“Here cometh April again, and as far as I can see, the world hath more fools in it than ever.” — Charles Lamb, English essayist and critic (1775-1834)

It’s April. The first quarter of 2019 is gone …

I was gonna do a gag for April Fools’ Day. But I tend to stir things up enough already so …

Instead of playing a joke on you, I’m highlighting the meanderings of fools. Fair warning: this might hit a little hard. I’m not looking for more friends. I’m looking for more dedicated Trading Challenge students. And I don’t suffer fools lightly.

Fools are everywhere. Especially when it comes to the stock market — day trading in particular. My goal with Trading Challenge and Profit.ly is to help you avoid being one of the fools. In the chat room I do my best to warn people from foolish trades and unwise ideas. Do they listen?

“Wise men don’t need advice. Fools won’t take it.” — Benjamin Franklin, American Founding Father and polymath (1706-1790)

Unfortunately, human nature hasn’t changed.

How do April fools lose money? That’s easy. They don’t follow good advice and they do foolish things. Translation: They break rules. Worse, sometimes they don’t even have rules to follow.

Table of Contents

Trading Rules Never Used by Fools

I trade based on a set of rules and it’s been a great strategy for me.* Let me be completely transparent here: I didn’t always trade with well-defined rules. It wasn’t until around my eighth year of trading that I put my rules down on paper and committed to them.

But the rules were based on the conservative way I’d traded most of my career. I also had some big losses over the years but in every case, I wasn’t following my own rules.

Let’s take a look at some of the rules you should follow to avoid being an April fool … or any other kind of fool.

“The main purpose of the stock market is to make fools of as many men as possible.” — Bernard Baruch, American financier and stock investor (1870-1965)

Cut Losses Quickly

“There are two ways to be fooled. One is to believe what isn’t true; the other is to refuse to believe what is true.” — Søren Kierkegaard, Danish philosopher (1813-1855)

Here’s a frequent comment I see pop up all the time in chat rooms, DMs, and emails:

“I didn’t cut losses quickly. I let the trade go past my stop loss. I froze and I blew up my account …”

You have no idea how often I see comments like this.

I say it, I teach it, and I trade by it. This rule is the number-one most important rule for a reason. Only a fool would disregard this rule. Many of you who are newbies … you’re fools. You wouldn’t know how to cut losses wisely if it smacked you in the face.

“Any man is liable to err, but only a fool persists in error.” — Marcus Tullius Cicero, Roman statesman and philosopher (106 B.C.-43 B.C.)

I prefer to exit trades when they start going against me. If a stock doesn’t do what I expect, I’m out. I go in with a very specific goal on every trade. Don’t be a fool. Cut losses quickly!

Shorting Is Not for Newbies and Small Accounts

“Fools rush in where angels fear to tread.” — Alexander Pope, English poet (1688-1744)

Are you a newbie? Are you trading a small account? If you answered yes to either question and you’re trying to short-sell, you’re a fool. My top student Tim Grittani is a master of short-selling. Did you know he tried short selling his first few months of trading and then stopped?

Guess why.

Grittani recognized that he didn’t know what he was doing, he wasn’t good at it, and …

… he was good at breakouts.

That’s the pattern where he had success. So what did Tim do? He stopped short-selling. Wise choice. Present day, Tim is brilliant at short-selling. He trades with a big account. And he knows how to cut losses quickly.

So here’s a thought for you newbies who keep trying to short-sell with small accounts when you don’t know what you’re doing: Stop it. Stop it now. You’re killing me. Fools!

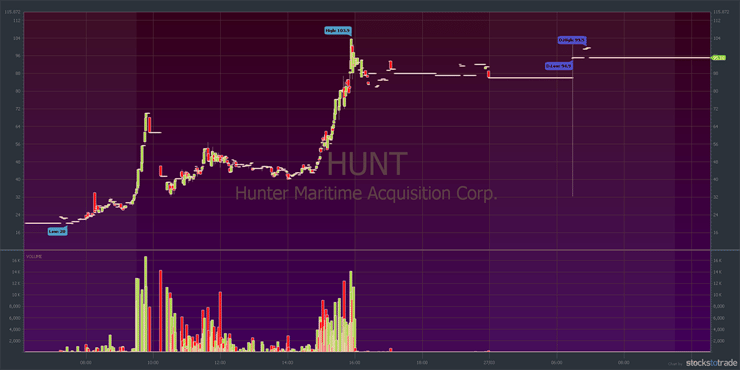

$HUNT nice short squeeze, I wonder if newbie shorts have had enough or if more want to blow up…they don't learn from plays like $BPTH so the market will try to teach them again and again…unfortunately newbies think they know everything so they have to learn the hard way!

— Timothy Sykes (@timothysykes) March 26, 2019

The market will teach you if you aren’t willing to listen. Last week it was Hunter Maritime Acquisition Corp. (NASDAQ:HUNT). Several times last month it was Bio-Path Holdings Inc.(NASDAQ:BPTH).

Here’s the HUNT chart. The reason it’s a funny color is because Nasdaq halted trading of HUNT as I was writing this post. (Due to strange and conflicting last sale prices of $95, $88, and $0.465 per share.)

Just because a stock runs doesn’t mean it’s coming down right away. Remember, the stock has to prove itself. (I addressed this in last week’s Millionaire Mentor Update.)

The chart covers just over one day of trading. The stock ran from a low of $20 all the way to the high $103s in one day. Shorts tried more than once and got squeezed bad. Look at that spike from around 3:30 P.M. until the market closed …

That’s a painful lesson for fools to learn. What happens when this starts trading again? I won’t even try to guess.

Here’s the chart for BPTH:

This chart is for most of March. Shorts had a go when BPTH went from the $2s to the $7s. They tried again when it went up to the $14 range. Then it broke from the $25s all the way to $73.

It was a great chart for longs as it ran. And foolish for shorts, especially newbies with small accounts. You have no idea how far these stocks can run. You might blow up your account before it finally comes back down.

Do these charts indicate all short sellers lost trading these stocks? No. But many, many shorts got crushed. Shorting stocks sounds amazing when you first hear about it. You get to win when suckers lose, right?

“Fools act on imagination without knowledge, pedants act on knowledge without imagination.” — Alfred North Whitehead (1861-1947)

Read that last quote a few times. Please!

More Breaking News

- Morgan Stanley’s Bold Moves Boost Cipher Mining’s Prospects

- Huntington Bancshares Misses Q4 Earnings Estimate Amid Turbulent Market Conditions

- Credo Technology Stock Skyrockets After Impressive Fiscal Performance

- BigBear.ai Under Investigation: Stock Faces Turbulent Times

Preparation Is Key

“Only fools and charlatans know everything and understand nothing.” — Anton Chekhov

You have to study. Between social media, my blog, the Trading Challenge chat room, Profit.ly, and videos — I must say it 50 times a week. All the work my team and I put into teaching you is meant to take a 10-year learning curve and compress it into a few years. But it’s up to you.

Start by cutting out all the noise. Don’t listen to so-called gurus who don’t share every trade with you. Be careful of scammers in chat rooms. Don’t trade off my alerts. Study hard to recognize patterns. Prepare.

Don’t Listen to Other Newbies

I have to throw this in here because there are too many newbies trying to teach. Stop it. You’re just making things harder for other newbies. And you look like a fool.

“Those who wish to appear wise among fools, among the wise seem foolish.” — Quintilian, Roman rhetorician (35-100)

Start Studying Today

Procrastination is your enemy. You don’t have to know everything right away. But you have to start right away. You’re here now. So start now.

“Tomorrow is the day when idlers work, and fools reform, and mortal men lay hold on heaven.” — Unknown but likely Aulus Persius Flaccus, Roman poet (34-62)

Don’t wait for tomorrow. Fools wait for tomorrow.

Always Use a Trading Plan

“There’s no such thing as a foolproof system. That idea fails to take into account the creativity of fools.” — Frank Abagnale, American security consultant and former con man (born 1948)

A trading plan can help prevent you from making foolish mistakes. Remember, you will lose some trades. How you lose matters. Don’t get creative. That’s a fool’s game.

With a trading plan, you know your entry and exit price whether the trade goes your way or not. A trading plan prepares you so your emotions don’t get in the way. You won’t wonder what your position size should be because a risk management system is part of the plan. I could go on.

Bottom line: Only fools trade without a plan. Most of the time they regret it.

Trading Challenge

“We are the worst of fools if we do not teach every child to become truly expert, deep readers.” — Maryanne Wolf, American scholar and advocate for children and literacy (born 1950)

I love that. Every child should become a truly expert, deep reader. What does this have to do with trading?

Here’s the underlying idea …

… you should become a truly expert, deep student of stock trading. If you’re serious, that is. If you want a long and happy career as a trader you need to immerse yourself.

The Trading Challenge is a great way to do it. Total immersion — video lessons, webinars, DVDs, the Challenge chat room, and more. Go deep. Fools won’t. Don’t be a fool.

“It seems to never occur to fools that merit and good fortune are closely united.” — Johann Wolfgang von Goethe, German statesman (1749-1832)

Happy April first. Don’t be an April fool.

Remember …

“A fool and his money are soon parted.” — Thomas Tusser, English poet and farmer (1524-1580)

Hey, traders! Comment below to share how you avoid foolish trades and bad ideas. New to trading? How can you use what you’ve learned today? Comment below.

Leave a reply