With all the recent volatility, it’s crucial to know your stock market history. The big market plunge last week wasn’t really unexpected. But the amount of opportunity surprised a lot of newbies.

People have misconceptions about market crashes. I’ll get into some of those in this edition of the update — along with why you MUST study stock market history.

But first, a travel update…

Table of Contents

Unveiling the First Karmagawa School Bus

In the U.S. we take basic education for granted. Sadly, there are places in the world where kids don’t have the same access to education. In the last update, I told you about the new school openings in Bali. Karmagawa works closely with Bali Children’s Project so more kids can go to school.

We’re up to 70 schools and libraries worldwide, including 20 funded projects in Bali. But in some of the villages, the kids have to walk up to four miles to school. The roads are very narrow — so if it’s raining they just don’t go. That’s a problem. So we decided to take action.

I’m very proud to announce the unveiling of the first Karmagawa-sponsored bus. It’s the first of many.

When Mat Abad and I started Karmagawa, we talked a lot about how important education was in our lives. We decided education is a huge priority for Karmagawa. These buses give kids easier access to school. They’ll never need to worry about walking long distances to get there again.

Update on Our Mission to Save Animals in Australia

We’re still talking with a bunch of different charities. As I wrote last week, it’s a complex issue. I wish it were simpler. It’s not. With a lot of the charities, the money doesn’t go to just helping animals.

When we were in Australia, we met with sanctuary after sanctuary. They’re not getting the money they need to help many animals.

I wish I could donate directly to these small sanctuaries. Unfortunately, they’re not set up as normal charities. So we’re searching for a mother charity that can (and will) give money to these small sanctuaries that need it.

We’ll know more soon and I’ll update you here.

Let’s get to trading and why you need to study stock market history. We’ll jump right into student questions this week…

Trading Questions from Students

The first question in this edition is a great example of why knowing stock market history can save you a lot of pain. Check it out…

“Does fear in the markets create safer opportunities for short sellers?”

You would think that’s the case. Here’s the problem …

These short squeezes have gone on much more than in the past. Again, study stock market history.

Here are two prime examples…

Alpha Pro Tech, Ltd. (NYSE: APT)

I mentioned APT in my recent post about the stock market crash. The company makes medical masks. There’s a huge demand for masks as the coronavirus spreads around the world.

During the Ebola outbreak of 2014, APT went from $3 to $12. Now — during the coronavirus scare — the stock went from $3 to $41. So it’s roughly three to four times more than the previous spike.

Short sellers think it’s easier, but it’s a trap. It’s even more dangerous than ever. I know many short sellers blew up on APT.

Here’s another example…

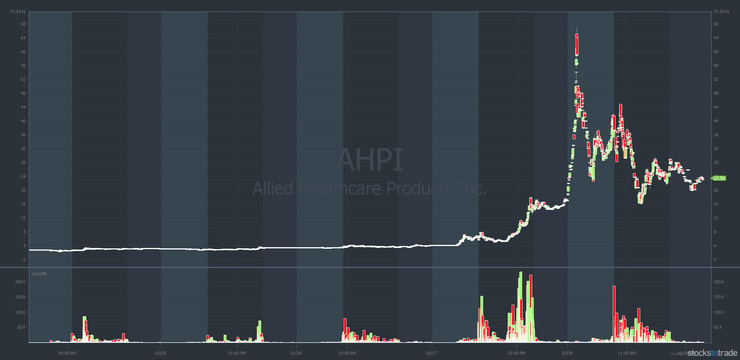

Allied Healthcare Products Inc. (NASDAQ: AHPI)

Again, study stock market history. AHPI spiked in October 2014 during the Ebola outbreak. Its biggest single-day move was 78% on October 9, 2014.

Take a look at the AHPI 10-year chart…

Now look to the right on the chart. This time, with coronavirus, it went much further. But that chart still doesn’t tell the whole story because you can’t see extended-hours trading.

Here’s the APHI five-day chart…

APHI went from $4.15 to $66.99 in less than 24 hours. That’s sixteen times your money or 1,614%. It’s another example of a short-squeeze supernova.

In case you’re wondering how I know it was a short squeeze…

Short sellers are a lot like vegans. You don’t have to ask — they tell you.

Since short interest data is delayed it’s never very accurate. So I use StocksToTrade’s social media search tool to get an idea who’s doing what. I recommend it. It’s almost like a secret weapon.

Remember — it’s not an exact science. But when you study stock market history, you know what clues to look for.

Next question…

“Could the coronavirus cause forced selling from institutional investors due to client redemptions?”

It’s hard to say. It’s just a panic at this point. We don’t know how bad it’s gonna be for the world economy.

If you’re new to penny stock trading, this question might raise more questions…

First, what’s forced selling? It’s just what it sounds like. An investor gets forced into selling off assets. It usually happens due to some kind of big or unforeseen event.

Next, what’s forced selling by institutional investors? I talk about it very briefly in my TimRAW guide. When the stock market goes down enough, people get scared. Institutional investors get hit by client redemptions.

Clients invested in mutual or hedge funds want out. So they redeem their shares. These client redemptions can force the fund managers to sell off their positions.

So when stock prices are already low and big sellers come into the market, prices drop more. It creates a kind of downward spiral.

Come back to the present — again we just don’t know.

Both Tesla and Apple warned that the coronavirus will affect operations. Some of these companies won’t have the demand they’re used to. Especially in the Chinese economy. Also, Chinese manufacturing is off for many weeks.

Frankly, it surprised me the markets held up so well. Then, on Friday, I was surprised by the big bounce running into the close.

It looked like some sort of buying program designed to get everyone all excited. For me, I didn’t go long over the weekend. This is scary stuff right now.

New to penny stocks? Get my FREE penny stock guide here.

Let’s finish up with the…

Trading Lesson of the Week: Know Your Stock Market History

Last week I made $2,785. Jack Kellogg made roughly $29,000 on the week. Tim Lento made around $26,000 on Friday. Mark Croock made roughly $30,000 on Thursday and Friday.**

Having a career best month in Feb has been damn nice …that said it’s just a number who cares move on to next trade and execute with discipline… never thought $TSLA would be one of my biggest winners but setup was a beauty!!

— Mark Croock (@thehonestcroock) February 26, 2020

[**Please note these results are not typical. These traders have exceptional knowledge and skills that they’ve developed with time and dedication. Most traders lose money. Trading is risky. Do your due diligence and never risk more than you can afford.]

Then there’s Tim Grittani. He celebrated his birthday last week. And he made somewhere around $160,000 in one day.** I don’t know the exact number, but I think he made a quarter-million last week. We’ll find out when he posts his trades on Profit.ly.

Speaking of Grittani, check this out…

Announcing The Biggest Penny Stock Milestone Ever!

OK, back to stock market history. My point is…

I don’t throw out those numbers to brag. There are just so many students to congratulate. SO many students had a huge week. It was almost fire at will.

But to do it, they had to know stock market history.

You should know your stock market history, right?

If you’re gonna trade coronavirus-related stocks, you should study previous outbreaks. Even if they’re not as big.

Stock Market History Repeats Itself

Looking back at when the Ebola outbreak happened — it’s the same exact stocks. This outbreak is just bigger. At least study stock market history so you can have some kind of framework.

Also, I keep getting DMs from non-students and students alike saying…

“I’ve never seen anything like this.”

Yes, you have. You just haven’t watched my DVDs or video lessons enough. Study harder.

Millionaire Mentor Market Wrap

We don’t know what’s gonna happen with this market. Today the market’s trying hard to rally. And while we know the coronavirus will affect the world economy, it’s not clear how much. But I can tell you one thing…

My top students — those who are crushing it on virus plays — all studied stock market history. Or they were there the last time these plays were hot. Either way, a knowledge of stock market history is part of their skill set.

Wherever you are on your journey — whether trading or still learning — pay attention to what’s going on. Then do yourself a favor and go watch all my DVDs and video lessons.

Some people want to know which DVDs or video lessons are the most important. They’re all important. This market is a perfect example of why. Watch every single one. More than once.

More Breaking News

- Huntington Bancshares Faces Earnings Miss, Market Considers Impacts

- Morgan Stanley’s Bold Moves Boost Cipher Mining’s Prospects

- DealFlow Discovery Conference Unveils Corporate Opportunities

- GTM Stock Experiences Notable Fluctuations Amid Recent Financial Developments

Trading Challenge

All my top students are part of the Trading Challenge. The program includes access to over 6,000 video lessons, hundreds of hours of DVDs, and weekly webinars. Plus, you get access to all archived webinars — thousands of hours of stock market history as it happened.

Fair warning: not everyone who applies gets accepted. The Trading Challenge requires an incredible amount of dedication. Think you have what it takes? Apply here.

Congrats to Students Learning AND Profiting**

There are so many students to congratulate I’m planning an entire post dedicated to it. For now, here are only a few of the trades reported in chat last Friday.

[**Please note these results are not typical. These traders have exceptional knowledge and skills that they’ve developed with time and dedication. Most traders lose money. Trading is risky. Do your due diligence and never risk more than you can afford.]

Comments From Trading Challenge Chat February 28

10:56 AM craz4sure: Started the challenge on the 14th. Up almost $900 since then. My friends keep telling me they miss me because I’m studying all the time. 🙂

12:01 PM markcroock: +10k on VXRT.

12:04 PM PJCraddock: $2.43-$3.04 on $IBIO. Emotions have been killing me since a big (for me) loss about 2 months ago. My biggest gain since Oct. $535.

12:04 PM markcroock: all out everything +16k.

12:09 PM Jackaroo: covered $APT +$5k up $9000 realized 💪

12:46 PM Androo: best day ever, up $1.9k ! I think Imma call it and get back to my job so I get it done on time lol

01:50 PM MikeySaghbini: im up around $1200 on the day.

02:11 PM Mk12: $APT- quick in and out for $500 profit… total for the day $6500

02:17 PM kylecw2: the most predictable moves for these virus plays are over imo. Who knows what happens news wise over the weekend. Closing today roughly $5k and $18k for the month.

02:38 PM GoodNeighbor143: up $542 on my $3500 paper trading account with STT goood week of learning.

02:54 PM wildwes: $BIOC quick 10% from .49 to .54 on the breakout.

03:16 PM craz4sure → DevineMofo: I took gains of $725 this week (on $1k account) buying and holding overnight… I’m not opposed to doing that again next week.

What do you think about studying stock market history? Comment below, I want to hear from you!

Leave a reply