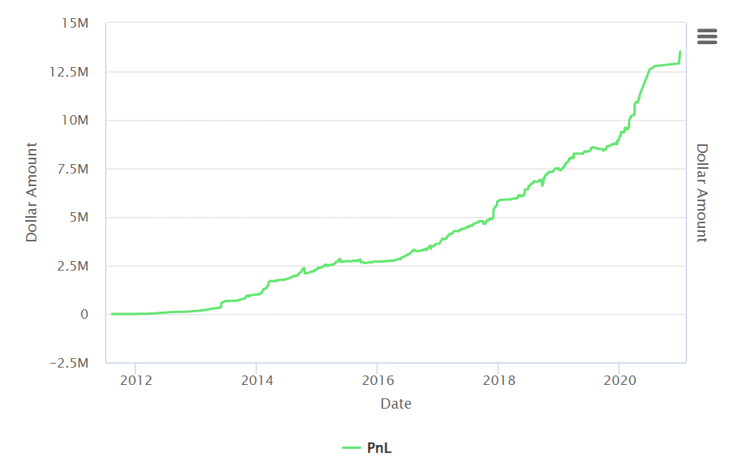

In this day trading community, Tim Grittani is recognized as the GOAT. Just check out this profit chart…

That’s what Tim Grittani has been able to accomplish as a day trader — over $13.5 million in trading profits. (See a great overview of his trading career here.)

I may have taught him how to trade, but it only took him a few short years to surpass me in profits.

In the past few years, Grittani took some much-needed time off. And I’m ecstatic to announce that now he’s back in action!

Last week, the GOAT gave a webinar to Trading Challenge students. (Catch a sneak peek at the webinar here.)

New @kroyrunner89 webinar for https://t.co/occ8wKmT5U students starting right now, come on in Challenge students & be ready to take crazy amounts of notes, THE MAN IS BAAAAAAAAAAACK! pic.twitter.com/b9ArUs1DPb

— Timothy Sykes (@timothysykes) March 12, 2022

I had to tune in to see what this amazing trader is up to in this wild market. Read on for my top 10 key takeaways…

Want access to every Challenge webinar? Apply to join us today.

Table of Contents

- 1 1. He Trades Very Little

- 2 2. He’s Already Found Lots of Volatility in 2022

- 3 3. Grittani Is NOT Perfect

- 4 4. He Has Distractions

- 5 5. He’s Primarily Long in 2022

- 6 6. Part-Time Trader … Forever?

- 7 7. Still Working to Refine His Algos

- 8 8. Greatly Prefers Breakout Longs vs. Dip Buys

- 9 9. Start With Small Positions…

- 10 10. Despite His Success, He’s Still Humble

1. He Trades Very Little

A lot of people think they need to trade all the time to make money. That’s not true.

Yes, Grittani spent his first few years in the stock market grinding hard. But now he spends less time on trading. He’s actually been working on algorithms that will — hopefully — eventually trade for him. That way, he can spend even less time trading.

Don’t get me wrong. Grittani put in a lot of work to get where he is now. All my millionaire students spent countless hours studying and watching the markets.

But when it comes to actually placing trades … things can get kind of boring.

For example, last week I only made three trades.

Grittani and I wait for the best setups. That’s how the pros do it.

2. He’s Already Found Lots of Volatility in 2022

Grittani might not trade as much anymore, but he knows when to buckle down and take profits.

Within the last month, a lot has happened. Putin’s invasion of Ukraine sent a tidal wave of chain reactions through the markets.

Here’s just a taste…

But one of the outcomes was a huge energy sector spike. We saw runners like Houston American Energy Corporation (AMEX: HUSA)…

… and Mexco Energy Corporation (AMEX: MXC)…

More Breaking News

- Denison Mines Stock Surge Amid Strategic Developments

- Pagaya Technologies Sees Stock Fluctuations Amid Strategic Moves

- RITR’s Strategic Moves Signal Potential Growth Amidst Market Challenges

- Datadog Soars with Strategic Price Adjustments Amid Optimism

You have to be ready to capitalize when things get hot.

3. Grittani Is NOT Perfect

It’s impossible to be perfect — especially when it comes to day trading.

Here’s a stat that might surprise you: As a trader, Grittani’s only right 67% of the time. That should put you at ease. Even the best traders are wrong at times.

Stop trying to squeeze every drop of money out of these stocks. And if your plan falls through, cut the loss quickly!

Grittani missed out on some of the biggest energy supernovas. He was a day early.

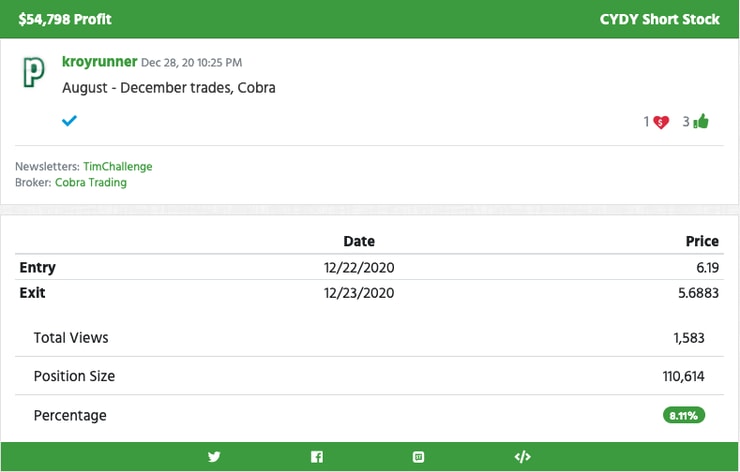

And when prices started falling off a cliff, he missed on the short side too. And Tim’s a guy who knows how to profit on overextended stocks. Check out his trade on Cytodyn Inc (OTCQB: CYDY)…

Let me say this as clearly as possible … If Grittani’s not perfect, neither are you. So relax and focus on the process.

4. He Has Distractions

Stop making excuses. I hear excuses all the time:

- “I can’t learn to trade because I have a 9-to-5 job.”

- “I have kids to take care of”

- “I’ve got a bunch of school work.”

Listen, there’s always a reason not to do something. And I have good news — you’re not alone.

Many of my students have gone before you, from all walks of life.

Tim Grittani learned to day trade while working as an insurance agent.

Roland Wolf became a millionaire while raising a family.

And Matt Monaco studied my trading framework while in college.

The road is difficult, but the reward is worth it.

Once he hit profitability as a trader, Grittani was able to quit his insurance job. But that doesn’t mean he’s run out of distractions. In the webinar, he shared he’s been sick and that there’s a mouse loose in his house.

He named it Skitters.

Please thank @kroyrunner89 for his amazing https://t.co/occ8wKmT5U webinar tonight all done while he's sick & there's a mouse in his house that he calls Skitters LOL. Challenge students review this webinar when its posted this weekend, along with his 70+ other challenge webinars!

— Timothy Sykes (@timothysykes) March 12, 2022

5. He’s Primarily Long in 2022

I don’t encourage newbies to short stocks.

Day trading is inherently risky. But it’s even riskier for short sellers.

In long positions, a trader can only lose as much money as they put in. But there’s technically no limit to how much money short sellers can lose. That’s not a risk to take lightly.

I know I showed you his $54,000 profit on CYDY. But understand that Grittani’s been in this niche for years. His experience and discipline are what keep him safe.

In 2022, he’s more interested in long positions.

Please congratulate @kroyrunner89 & retweet this as he confirmed on this MUST SEE https://t.co/occ8wKmT5U webinar that he's not with the dark side anymore, aside from his +$90k $CEI short, the $1.5 million he's made in 2022 has been on LONGS on plays like $INDO $IMPP $HUSA $ENSV

— Timothy Sykes (@timothysykes) March 12, 2022

Most traders would take that as a hint to focus on bullish patterns. There just aren’t many reliable short setups right now.

6. Part-Time Trader … Forever?

Full-time day trading is exhausting.

This niche moves quickly. To consistently profit, you have to stay on high alert during market open.

Tim doesn’t regret the work he’s done to get to this point. Far from it. Achieving +$13.5 million in profits helped him realize there’s far more to life than making money.

He prefers spending more time with his family and less time working.

That’s the beauty of this profession. Once you’ve put in the work, your life can become much freer.

Grittani could go back to full-time trading and make a buttload of money. But he seems fine with a couple of million dollars every now and then.

7. Still Working to Refine His Algos

Never give up.

It takes years to do what Gritanni’s done. And he’s still working every day to get better.

He mentioned some difficulty in creating his algorithms. Apparently, it’s difficult to quantify his trading strategies. I figured as much, and that’s why I’ll stick to teaching.

But he’s not giving up on the project. It took years of studying and a lot of hard work to make +$13.5 million in profits. And he’s ready to put in the work for his new project. But it might take longer than expected.

You should approach day trading the same way.

8. Greatly Prefers Breakout Longs vs. Dip Buys

You may need some background info on these setups:

If so, here’s a video on breakouts…

And here’s one on dip buys…

Personally, the panic dip buy is my favorite pattern to play. But Grittani disagrees.

That’s why day trading is so great! There are so many opportunities to profit. My students and I don’t trade the exact same stocks. And even if we do, we usually trade them differently.

Grittani has some great insight into breakouts versus dip buys that he shares in his webinar.

It’s true that breakouts usually have higher upsides.

Daily breakouts have less resistance and therefore can spike higher.

Dip buys run into resistance from the most recent spike. And as a result, they can struggle to achieve the same percentage gains.

But both patterns are viable options for day traders. It all depends on what makes you the most comfortable.

9. Start With Small Positions…

The really great thing about penny stock trading: the price per share is low.

These stocks are cheap. And that’s great for two reasons…

- Traders can load up on shares and take advantage of big percent gains.

- Newbies starting out can practice trading without blowing up accounts.

That’s not always how it goes … Just ask Grittani.

His first attempt at day trading resulted in his draining his account.

Learn from his mistakes. Stop trying to make millions right away. Buy fewer shares and practice in the beginning. You’ll thank me later.

Then, as you get better, SLOWLY start increasing your position size while following the same trading strategy.

As you gain experience and confidence, you can even add shares to your positions.

10. Despite His Success, He’s Still Humble

This is a quality I’m proud to see in my millionaire students like Grittani.

It takes a lot of hard work to become a day trader. Pretty much all the cockiness gets beaten out of you along the way.

If there’s anything I can count on in this world, it’s the ability of the market to humble rookie gunslingers.

The market giveth, and the market taketh away.

I’ve seen traders come and go. Some of them learn the right lessons. Some don’t.

That’s why I’ve dedicated myself to teaching traders all over the world. I’m tired of seeing people waste their hard-earned money on dreams of a $1 million stock pick.

This isn’t a casino. If you’ve come to gamble you’ll regret it.

There’s a framework you need to learn, and I’m here to help.

Apply for the same program as Grittani and learn to trade today!

But you’ve gotta show you’re willing to put in the work. I don’t accept just anyone. My trading course is no joke, so we keep the jokesters out.

Did you watch Grittani’s live webinar? What’s one thing you learned from the GOAT of day trading? Leave a comment to show me you understand these lessons!

Leave a reply