Fill-or-Kill Order: Key Takeaways

- How FOK orders can help you become a self-sufficient trader…

- What you can learn from my mistakes to make smarter trading choices.

- The next step in your day trading education journey…

Learn the strategies that kept me in the game — and profitable — for 20+ years*

Fill-or-kill orders are one of many tools successful traders use. But are they right for you? Knowing which orders best fit your trading strategy is crucial to making safer trades. I’ve missed entries on plays before because I entered the wrong order. Don’t let that happen to you!

Let’s dive in…

Table of Contents

- 1 What Is a Fill-or-Kill Order (aka FOK Order)?

- 2 Types of Orders: FOK vs. IOC vs. GTC

- 3 Fill-or-Kill Order Examples

- 4 How Long Does a Fill-or-Kill Order Last?

- 5 How Do You Place a Fill-or-Kill Order?

- 6 Fill-or-Kill Orders and Stock Trading

- 7 Fill-or-Kill Orders: Frequently Asked Questions

- 8 What Is a Fill-or-Kill Order?

- 9 What Is a Limit Fill-or-Kill Order?

- 10 What Is the Difference Between Fill-or-Kill and Immediate or Cancel?

- 11 The Wrap on Fill-or-Kill Orders

What Is a Fill-or-Kill Order (aka FOK Order)?

It’s a buy or sell order that a broker must execute immediately in its entirety or cancel. A fill-or-kill order is all or nothing.

Traders often use these orders to open a position without influencing a stock’s price.

Let’s say you place an order to buy a bunch of shares, but none are available. That creates demand that will sit on the Level 2 and likely push the price of the stock higher.

If you’re new to trading, Level 2 is a tool I use every day to get in and out of stocks safely. Watch my “Learn Level 2” DVD to learn how I use this tool.

Fill-or-kill orders can be useful when you use them correctly. But there are many other order types you can place. You need to learn which will fit your trading strategy best first.

Types of Orders: FOK vs. IOC vs. GTC

To be a self-sufficient trader, you need a solid understanding of the different order types available. It’s part of finding a system that works for you.

Depending on your strategy, you’ll likely end up trading with one of the following orders…

Fill-or-Kill Order

Like I said before, the FOK fills your entire order or not at all. It only takes a few seconds.

I don’t usually use this kind of order because I trade sketchy penny stocks that are notoriously illiquid. Fill-or-kill orders are tough to execute when there are few outstanding shares.

It’s important you know that if you want to trade illiquid stocks using FOK orders. You could spend an entire day submitting orders that won’t get executed.

Immediate or Cancel (IOC) Order

An IOC is similar to a FOK with one major difference — it can fill all, some, or none of the requested shares.

Like FOK orders, IOCs happen quickly. It usually takes just a few seconds to know whether your broker can fill the order. They’ll fill as much of the order as possible and cancel the rest.

More Breaking News

- BigBear.ai Expands Partnerships and Strengthens Financial Position

- Morgan Stanley’s Bold Moves Boost Cipher Mining’s Prospects

- Credo Technology Stock Skyrockets After Impressive Fiscal Performance

- Needham Upgrades Ichor Holdings to Buy Amid Positive Forecasts

Good Till Canceled (GTC) Order

This is my go-to type of order. The name is pretty self-explanatory. Brokers fill the order at the specified price until it’s complete.

If your broker can’t fill the full order, you’ll have to decide whether to cancel the remaining shares or wait.

When GTC orders are partially filled, traders can typically wait a bit longer to see if their broker can fill the rest … They usually can.

Some traders like GTC orders because they allow buying at a certain price point. So you don’t need to be first to a trade or fill an entire position. Sure, it’s nice to have every order filled in its entirety right away, but that’s not realistic.

Every trade is different. GTC orders can give some wiggle room to open positions on sketchy stocks. Trading sketchy penny stocks is my trading strategy. Find what works for you.

Fill-or-Kill Order Examples

Let’s go through some FOK order hypotheticals. It’s good to put numbers behind the definition.

Example 1

Let’s say stock XYZ trades at $5.20. You’d like to buy 10,000 shares at the current price but don’t want a partial fill. You want the shares immediately.

So you choose a fill-or-kill order. But when you try to execute it, your broker only finds 5,000 shares available. A few seconds go by … there are no other shares in the market. The order cancels.

You could have filled half your position, but your order type was all or none of the 10,000 shares at $5.20. So you get none.

FOK Order Example 2

Let’s look at the same example with a key difference. Again, you place a FOK order to buy 10,000 shares of stock XYZ at $5.20.

This time your broker finds 12,000 shares available. Within a few seconds, your entire order fills, and 2,000 shares remain in the market at $5.20. Congrats, you completed a successful order.

How Long Does a Fill-or-Kill Order Last?

FOK orders are immediate. So expect your order to last just a few seconds.

Traders who use this order type don’t want to sit around all day and expose their positions. They want to buy several shares of one stock and don’t want other traders to notice. That could influence the stock’s price and ruin the entry point.

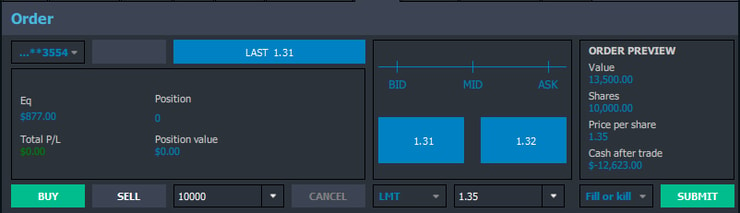

How Do You Place a Fill-or-Kill Order?

Before you place an order, first choose the type — market or limit.

Market orders fill at the best possible price. That sounds nice … but it really means your broker gets to choose. That’s why I always use limit orders. My orders get filled at the price I want or not at all.

Placing a limit order is relatively simple. First, select a limit type order and then choose fill-or-kill.

Here’s a screenshot of what that looks like from StocksToTrade.**

Your broker might offer different order types, so check before trading.

Fill-or-Kill Orders and Stock Trading

It’s critical that you pay attention to the type of order you use when you trade. I’ve missed plays before because I had used the wrong order type and couldn’t get filled. It’s frustrating.

Learn from my mistakes and double-check your order before you make a trade. The stock market is no place to wander around without a clue of what’s going on.

The penny stocks niche is volatile and risky. Yours may be different, but you can still blow up your account if you don’t know what you’re doing or don’t pay attention.

Fill-or-Kill Orders: Frequently Asked Questions

What Is a Fill-or-Kill Order?

A FOK is an order type that fills all or none of your position instantly.

What Is a Limit Fill-or-Kill Order?

FOK orders are limit orders. That means traders set the price they want, and brokers have to complete the order at the specified price or better. If the broker can’t execute the full order as requested, the order’s canceled.

What Is the Difference Between Fill-or-Kill and Immediate or Cancel?

A FOK order ensures your whole position is either filled or canceled immediately. An immediate-or-cancel order is just as quick, but it can be partially filled. Your broker will fill as many shares as possible and cancel the rest.

The Wrap on Fill-or-Kill Orders

See why order types are so important? Day trading is risky. You can easily blow up your account if you don’t know what you’re doing. So learn as much as you can about the stock market — including order types.

Education should be your #1 priority. I’ve been trading for over 20 years and teaching for more than 10. I know now that the truly successful traders are the ones who take studying seriously.*

That’s why I started the Trading Challenge. It’s a place for people to get serious about their trading education. If you think it’s right for you, apply. But note that I don’t accept just anyone. You must prove you can put in the work.

That’s what it takes in this niche. If you’re not prepared, the market will humble you.

I see it happen over and over. Some newbie gets cocky and starts gunslinging. They think they know what to do and take big position sizes on sketchy plays. That’s a losing equation. Sooner or later, they discover that the hard way.

So learn from my mistakes and my successes. Take the time to learn now and thank me later.

What do you think about fill-or-kill orders? Do you use them? Let me know what order types you prefer to use. I love to hear from all my readers!

Disclaimers

*This level of successful trading is not typical and does not reflect the experience of the majority of individuals using the services and products offered on this website. From January 1, 2020, to December 31, 2020, typical users of the products and services offered by this website reported earning, on average, an estimated $49.91 in profit. This figure is taken from tracking user accounts on Profit.ly, a trading community platform. Timothy Sykes has a minority shareholder interest in the platform.

****Tim Sykes has a minority ownership stake in StocksToTrade.com.

Leave a reply