working to turn his luck around.

Kyle applied for and was accepted into my Trading Challenge. He watched all of my DVDs. He devoured every single video lesson.

Next, he scaled his position size way down. Sometimes he’d go long on just 100 shares.

He wasn’t trying to build his trading account anymore. Kyle understood that he needed to first build his knowledge account. He had to work on his strategy first.

Shorts of Increasing Size

By his second year, Kyle had worked out his strategy.

He’d started out going long with panic dip buying. But that didn’t really work for him.

Next, he tried buying breakouts. He says he was terrible at it and that he didn’t have the patience.

Eventually, Kyle turned to short selling with the first red day strategy. And he learned to short OTC promotions.

This is the point where you might start tuning out. You may just want to go long. So you think this doesn’t apply to you.

More Breaking News

- Nektar Therapeutics Set to Discuss New Study Results

- QuantumScape Takes a Big Leap with New Battery Line

- Entegris Faces CFO Transition Amid Price Target Boosts from Analysts

- FMC Plans Debt Reduction and Strategic Growth Initiatives for 2026

But I’m about to show you how valuable it is to learn about the opposite side…

Preparation Meets Opportunity

First, check out Kyle’s stats:

- 2018: Kyle makes $32,282

- 2019: He makes $92,100

- 2020: This is the year that Kyle’s preparation pays off for him. He makes $701,167 — his best year yet.

He did it by sticking in his wheelhouse. Kyle didn’t change his limits or take on more risk.

And he knew what worked for him. He was able to size up and take bigger risks safely when an opportunity came.

This made for some MASSIVE profits. But I want to look at the next two months.

Changing Gears in a Changing Market

Up to this point, Kyle had gone 90% short and 10% long.

But the market was changing, and Kyle saw a new opportunity.

The first few months of 2021 were amazing for OTCs. But they could make volatile moves.

So Kyle leveraged his short-selling skills to go long.

“If I was a short seller, would I want to short safely right here?” That’s what Kyle would ask himself.

In other words, if he wouldn’t short it, he knew the odds would be better for going long…

So he changed his tactics. From a heavily short-biased trader, he started going long 50% of the time.

He got good at trading breakouts — good enough to lead the Breakouts & Breakdowns chat room.

In the first two months of 2021, he made more than he had for the entire year in 2020. He banked an incredible $714,064.

Why Kyle Is on Year 6 of the Trading Challenge

Kyle’s still in my Trading Challenge — as a moderator now. That means Challenge students have the opportunity to learn from him.

And I know Kyle — like all successful traders — still works to grow as a trader. The best traders never stop trying to improve.

I want Trading Challenge students to learn that and to learn from as many top traders as possible. You never know when you’ll need to adapt to a changing market or whose strategy you’ll vibe with.

So study from as many as possible — like Kyle. See how he’s put in the kind of effort you need to take on my Trading Challenge.

Ready to put in that level of commitment and discipline? Apply to my Trading Challenge now.

We don’t accept everyone. We want more traders like Kyle. Are you that trader?

What can you learn from Kyle’s story? How have you progressed in your trading journey? Let me know in the comments!

Leave a reply