This penny stock market is HOT, and I recently had my best trading day of 2020 because of it.

In fact, the second week of June 2020 has been one of my best trading weeks in a long time. On June 11, I ended the day up about $27K* in profits. And I ended the week with over $84K *.

Like I’ve been saying, this market is the hottest it’s been in a long time. Most of that’s due to the economic reaction to the global pandemic.

We’re seeing hot sectors around the pandemic, virus plays, and civil unrest. It’s all giving us so many penny stock plays. I’ve never seen a market quite like this one.

But even in a hot market, you can’t go into trades without a plan.

My top Trading Challenge students report slaying it in this market.* But they go in prepared with strategies based on the patterns I’ve taught them — and then execute on those plans.

Sure, a lot of newbies may be getting lucky buying and selling randomly as a stock goes up … But let me tell you — they’ll likely get burned with big losses down the road.

I don’t want that to be you, especially if you’re new to the market.

New traders usually lack the training and discipline required in these hot markets. Take it from someone who’s been in the game for more than 20 years now — I’ve seen A LOT.

That’s why I want to share my top six lessons that led me to my best trading day of 2020.

(*My results, as well as the other traders mentioned in this post, are not typical. Most traders lose. Always remember trading is risky — never risk more than you can afford to lose.)

Table of Contents

Lesson #1: Cutting Losses Quickly

I don’t care what type of market we’re in — I always have one rule that tops every other rule in the book…

Cut losses quickly.

This is one of the most important lessons I follow and teach to my students. It’s the one rule that allows my most top students to stay on their game month after month.

But for more advanced traders, there can an exception to cutting losses quickly — cutting losses intelligently. That’s what my top student Tim Grittani does. But make no mistake, he’s worked his way to this level of trading.

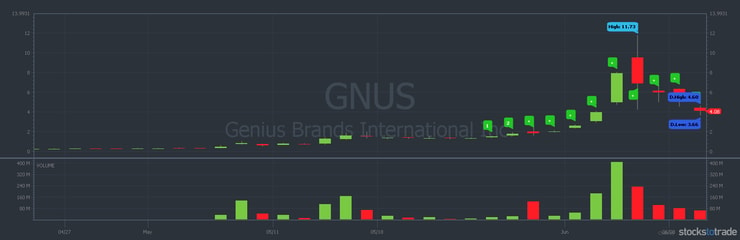

I’ll talk more about my actual trades soon, but Grittani got caught options. For trading purposes, especially short selling one of the biggest runners of this hot market — Genius Brands International Inc. (NASDAQ: GNUS).

Look at this chart … GNUS went from around $1 to almost $12 in a matter of days:

Again, I’ll dig deeper into this move, along with many others, soon. But right now I want to focus on one thing … how Grittani cut losses intelligently, which in this case was quickly.

Grittani was short-selling this stock in the $1s — and then it went to $12.

Luckily, he got out quickly and kept his losses to about $20K or so. If he’d held, he would have been down over $1 million at the top.

In a market like this where so many stocks make massive moves, cutting losses is more important than ever. And that applies to the long side, too.

Just as fast as they go up, they go down. You don’t want to be caught in a massive dump like this one on GNUS:

It’s not worth it. Don’t be stubborn. Cut losses quickly — you can always re-enter if the setup is right.

Lesson #2: Understand WHY These Moves Happen

I know why these stocks can move 100% or more in a single day … do you?

I talk about it more in-depth in this video:

I don’t know how long this hot market will last. But I’ll keep taking advantage of it as long as I can.

My results are what years of studying looks like. I’ve been trading for over 20 years. I’ve seen so many different hot markets. But they all have one thing in common…

There’s often a common reason for these massive moves — a lot of these stocks are pumped.

But every hot market differs a bit in terms of how stocks are pumped and promoted.

Because of SEC regulations, we don’t see boiler rooms and paid promoters pumping stocks like they used to.

These days, promotions are more driven by social media hype on ‘good news’ … and uneducated newbies follow right along.

The reason the stocks keep going up isn’t random. My haters will say I get lucky trading these stocks. Truth is, I know exactly why these stocks are running as much as they are. And so do my Trading Challenge students.

I won’t sit here and tell you these insane moves are from random buyers … they’re not. I know a lot of shorts are getting squeezed. And if you’re prepared, you can ride that momentum on the long side.

More Breaking News

- Credo Technology Stock Skyrockets After Impressive Fiscal Performance

- Cipher Mining Hikes Price Target Amidst Bold Strategic Moves

- Clear Channel Outdoor’s Strategic Move: Major Acquisition Unfolds

- Oracle’s $50B Cloud Expansion Plans Fuel Stock Surge

But knowing why they’re going up is only half the battle. Certain patterns work better than others right now. You gotta know how to take advantage of them. Which brings me to…

Lesson #3: Identifying Patterns

I trade the same patterns over and over again — and I have for years. But some patterns work better than others in hot markets.

I used to short sell back in the day, but that strategy is so risky right now.

The over-aggressive short sellers today hate my lessons and DVD guides. They think my lessons are too conservative. I guess they don’t like that I teach my students how to safely grow their small accounts.

But really, I should be thanking the aggressive short sellers right now. If you know any aggressive short seller, tell them I personally thank them for creating these big spikes — and my best trading day of 2020 yet.

Even though the moves are insane, I hate to see any trader lose. That’s why I’m so passionate about teaching. If I can help just a few students grow their accounts and avoid big losses, it’s all worth it to me. But still…

The aggressive short sellers create these massive spikes. My top students and I are prepared for it — these shorts are the best pumpers in the game right now.

In fact, they allow my patterns to work better than they have in a long time. Here’s one of my favorite patterns to play off of the short squeezes right now…

Morning Panic Dip Buy

The morning panic dip buy is one of my favorite patterns, no matter the market.

But when tickers like GNUS and SSFT move more than 100% in a day, I like it even more.

It all comes back to understanding why these patterns work. When shorts are stuck after a big gap up, they’re so stubborn that they’ll wait for a dip to cover their shares at a better price.

That means that on most dips on big gappers can be a great opportunity to buy. As shorts begin to cover, the price of the stock usually goes up more.

It’s also important to find these gappers before it’s too late. Dip buying the morning panic requires precise entries. So I’m watching these plays long before they even happen.

I’m not always right on these plays, either. That’s why I cut losses quickly when I’m wrong. If the dip keeps going down, I can always play it again later.

Let me show you a dip buy trade I took on Sonasoft Corp (OTCQB: SSFT). Here’s the chart:

You can check out this trade on Profit.ly (as well as every trade I make). I made $2,925 on this dip buy alone.* And I love this trade — it was clearly trending up with good news. That means more longs chasing and more shorts covering.

(*Please note: my results aren’t typical. I’ve spent years developing exceptional skills and knowledge. Always remember trading is risky. Never risk more than you can afford.)

Lesson #4: Finding Plays

I find these plays because I use the right tools.

I don’t randomly trade — I look for volume and news. Volume isn’t random. Shorts covering are a big part of it, but there’s usually more to the story.

Companies like SSFT often drop press releases or news to draw attraction to the ticker. That can create more volume. Shorts think the momentum can’t last and longs want to ride the wave.

So smart traders need a way to find the news that can move stocks. That’s why I use StocksToTrade.

Between the built-in scans, the Social Media tool, and the new Breaking News chat — I have access to so much information. It’s easier for me to find the stocks that can spike on the right news with volume.

In fact, StocksToTrade is how I found SSFT. My first trade on it was the biggest trade on my best trading day of 2020 so far. I locked in about $17,000 in profits.* Check out the chart from the morning of June 11:

Notice the volume boost around 10:11 a.m. I got in around 18 cents and out around 28 cents for a 52% gain.*

The built-in scanners on StocksToTrade use the same criteria I look for when finding opportunities. There’s a reason for that: I helped design and develop it. These scans are great for low-priced stocks.

And with the Breaking News feature, I’m getting news that matters FAST. Speaking of news, you have to know which news has legs. In other words…

(*Please note: my results aren’t typical. I’ve spent years developing exceptional skills and knowledge. Always remember trading is risky. Never risk more than you can afford.)

Lesson #5: Don’t Believe the Hype

I know I just dedicated a whole section to news that can move penny stocks. But don’t believe the hype.

There’s a reason these stocks are penny stocks — most of these companies are crap.

Digital Ally, Inc. (NASDAQ: DGLY) is a company that released great news. It turned into one of June’s supernovas, and I traded it on June 5. If DGLY was a big company and released that news, it would have been halted and all eyes would be watching it.

But people hate on penny stocks all the time. I know some traders who trade bigger companies, and they hate on me for trading penny stocks. They say it’s impossible to make money day trading these crappy stocks.

I’ll happily keep proving them wrong.

But you have to know the difference between how big companies trade and how penny stocks trade.

Luckily, I’m trading against traders who don’t prepare. Like the shorts behind short squeezes or those who believe the news and invest long-term in these sketchy stocks. Don’t be these traders!

Focus on your education, the patterns, the process, and how these stocks move. Never hold and hope.

That’s why I’m in and out of these stocks so quickly … and how I just had my best trading day of 2020 yet.

Lesson #6: Education Pays Off

My haters tell me that I’ve just gotten lucky all these years trading penny stocks. Apparently, a 76% win rate is all luck.

But I didn’t make over $5 million trading penny stocks on luck** … I got it through studying my butt off for years.

I’ve learned so many lessons the hard way. And now I want to help others so they don’t have to make those same mistakes.

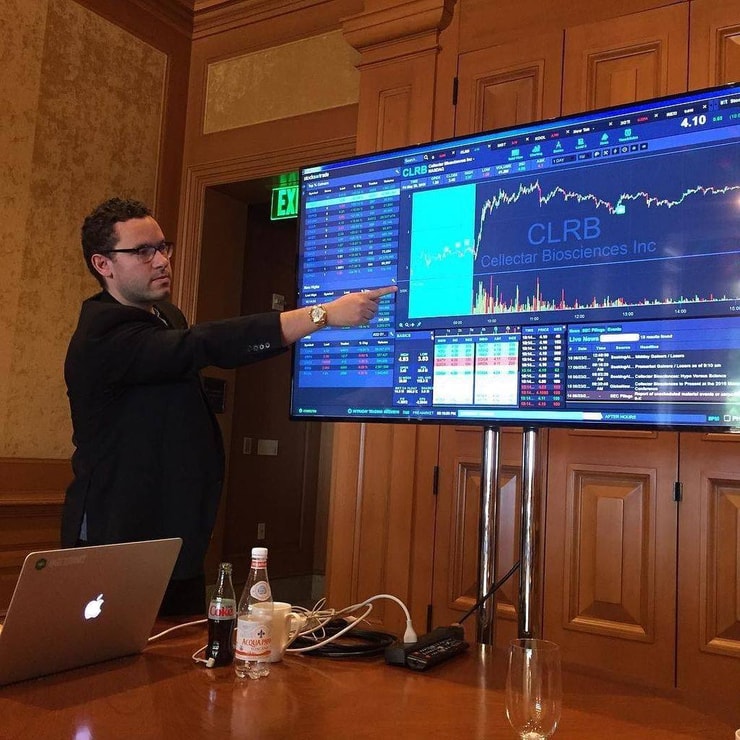

That’s why I have over 6,300 video lessons for my students to study. It’s why I have so many DVDs, webinars, and other videos. It’s all to help my students become self-sufficient traders.

If I can help even a few students learn to trade smarter, it’s worth it to me.

The penny stock niche is NOT easy. Some of my top students studied for 12+ hours a day until they found consistency. It’s hard work. And everyone’s level of commitment is different. That’s why I offer so many ways you can learn from me — from YouTube to Pennystocking Silver to my no-cost weekly watchlist.

Maybe you’re brand-new to trading … or maybe you’re ready to take the next step. If you’re up to it, apply to my Trading Challenge. It’s an opportunity to learn and level up.

Or don’t. If you want ‘hot’ stocks or if you don’t want to commit to the process, I can’t help you. You do you.

Best Trading Day of 2020 Conclusion

I’m looking back on my best trading day of 2020 yet … and I’m in awe of this market. I don’t know how long it will last. But I’m prepared for every last bit of it.

Really … I mean it when I say these patterns repeat. My biggest day of the year was $27K* in profits. But I had another close contender on June 15, coming in at almost $25K in profits:

Whewwww, what a day, I made $24,766 today overtrading on $UONE $UONEK $CIOXY $TSOI $HYSR $QPRC $SSFT $RAFA won most, got sloppy w/some losers, but overall another HUGE day, now I'm +$168,066 in June & +$378,299 in 2020, see my FREE https://t.co/KON0UFjulH for the best strategies!

— Timothy Sykes (@timothysykes) June 15, 2020

This is why your education matters. In every hot market, there are different reasons for how and why these patterns move. That’s why adapting to the market is key. I may be trading the same patterns, but I have to adapt them to this market. It’s not always the same.

I know to react, not predict. That’s part of what allowed me to have my best trading day of 2020 yet.

I hope you learn something from these lessons and this market. I think there’s no better time to learn. This market is insane!

(*Please note: my results aren’t typical. I’ve spent years developing exceptional skills and knowledge. Always remember trading is risky. Never risk more than you can afford.)

I’m curious … What lessons have you learned in this HOT market? What’s your best trading day of 2020 so far? Let me know in the comments below!

Leave a reply