I’m not very good at investing. And I’m totally fine with that.

When I recently sat down with Jordan Belfort for his Wolf’s Den podcast, I told him the story of my worst investment.

And it caught him by surprise.

And it caught him by surprise.

Early in my career, my best friend’s dad and I were talking over Thanksgiving dinner.

He convinced me print-at-home ticketing would take off, and I needed to invest.

Turns out you can be dead right on your predictions and still lose money.

The technology took off. The company I invested in declared bankruptcy.

Even for me, $1 million is a lot of money to lose.

Yet, it probably saved my students and me far more money in the long run.

You see, I learned a very important lesson…

No matter how much you believe in a company, always expect the worst, whether it’s a penny stock or a blue chip.

This single idea made me a better trader and can also help you if you know how to apply it correctly…

There is Always More You Don’t Know

My friend’s dad’s company didn’t fold because it didn’t time the trend correctly or understand the technology.

Simply, they failed because they took on too much debt during product development.

Even the biggest companies hide things in plain sight, from Enron to Countrywide Mortgage.

Rather than try and figure out who’s telling the truth, I assume they’re all lying.

And it makes my life a lot easier.

In the world of penny stocks, promoters pump stocks. That’s their job.

Sometimes it’s a legit news release. Other times they’re trying to scam you.

However, their motives don’t matter if you assume they all lie because you only need to focus on price action at that point.

My 7-step penny stock framework highlights the patterns and price action I see repeatedly.

These setups occur over and over precisely because traders react to pumps the same way, whether they’re legit or not.

All I do is exploit the price action.

Expect Extremes

I stopped short-selling several years ago when it became too crowded.

Stocks like AMTD Digital Inc. (NYSE: HKD) that shoot up 2,000% before crashing can wipe out poorly timed short trades.

Instead, I prefer to buy stocks after they crash, scooping them up at support levels based on the price action, or jump on pumps as the stock rebounds.

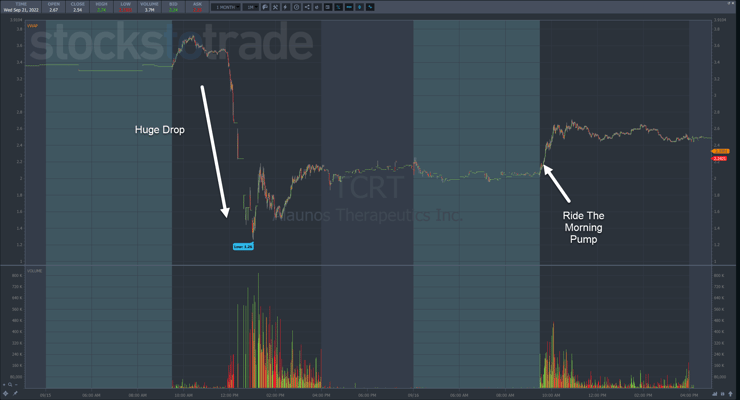

Alaunos Therapeutics Inc. (NASDAQ: TRCT) is a recent example of this trade setup.

After shares plunged on Thursday, I bought into a pump that sent shares higher on Friday.

I want to see these types of big moves for my potential trades, not something that’s up or down 5%.

For the majority of my trades, I shoot for 5%-10% gains.

That’s much easier when a stock moves +30% than only a few points.

My #1 rule is to cut losses quickly and keep them small.

The flip side of this is to take profits often and early.

I don’t know how far a stock may run or how long it will take.

What I know is my chart patterns, how to apply them, and what they look like when they work and fail.

I go into every trade with the mindset that I want the trade to prove itself to me.

If I buy a stock, expecting it to bounce, I will not hold onto it if it trades sideways for more than a few minutes.

Anything can happen at any time, especially with pumpers involved.

More Breaking News

- ALAB Stock Climbs Amid Strategic Moves and Strong Financial Indicators

- Vizsla Silver Corp US Market Rift: Challenging Times Ahead

- Under Armour Battles Data Breach Amid Revenue Challenges

- Datadog Soars with Strategic Price Adjustments Amid Optimism

They can vanish just as quickly as they appeared.

Healthy Self-Skepticism

In yesterday’s newsletter, I covered mistakes I made trading an IPO.

After more than two decades of trading, I could pretend like I don’t make mistakes

But I do and so do the best traders I know.

When I assume I screw up more than I actually do, it creates a healthy skepticism that forces me to look for mistakes.

Even when I don’t find them, it keeps me vigilant and always improves my game.

Remember, don’t take anything for granted.

Prepare for the worst so you can achieve the best.

—Tim

Leave a reply