Want to make 2021 YOUR year? Here’s a tip: change your perspective.

The new year starts in a couple of days. So in my final 2020 update, I’d like to leave you with a few thoughts that I hope you’ll take to heart.

Your perspective is crucial to how well you do as a trader. But it’s not only trading. It’s everything. How you make your way through life has a lot to do with perspective. And some of you need a change.

Here’s an example…

Table of Contents

The Power of Perspective

Humans are destroying the environment and endangering wildlife at an alarming pace. I know some of you don’t want to hear that. There are still people who believe it’s all a hoax or that it doesn’t really matter.

So while we’re on the subject of changing your perspective to have a better 2021, watch this three-minute animated video I reposted from Karmagawa…

A Different Perspective on the Environment

View this post on Instagram

A lot of people think their individual actions don’t make a difference. They do. I often ask trading students this question…

“What can you do today, tomorrow, or next week to set yourself up for one or two years from now?”

Change Your Perspective to Be Part of the Solution

Being part of the solution to our environment and wildlife issues works the same way. Yes, there are big problems that need big solutions. But the simplest and most effective thing you can do is change your perspective. Then make your actions reflect your new perspective.

Do you value our planet and the animals that live on it with us? Yes? Then act like it. Remember the video. Look at the world as if you’re the one getting poisoned. Then do the right thing.

The world is an amazing place. Appreciate it. We CAN and MUST do better. Then, when you’re ready, get out and explore it.

Let’s talk trading…

Trading Mentor: Perspective vs. Perception

There’s a common rhetorical question people ask to get an idea about your perspective on life. I’m sure you’ve heard it before…

“Is the glass half empty or half full?”

It holds you back in life if you have the wrong mindset or wrong perspective. It might sound cliché, but your perspective can make or break your trading career.

When you place your trust in me, I promise to give you my 100%. And I do. But to maximize your education, you need to have the right perspective. It’s not about any one pick or hot alerts. It’s not about any one trade. And it’s not about any single pattern.

This is key, because too many people sign up with me and expect a hot pick. Then they want another … and another. Even though I say to focus on the process and NEVER follow my alerts.

So what’s underneath that flawed perspective?

More Breaking News

- MNTS Stock Surges Amid Strategic Expansion and Financial Insights

- Needham Upgrades Ichor Holdings to Buy Amid Positive Forecasts

- TRX Gold Shines with Strong Q1 Earnings and Raised Price Targets

- DealFlow Discovery Conference Unveils Corporate Opportunities

Perspective vs. Perception

Perception is the information you take in. It’s your mental impression.

Let’s apply it to trading — especially if you’re new.

Everyone seems to complain about the early obstacles, mistakes, losses & how long it takes to become a true expert at whatever subject of your choosing, but did you ever think that all those negative experiences help mold you & allow you to improve BIG in time?! #perspectiveiskey

— Timothy Sykes (@timothysykes) December 22, 2020

At first, it seems like there’s a lot to learn. You face obstacles. Mistakes and losses are part of your experience. There’s confusion and frustration. And it’s likely you’ll lose money for a while.

Some people reading this will say, “Wow, that sounds hard. Why would I put myself through that?” If that’s you, your perception is coloring your perspective. You want it to be easy. Or you want an ‘aha’ moment. But it doesn’t work that way.

My latest millionaire Trading Challenge student Jack Kellogg is a perfect example of having the right…

Perspective of Learning

Jack accepted early on that becoming a better trader was worthwhile and would take time. But he admits that by the end of 2019 he wondered how long it would take.

Why? Because his total profit at the end of the year was $160,091.* After two years of grinding. He knew how hard he’d studied. His grind was a part of him. It didn’t define him as a person, but it had a big influence.

But Jack’s perspective was still that the hard work would pay off if he just kept at it. He didn’t make excuses or even think about giving up.

Here’s Jack’s perception vs perspective…

Perception: This is taking a long time. It’s going slowly. It’s hard work. I still make mistakes.

Perspective: It’s worth it. Stick with it. When preparation meets opportunity, I’ll be ready.

Fast forward to now…

Jack’s Visit From Santa

It’s fun for me when I get to reward students. Since Jack passed the $1 million milestone, I’ve been waiting for the moment when I could surprise him.* Check it out…

View this post on Instagram

The crazy thing is, Jack is up another $680,785 … in December alone.*

(*These results are not typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

Adopt Jack Kellogg’s Perspective

Jack is up $1.660 million in 2020.* His total profits a year on from wondering how long it would take … $1,812,518.*

Jack is exceptional. Don’t think you’re gonna do the same thing. You’re not.

But you CAN adopt Jack’s perspective … It’s worth it. Stick with it. Study, refine, and focus on the process. Learn to take singles. Show up EVERY day with a desire to get better. Work your butt off.

You MUST have the right perspective. Anything worthwhile in life takes time. And the benefits in one, two, or three years far outweigh the experiences you face right now.

Change your perspective heading into 2021. Every day, say to yourself, “This is a marathon and not a sprint. But it’s worth it. What can I do today, to set myself up for next year?”

Trade Review: Perspective Is Key

Here’s another perspective tip for trading: No one trade matters. Too many people get caught up with crazy ideas about how much money they can make. So instead of studying, they swing for home runs. Or they ignore my rules.

But no single trade will make you rich. You MUST learn to take singles. Only with the skills you develop over time will you be ready for perfect setups and bigger wins.

Again, it’s all about perspective. You can think like a gunslinger, or you can focus on one trade at a time knowing that singles add up.

Let’s check out the trade…

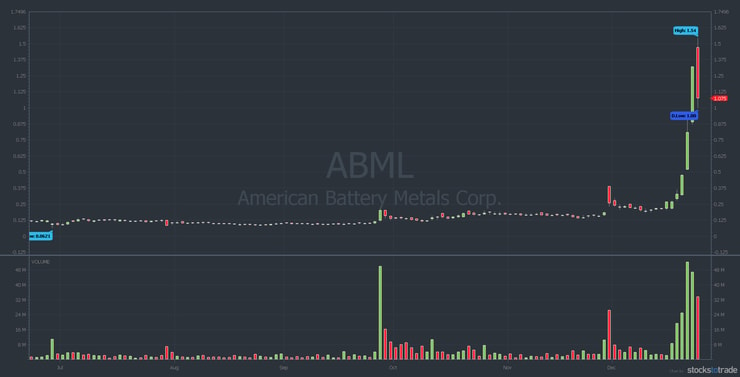

American Battery Metals Corporation (OTCQB: ABML)

ABML is a lithium-ion battery play. I was buying it around 17 cents a share back in September when it was an EV sector sympathy play.

ABML ramped on news the company reached milestones on a new battery recycling plant. Then, on December 21, it went supernova.

Check out the ABML six-month chart:

Multiday runners like ABML are a great setup for morning panic dip buys. Especially if they go full supernova. As you can see from the red candle on the right, ABML finally cracked on December 23.

Here’s the ABML intraday chart from December 23 with my alerts:

My trade was FAR from perfect timing. I didn’t nail the bottom, I sold too soon, and I didn’t quite hit my goals. But it was still a solid trade.

If you think you need to be perfect to win in this game … change your perspective. I would love to have done better. But do you think I care at the end of the day about this one trade? I don’t. I’ll never complain about a $5,521 profit on a trade — no matter how imperfect it was.*

But I will try to learn something from every trade. And THAT is an example of…

The Power of Perspective

You have two accounts to grow in 2021: your knowledge account and your trading account. A lot of you reading this are focused on growing your trading account. But you have to grow your knowledge account first. There’s no getting around it.

Check this out…

Prepare for 2021 Now With 21 Tips for Penny Stock Trading!

At the same time, there are things you can do and tools you can use to help speed up the process.

The question is, how bad do you want it?

Having the right perspective makes exponential growth of your two accounts possible. The reason I say “No days off” so often is because studying has to become a habit. A musician once said to me, “Practice isn’t something you do, it’s something you are.” Change your perspective.

One thing you can do right away is to start using the right tools. It blows my mind when students ask where I find the stocks I trade. Then when I tell them to use StocksToTrade they say, “But I don’t want to pay for that. I just want hot picks…”

Change your perspective. If you want to drill a hole, is a hammer the right tool? NO! So if you want to find penny stocks using the same scans I’ve been using for 20 years … then use StocksToTrade.

(Quick disclaimer: I proudly helped design and develop StocksToTrade and am an investor in it.)

StocksToTrade Special Offer

Do you need a reason to try it? Let me just say this: I use StocksToTrade every single day. The Breaking News Chat add-on has been a game changer for me in 2020. The good news is…

StocksToTrade is running a year-end sale. It’s only on until January 1. Check it out…

Get a StocksToTrade 2-Week Trial PLUS Breaking News Chat PLUS Small Cap Rockets for $20. That’s CRAZY.

Click the link below…

StocksToTrade End of the Year Sale

Change your perspective. Start 2021 by using tools that let you trade confidently.

Millionaire Mentor Market Wrap

That’s a wrap on 2020. It’s been a crazy year…

- Two more Challenge students hit the millionaire milestone: Roland Wolf and Jack Kellogg.*

- A bunch of new six-figure students like Matthew Monaco. Matt also helped with…

- The release of my highly acclaimed 30-Day Bootcamp.

- The best stock market in decades with so many plays I can’t keep up.

- My best year as a trader.

- And so much more…

I want to personally thank YOU for continuing to read my posts this year. Now go crush it in 2021. If you’re ready to immerse yourself in your trading education…

Trading Challenge

All my top students are members of the Trading Challenge. Everything I’ve learned in 20+ years of trading is there for you in DVDs, video lessons, and webinars. Plus, you’ll spend trading days in the Trading Challenge chat room. Watch what others trade so you can learn their mindset and process.

Do you have what it takes? Apply for the Trading Challenge today. Come ready to study.

If you’re already in the Trading Challenge you can become a Challenge Lifetime member here.

Are you ready to change your perspective for 2021? Comment below with “I will have the right perspective in 2021.” Do it. I love to hear from all my readers!

Leave a reply