Let’s continue with my four-part series of what to watch in 2020. Here’s part 2: hot biotechs.

People love to start a new year with big goals and aspirations … yet so many fail to follow through. One reason I’m writing this four-part series is to help you follow those dreams of becoming financially free. (Just don’t think it’s gonna be easy. It’s not. You’re gonna have to study your butt off.)

Please share this series with anyone who will appreciate it.

The stock market can offer unlimited possibilities for the most dedicated. But too many people don’t even understand market basics. That’s why I teach all my strategies to my students and pride myself on being one of the few truly transparent traders.

Use this series as a guide to help you build your knowledge database. I can’t give you all the answers in these posts. My goal is to help you focus on the most important things happening in the market right now.

In part 1, I discussed the growing trend of MASSIVE short squeezes. I love to say short-sellers are the new promoters. Their degenerate strategies can push multiple stocks up 100% or more.

Today I’ll focus on one of the hottest sectors in the market right now — low-priced hot biotechs.

Table of Contents

- 1 Why Are Biotechs Running?

- 2 Hot Biotech Examples

- 2.1 Trillium Therapeutics Inc. (NASDAQ: TRIL)

- 2.2 Sorrento Therapeutics, Inc. (NASDAQ: SRNE)

- 2.3 La Jolla Pharmaceutical Company (NASDAQ: LJPC)

- 2.4 Seneca Biopharma, Inc. (NASDAQ: SNCA)

- 2.5 Applied Genetic Technologies Corporation (NASDAQ: AGTC)

- 2.6 IVERIC bio, Inc. (NASDAQ: ISEE)

- 2.7 OWC Pharmaceutical Research Corp. (OTC: OWCP)

- 3 Will Hot Biotechs Continue in 2020?

- 4 Conclusion

Why Are Biotechs Running?

2019 was a challenging year for the biotech sector. The stocks were especially beaten down in December as investors and funds sold their shares for tax losses.

The tax-loss selling in December is the critical first stage of the January effect. A lot of people sell their shares. So a lot of low-priced stocks get beaten down further than they should.

This isn’t rocket science … but I’m not saying you should buy every stock you can in December. Let the companies take a beating. Wait for the new year before you get too trigger happy.

2019 was a lousy year for biotechs … The prices were pushed down hard (I’ll show examples in a bit) … 2020 might just be the right setting for an explosive biotech run.

Anytime these crappy, beaten down companies have a glimmer of hope, they tend to spike further than most traders expect. Once a couple of these biotechs start running, it can become a self-fulfilling prophecy. Traders remember what type of stocks run and prepare for sympathy plays.

Since the start of the decade, almost every top percent gainer has been a biotech company. I’d guess that 60%–70% or even 80% of the largest low-priced multi-day winners the first few weeks of 2020 are biotech stocks.

Hot Biotech Examples

Most of these biotech companies have terrible — and I mean TERRIBLE — long-term charts. They’re beaten down, and many have had previous offerings just to keep the lights on.

Trillium Therapeutics Inc. (NASDAQ: TRIL)

TRIL has one of the best daily charts I’ve seen in a long time. But, zoom out to a three-year chart and you see how this company has been terrible for years.

When I see a daily chart that’s down for years, I’m always extra careful. I rarely hold these overnight. I’m always prepared to cut losses quickly. At the end of the day, these companies suck. There’s a reason they’re beaten down.

TRIL was different than most January effect plays … It started its run in December around 30 cents and spiked to a high of $3.90 on January 10. That’s a move of over 1,000% in less than a month.

There were multiple opportunities to play TRIL, and many of my top students played its multi-day breakout of over $1.75 earlier this month.* There’s no one way to trade these stocks. I just want you to be aware of hot biotechs and the patterns my students use on them.

If you’re just getting started, check out this book written by one of my top Trading Challenge students: “The Complete Penny Stock Course.” (Chapter II:7 — Understanding Catalysts has a section on biotechs. See pg. 190)

I capitalized on this volatile spiker a few times.* Usually, I avoid buying strength on these plays to minimize my risk. So, I dip bought TRIL on December 27 and January 3 using my classic morning panic dip buy pattern.

[*Results aren’t typical. It takes time and dedication to build exceptional trading skills and knowledge. Most traders lose money. Always remember trading is risky … never risk more than you can afford.]

Sorrento Therapeutics, Inc. (NASDAQ: SRNE)

SRNE also began its move at the end of 2019. The day after Christmas, SRNE started its run from the $1.50s to the $5s.

This biotech has been running for nearly a month. It’s crazy how predictable these patterns can become once you dedicate yourself to learning market history…

Every year, the same thing happens. Sometimes it’s in a different industry, but the theme is the same. January can bring new life to penny stocks.

More Breaking News

- Bitmine Immersion Technologies Secures Strategic Edge with $14 Billion Crypto Holdings

- GTM Stock Falls Amid Latest Earnings Report and Market Reactions

- Under Armour Faces Data Breach Affecting 72 Million Customers

- QuantumScape Launches Eagle Line for Solid-State Battery Pilot Production

La Jolla Pharmaceutical Company (NASDAQ: LJPC)

LPJC is a classic beaten-down chart. The company’s had a few difficult years. It ended up in the low $2s at the end of 2019…

Again, since a lot of investors sold at the end of 2019, these failing biotechs can spike — they have fewer sellers. It’s basic supply and demand … The supply on these got whipped out. That allows them to spike much higher than normal.

LJPC is a great example of supply-and-demand imbalance. There were hardly any sellers after the start of 2020. So when the company had good news, it spiked from the $4s to about $9 in four days.

Seneca Biopharma, Inc. (NASDAQ: SNCA)

SNCA isn’t a huge spiker like some of the other biotechs here … But it’s still up 100% from its lows.

Think about it like you’re an investor in SNCA. Anyone who bought this stock in 2019 in the $9s, $7s, $6s, or even $2s … they’re all down 50%–90%. These investors want to leverage U.S. tax laws. They want to sell for a loss and reduce their tax bills due in April.

But it’s critical to be careful and cut losses quickly…

On January 17, SNCA released an offering to raise money to keep its operation going. The stock immediately tanked from the $4s to around $1.50.

Biotech is one of the most dangerous sectors in the stock market. Only trade these stocks if you understand the risks. NEVER risk money you can’t afford to lose.

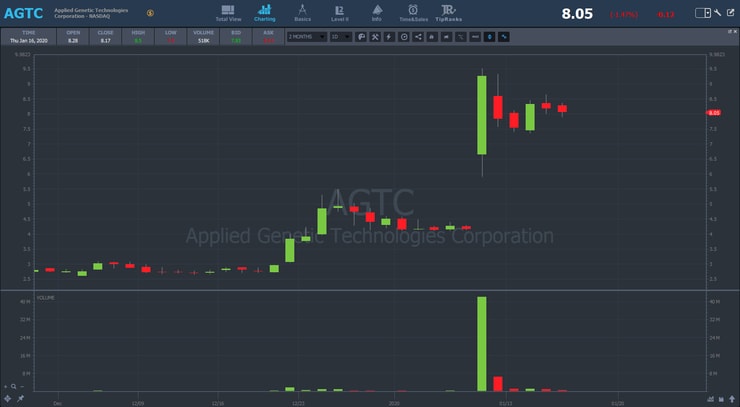

Applied Genetic Technologies Corporation (NASDAQ: AGTC)

AGTC was one of the biggest biotech runners this year — spiking from the low $3s to a high of $9.50 on January 9, 2020.

The stock is holding up well. If it continues to hold, it may have a multi-day breakout similar to TRIL. But nothing’s guaranteed. It could fail, the company could have an offering, or it might do nothing.

I honestly don’t know. I don’t try to predict where these stocks will go. Instead, I react to the price action.

IVERIC bio, Inc. (NASDAQ: ISEE)

ISEE was one of the first biotechs to run and start the hot biotech stock trend. The company had good news in October and really started spiking at the end of 2019.

Again, it’s not just about January — it’s about this time of year. A lot of money exchanges hands, and there’s usually more volume in the markets as investors readjust their positions for taxes.

I won’t lie to you — trading isn’t easy. My best students learn to think outside the box. They dedicate themselves to this profession. Don’t be too narrowly focused on one stock or one-time frame. Take a step back and look at the big picture.

OWC Pharmaceutical Research Corp. (OTC: OWCP)

OWCP is another biotech, but this one is under 10 cents. I’m usually not a huge fan of stocks this low. But I noticed the sector was hot and traded it multiple times using my PennyStocking Framework. Check out my verified trades here.

OWCP went from 1 cent to 15 cents in nine days. That may not seem like much since it’s so low priced. But you could have made 15 times your money in less than two weeks. Obviously, it’s not realistic to expect 100% of the move. But it gives you an idea how much these stocks can run.

Unlike most of these biotechs, OWCP wasn’t a short squeeze. People don’t usually short stocks this low priced.

Will Hot Biotechs Continue in 2020?

If you watch the news, you know about the outbreak of the Wuhan coronavirus in China. To make matters worse, the virus made it to the U.S., which has a lot of people on high alert. Last time there was an outbreak of this scale, a few biotechs and related stocks like Lakeland Industries, Inc. (NASDAQ: LAKE) exploded.

My students and I are watching the news closely to see if it sparks sector momentum. Especially for antiviral drug companies. If the outbreak spreads it could be a catalyst, but nothing’s guaranteed.

So will biotechs continue to be hot in 2020? I don’t know. It’s not like these biotechs have changed and are suddenly better companies.

You might hope that with all the money invested in this sector, some of these stocks will start running as they find drugs that work. But it’s a very inexact science.

No matter how you look at them … they’re crappy companies. But that’s why they can make 100%+ moves in a day. You won’t see well-established blue-chips move even 50% in a day.

Are biotechs riskier? You better believe it. But they can be a quick way to grow an account. That’s why so many of my students trade them. But do your research first. Make a trading plan and stick to it. Cut those losses quickly.

Props to Students

There have been so many plays lately. Here are some comments from students who are crushing hot biotechs. I want to give a shoutout to these students … especially Mark Croock who’s been on top of these biotechs all year.*

Props to these students, but remember … don’t get cocky. We all saw what happened with SNCA … Lock in those singles and protect your gains!

From the Trading Challenge Chat Room

01/10 3:45 PM markcroock: Locked in 6200 so far on $TRIL see if we get a flush to 2.50 here

01/13 9:48 AM markcroock: $TRIL gawgeous

01/13 9:55 AM Batcat: In $TRIL @ 2.50 and out at 2.70

01/13 10:19 AM AmishMiser: OMG $TRIL is nice..

01/13 3:42 PM Johncarlos_510: $OWCP 60+% bounce very impressive…

01/14 10:26 AM crouchie: bot $AGTC 7.68 aiming for short squeeze, sold 7.89 3secs before it broke 8…

01/15 9:54 AM hichamzer: $AGTC potential squeeze

01/17 2:37 PM zzaznhan626zz: just can’t believe I sold $SNCA way too early, 300% too early. was out 1.38 to 1.55 holding o/n.

More Comments From the TimAlerts Chat Room

01/13 9:58 AM cjcolizzi: $TRIL good R/G play, sold too quickly but a win is a win.

01/13 10:03 AM sealwg: In $TRIL @ 2.67, out 2.90: In $ADAP @ 2.50, out @ 3.85….>$350 up… there are a LOT of good plays today…

01/17 2:01 PM Shanky7: $SNCA wow I am glad I got all out .phew

01/17 2:01 PM HammsKC: ahaahah dirty mother F $SNCA doing an offering

Sometimes the best play is no play at all. I’m so proud of the students that avoid SNCA after it was already up HUGE. I can’t wait to see more of these comments in 2020.

[*Students’ results are NOT typical. It takes time and dedication to build exceptional trading skills and knowledge. Most traders lose money. Always remember trading is risky … never risk more than you can afford.]

Conclusion

Any biotech that has even a little bit of good news can spike. If it holds its initial spike, it can spike more into the close on days one, two, three … even days four and five. The longer it holds, the higher the odds of a short squeeze.

2020 has only just begun. There have been too many plays for me to capture. But I like to think of myself as a retired trader … I only come out of retirement when a play is so good I’m forced to take it. So far in 2020, I’ve hardly had a break. And my top students are riding the volatility momentum.

Focus on how you can be a smarter trader and adapt to the market. That’s exactly what I teach my students in my Trading Challenge. Apply today.

Stay tuned for the next part in this series. You won’t want to miss it. And if you’re hungry for more content, check out my YouTube channel. You’ll find interviews with my top students, discussions on strategies, trade reviews, and more.

What do you think about hot biotechs? I love to hear from you!

Leave a reply