I get so many questions about trading. Recently someone asked me if the profit/loss ratio matters. If you’ve been following along, you know I like to keep things simple. Keep reading. I’ll explain more about the profit/loss ratio later in this post.

I’ll also share lessons from my only red day in the past month. It reinforces why it’s so important to follow rule #1: cut losses quickly.

Before we get to trading talk…

Table of Contents

Donate to Karmagawa’s Lebanon Fundraiser

I’m sure you’ve seen the horrifying videos on the news and social media. On August 4, a horrible explosion in Beirut, Lebanon killed at least 154 people. It injured thousands more and destroyed a section of the port. The shockwave damaged homes of tens of thousands of people in surrounding neighborhoods.

When we saw the news, we decided right away we needed to do something to help. We set up a Karmagawa fundraiser on Facebook. Within hours we’d raised $60,000 — which is amazing. As of August 8, we’ve raised $329,077.

Please help us help those in need.

Donate to help the victims/families in Beirut, Lebanon.

We’re talking with a few different charities in Lebanon. Keep reading for more on why we donate to small charities.

First…

One Million Thank Yous For Yemen

Karmagawa is proud to announce a donation of $1 million for the children of Yemen.

Actually, the total donation will be more than $1 million. We extended the Facebook fundraiser for a few days once the NY Post ran the story linked above.

From the bottom of our hearts, Mat and I would like to thank everyone who donated. The food packs your donations buy cost around $50 each. They can feed a family of six for a month.

The reason our donations go so far is because we’re very careful about which charities we work with.

Better Bang for Your Buck: The Power of Giving to Small Charities

A lot of people say, “Yeah, I donated to the Red Cross.”

I appreciate the Red Cross. They do a lot of great work. But very little of the money you donate actually goes toward charity. This is why Karmagawa prefers working with smaller charities.

It’s very similar to penny stocks. If you invest in a big company, you have the potential to make a decent return over time. But you’re not gonna get rich. Trading penny stocks can give you a much better chance — as long as you learn the strategies.

When you donate to small charities, you get a bigger bang for your buck. They don’t have big marketing expenses like big charities. They don’t have big operating budgets. So they can work better — especially in tough, tricky situations like Yemen and Lebanon.

Now it’s time for another big announcement…

30-Day Bootcamp Launch

I’m super excited to announce this launch. Matthew Monaco and I put this together starting in April. My team has been working hard behind the scenes to get it ready. The feedback so far is excellent.

VERY excited to announce this 30-day bootcamp https://t.co/5na3WlyHE9 with one of my top upcoming https://t.co/EcfUM6l2S3 students @mono_trader who was making $5-10k/month before we began filming & now has been making $50,000-90,000/month ever since…the hot market helps too 🙂

— Timothy Sykes (@timothysykes) August 6, 2020

What’s the 30-Day Bootcamp? You’ll get 30 days of video training, the 30-Day Bootcamp Workbook, daily quizzes to test your knowledge, and more.

Here’s how you’ll progress through the 30-Day Bootcamp:

- Phase 1: The Fundamentals. Learn how to find the best stocks fast so you don’t miss out on this crazy market volatility.

- Phase 2: Strategies and Patterns. Learn my top six patterns, my seven-step framework, and how to lock in profits.

- Phase 3: LIVE Practice. This is a behind-the-scenes look at how I trade, including which tools I use and why.

Get Started With the 30-Day Bootcamp Today

Also included with the 30-Day Bootcamp as a bonus… “The Complete Penny Stock Course” by my student Jamil.

Since going through this material with me, Matt has now passed $250,000 in total profits.*

(*These results are not typical. Individual results will vary. Most traders lose money. My top students have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

Trading Questions From Students

This week’s question is about a winning trade on what turned out to be my only red day in the past month. It’s also a great lead into today’s discussion on the profit/loss ratio.

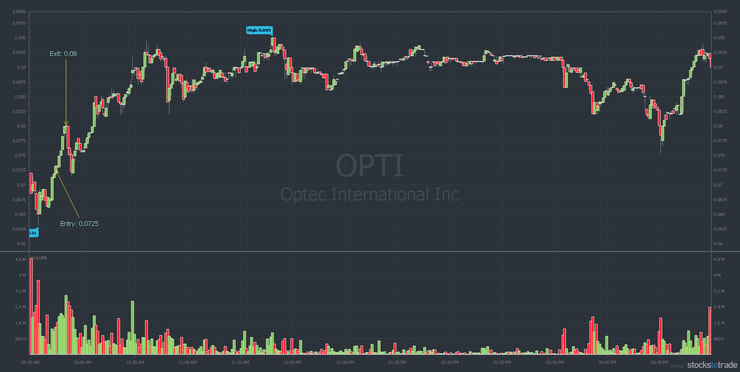

“OPTI had a breakout over the previous day’s high. You had a 10% win, but it was choppy. Do you ever consider a re-buy?”

First, let’s take a look at the trade…

Optec International, Inc. (OTCPK: OPTI)

OPTI was a runner on August 3 after the company announced the launch of the “Safe Scan” infrared scanner. The new tech is free-standing, contactless, and has built-in facial recognition.

Check out the OPTI chart from August 4…

I bought the breakout and sold safely for a solid 10% win.* One reason I was so careful is that I’d lost on another trade a few minutes earlier. But it’s also because it trades choppy AND my past experience with the stock.

So my answer to the question is….

Know What Works Best for You

Did I consider rebuying? No. I’ve always had trouble with OPTI. I’ve traded it five times since June 18. With certain stocks, you just don’t get a great feel. See my OPTI trades here.

I’ll always trade stocks like that very conservatively. Compare that to a similarly priced stock like Digital Locations, Inc. (OTCPK: DLOC). I’ve had big percentage wins on DLOC several times.* See my DLOC trades here.

With experience, you start seeing that different stocks have different characteristics. With OPTI, I was happy to take profits.

It’s interesting to note that I finished red on the day…

Lessons From My Only Red Day in a Month

My total loss for the day was $317. It doesn’t matter to me, but it brings up a good lesson.

The previous day I made $7,832. The day after my red day, I made $3,161. The next day, $9,708.* You could take five straight days of roughly $300 losses and one of those days will wipe away the losses.

Some people are convinced that you have to be perfect. They think you need to be green every day. But what matters more is how your average win compares to your average loss.

There are different ways of looking at it. Here’s one way…

Profit/Loss Ratio Explained

In the month from July 6 to August 6, I had 96 winning trades and 25 losses. My average win was $876. My average loss was $385.*

The profit/loss ratio is a simple way to compare average win to average loss. This shows how I calculated my profit/loss ratio:

- $84,128 made on winning trades divided by 96 wins equals $876.

- $9,634 lost on trades divided by 25 losses equals $385.

- $876 divided by $385 equals 2.27.

In this case, my profit/loss ratio was 2.27.

One thing to consider is that the profit/loss ratio can be misleading. You can have a profit/loss ratio of 2:1 and still be negative. How? If you lose 67% of the time with a 2:1 profit/loss ratio, it’s impossible to be profitable.

So the profit/loss ratio is only one way of looking at it. But it reinforces one of the most important lessons I teach…

(Please note: My results are far from typical. Individual results will vary. Most traders lose money. I have the benefit of years of hard work, dedication, and experience. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

It’s Key to Minimize Losses

I like to keep things simple. Cut your losses quickly to keep them small. Win more than you lose and make sure your wins are bigger than your losses. Over time, your small account will grow. If you want to use the profit/loss ratio as a way to keep track, do so. But it’s not essential.

It’s just another way of using data to track and improve your process.

I know it’s disheartening for newbies to have a red day because you put in time. But you have to focus on your overall account. You have to focus on your overall growth.

Protect, protect, protect.

Back to my red day…

Frankly, I was wrong on my loss on SINTX Technologies, Inc. (NASDAQ: SINT). It was my biggest loss in a while — nearly $2,000. It was moving fast and I had a pretty sizable position. See details of my SINT trade here.

But … I was right by that afternoon. It did spike. It just didn’t do it in the time frame I thought. It’s good that even though I had the loss, I cut the loss well. And I was on the right track but a few hours early.

With trades like OPTI and SINT, some people say, “Tim, you did OK but left so much on the table. Do you feel guilty?”

I don’t feel an ounce of guilt. I stick to my rules. Again, you have to do what works for you. Maybe if I had more patience I could sit and wait on a stock for hours. But that’s not my personality.

Which leads me to the…

Trading Lesson of the Week

Most traders think you have to make as much money as possible. NO! Not at all. You have to try to utilize the market to help you in life.

So learn to take small gains and keep your losses smaller than your gains.

Rule #1 is cut losses quickly, and also take singles NOT home runs, you'll be surprised how quickly $200, $500, $1,000 gains can compound over time especially if you keep losses minimal to less than 1/2, 1/3 or even 1/4 of the size of your gains. ALWAYS consider the risks FIRST!

— Timothy Sykes (@timothysykes) August 4, 2020

Whether you pay attention to the profit/loss ratio or not, the key is to build over time.

You won’t get rich quick from penny stocks. People don’t want to hear this, but it’s important. If you haven’t already … check out my FREE penny stock guide. It’s a great place to start.

Millionaire Mentor Market Wrap

That’s another one in the books. If you haven’t yet, please donate to Karmagawa’s fundraiser for the victims of the Beirut explosion.

Check out the 30-Day Bootcamp here. If you’re a Trading Challenge student, you get the 30-Day Bootcamp as part of your orientation.

Whether you use the profit/loss ratio or some other way of tracking, focus on the process. Gaining financial freedom from penny stocks is a marathon, not a sprint.

What did you think of this post? Will you use the profit/loss ratio as a way to track your trades? Comment below, I love to hear from all my readers!

Leave a reply