I want to show you the single BEST reason you should be trading penny stock supernovas.

No, it’s not just that penny stocks are cheap. Or that many of my top students have exponentially grown their accounts trading penny stocks.

It’s not even that they’re more volatile and can spike 100s of percent in a day.

I mean … after that list alone, what’s not to love about penny stocks? But here’s what I think is the best reason…

The one everyone should care about…

The number-one reason I love penny stocks: information inefficiencies.

You’re probably thinking … “What does that mean … Information what?”

Don’t worry. ‘Information inefficiencies’ is just fancy talk for…

Table of Contents

How I Consistently Capitalize on Penny Stocks

Most people hate penny stocks. They don’t understand my rules and usually lose money until they give up.

They treat penny stocks like lottery tickets — believing they found the next Amazon (NASDAQ: AMZN).

NEWS FLASH

Penny stocks are mostly garbage. You didn’t think I was dumb enough to actually believe in their scammy stories?

They’re TRADING vehicles — not investments. My students and I take advantage of the volatility. We trade them when they’re hot and ignore them once they complete the Penny Stock Framework.

MUST WATCH: “The Volatility Survival Guide”

This market is insane. There are so many plays, I’m having a difficult time keeping track of them all. But this market won’t last forever, which is why I encourage you to watch “The Volatility Survival Guide.” It’s brand new, ZERO COST, and created specifically for this crazy volatile market.

Access “The Volatility Survival Guide” Here

That brings me back to…

Why Penny Stocks?

Because I’m actually smarter than the competition. Listen…

I’m not a smart guy. And not all my top students were A+ students in school, but…

We’re consistent in trading penny stocks because we’re playing against idiots.

Idiots believe the press releases. They load up on the sketchy companies and get burned. While I play repeatable, predictable patterns.

Wayyyyyyyyy too many investors and traders do NOT adapt to new patterns/strategies/setups, they think they can just memorize one setup and it'll always work — NOPE! This is NOT an exact science, the path to the best, most consistent profits is a moving target so you MUST ADAPT!

— Timothy Sykes (@timothysykes) May 5, 2020

Let’s do some basic math (hang on … trust me)…

Less competition = More opportunities for me

Dumber competition = Easier opportunities for me

I’m not a mathematician … but it’s clear to me that penny stocks are the best niche in the stock market. They offer more easy opportunities than any other niche. Penny stock supernovas create incredible opportunities.

Back to…

Information Inefficiencies

For decades, scholars have debated whether the stock market is efficient.

In my opinion, it’s a bunch of bogus … But an efficient market would mean that at any given time, the price of a company’s stock accurately reflects the actual company’s value. In other words…

All news, world events, developments, and business operations are baked into the price. If this were true, there’d be no way to take advantage of stock movements. Fortunately, penny stocks are FAR from efficient.

This is where it gets good…

Real companies (large-caps, blue-chips, etc.) are close to efficient because so many highly educated people watch them ALL DAY. They have advanced math models and complex computer algorithms to take advantage of any tiny inefficiencies. But…

Who’s looking at penny stocks? Dumb people … and me and my top students.

Without the smart, well-funded Wall Street crowd, news spreads slow. What would take seconds on Wall Street sometimes takes days in penny stocks.

So if you prepare, understand the patterns, and use this revolutionary tool…

You can learn to take advantage of information inefficiencies too.

Here’s an example…

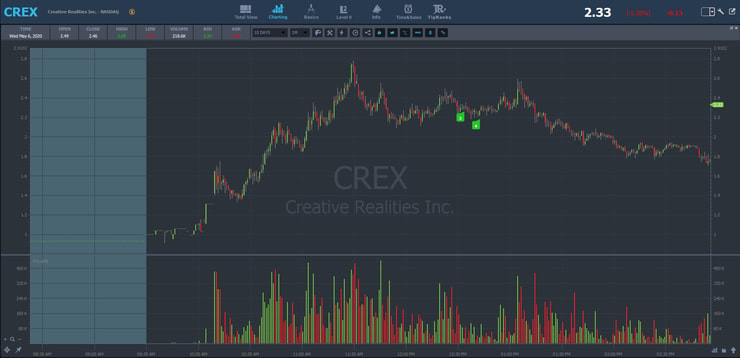

Creative Realities, Inc. (NASDAQ: CREX) Penny Stock Supernova

On April 28, 2020, Creative Realities changed its website to pivot to a more coronavirus-pandemic marketplace. Check it out here.

For large companies, a pivot like this is huge news to shareholders. But CREX redesigned its entire website without a press release … until the last two hours of the market day.

I want you to focus on the morning action. Pretend like you’re seeing this chart for the first time.

Somehow, traders discovered the website redesign before the press release. This discovery excited many traders. It meant CREX had an upcoming catalyst.

Traders started to buy the rumor that there would be a press release later that day. Unfortunately, if you weren’t using this revolutionary tool’s social scanners … you probably didn’t see the stocks movement until it was too late.

CREX’s failure to have a press release is a perfect example of an information inefficiency in penny stocks. Traders had over five hours before the company announced its website changes.

We’ve seen this pattern a lot recently. Companies like CytoDyn Inc. (OTC: CYDY), Decision Diagnostics Corp. (OTC: DECN), and AgEagle Aerial Systems, Inc. (NASDAQ: UAVS) preannounce catalysts like conference calls. These announcements can make people want to be in the stock before the call … That results in a classic “buy the rumor, sell the news” situation.

Although we’ve seen the pattern a lot … I think CREX is better because the company didn’t have to make a preannouncement. Traders started promoting the stock themselves (more on that later).

Reviewing My CREX Trades

Frankly, I didn’t have a good entry on CREX.

I started alerting it in the $1.50s to students, but I stayed away because it was so choppy.

I never trade choppy stocks well because I cut my losses quickly. When I enter a trade, I want to see it follow my trading plan immediately. If it doesn’t, I’ll exit and wait for a better time to enter.

Anyway … I eventually decided to enter when I thought the shorts were in trouble. I hope aggressive short sellers never learn … They make the best penny stock supernovas.

I chased an entry into the $1.80s but got an awesome spike into the low $2s meeting my trade goals. This quick morning trade netted me $1,650.* (Check out my verified trade here.)

(*Please note: my results are not typical. I’ve spent years developing exceptional skills and knowledge. Always remember trading is risky. Never risk more than you can afford.)

I usually only share my thought process with my students … but I want to help as many people as possible.

Below, I’ll share my Trading Challenge chat room commentary from April 28, 2020. It’s all time-stamped. Match my comments with CREX’s chart above.

More Breaking News

- Ondas Leverages Strategic Gains in Defense Sector Expansion

- Vale’s Stock Soars Following Significant Price Target Increases

- Redfin’s ChatGPT Integration Enhances Home Search, Boosts Rocket Companies’ Market Presence

- Valterra Platinum’s Q4 Forecast Drives Anticipation Amidst Earnings Surge

My CREX Penny Stock Supernova Trading Challenge Comments

10:05:24 AM: “$CREX new fever inspection product on website, no PR yet, spiking and halted, one to watch for further spikin and probable PR soon”

10:10:47 AM: “I would not chase $CREX in the 1.60s just chats trying to pump to each”

10:11:28 AM: “$CREX down to the 1.40s, chatroom pumpers/followers crushed as usual”

11:21:20 AM: “$CREX 2.50 awesome short squeeze now!”

11:28:50 AM: “WOW $CREX 2.60s if I had any left I’d be selling now, congrats to all longs here with patience, what a short squeeze!”

I missed the best entry on CREX because I was being extra careful. I wanted to make sure CREX had the attention of real traders before I entered. Nothing’s worse than being fooled by low-level promoters.

Remember … most chat rooms consist of an unknown ‘guru’ alerting a ticker to subscribers with a vague message telling them to buy now.

That kind of chat room environment is sketchy. That’s why I’m proud to be fully transparent. I specifically tell my students to NEVER follow my alerts.

There's no magic formula to getting rich as a trader, it's just a daily grind of choosing good setups & executing good plans, learning from your mistakes & what NOT to do, improving gradually over time while you grow both your knowledge & financial accounts in exponential fashion

— Timothy Sykes (@timothysykes) May 5, 2020

Study the alerts, but don’t follow them. I want my students to be self-sufficient traders.

Every time I alert a trade, I write a full paragraph explaining my thesis and outlining my trade goals. It’s critical to have a trading plan for every trade.

After my trades, I make video lessons for students so they can understand my mindset. That’s much more important than following alerts. Learning the proper mindset is far more important than making money in the beginning.

Learn the process. Once you understand the process … you can become a self-sufficient trader.

Promoters and Short Sellers — A Delicate Trading Dance

How did shorts get squeezed so quickly? It’s a delicate dance…

CREX first started to spike because a few chat rooms were promoting it to their members. At first, I wasn’t sure if the volume was based on the website change or if it was just chat rooms promoting it to each other.

You gotta be careful. Sometimes stocks run because of a small promotion. In this situation, there’s no real demand … and the stock will quickly fail.

So watch out for that. Whether it’s a morning spike or a company with news, there are so many chat rooms these days that promote stocks to subscribers.

I’d be a lot more popular and have a lot more students if I was like the other chat room ‘gurus.’ But I don’t care about making money trading. I want to teach you to become a trader. I’ve already made millions in the stock market.*

What’s the point if I’m the only one making money? I want more successful students.

That said … I’m very grateful for the promotional chat rooms. They create awesome opportunities for me and my students. I’ll keep saying it…

The Best Promoters Right Now Are Short Sellers

But please don’t tell them!

They’d hate to realize the market they’ve created. Short sellers are so high and noble. In their twisted minds, they think they’re doing the world justice by shorting these penny stocks. Little do they know that they’re the biggest reason these stocks go higher.

Short sellers act like angry vegans (no offense). They scream their exact positions all over the internet. I’m sorry … but I didn’t ask. Thanks for the awesome penny stock supernovas though.

Anyway, breaking down the dance for CREX … it was initially pumped by the chat rooms. Yeah, it had catalysts, but did it justify a 70% spike? I don’t know…

Then the noble short sellers tried to short it and failed. It all resulted in a huge squeeze my students report nailing.

This little ballet is awesome. Let’s review. Chat room promotions lead to short sellers selling … which leads to more promotion … and then a huge penny stock supernova. I LOVE it.

Comments from My Dedicated Students

I made a video lesson for my Pennystocking Silver and TimChallenge members. A lot of them studied the lesson and are now prepared for the next penny stock supernova. Here are some of my favorite comments…

Buckers: “Thanks Tim, I enjoyed watching CREX play out throughout the day, even though I have an IB account I was more than happy to watch and learn. I love this dance!!!”

FJ_trading: “Love the short dance 👌”

Ammaizeroi: “Really appreciate your knowledge of the subject ….. More reasons to study a bet harder ! and further!!”

Maxamillion: “Thanks Tim, I missed the run up on CREX but appreciate all your help and information. Study, Study, Study!!”

Osquin1315: “I love this dance, need to learn more on how to spot it and take advantage of the dance. thanks for teaching us.”

Josephshorten: “I love this dance, watched it jump from 3 to over 4 was crazy how fast it moved!”

Glock26: “I love this dance. Just haven’t figured it out yet. Still studying, long way to go but I’ll get there. Thanks”

Branwillm87: “Love the dance of momentum. I successfully traded CREX today.”

Windwalzer: “Thank you for continually educating me/us on short squeezing, classic morning panic pattern, and all the mental preparation. I love this dance.”

If you’re serious about trading, you need to join the Challenge. All my top students come from the Challenge. I don’t accept everyone. But if you think you have what it takes … Apply for the Trading Challenge today.

Conclusion

The reason I actually have millionaire students is because I’m teaching a process. I teach repeatable patterns that continue to work with penny stocks.

Be careful chasing short squeezes. Yes … I chased and profited,* but it can be very dangerous. Short squeezes aren’t always as successful as CREX.

At the end of the day, I don’t care about CREX or the news.

I care about the supernova dance. It happens a lot with different stocks.

It’s funny that shorts are better promoters than the promoters themselves. I’ve tried to help them but they don’t listen. Oh well.

It just means there are more opportunities for my dedicated students. Do you think you have what it takes? Apply for my Trading Challenge today.

I want to hear from you! Do you love patterns like this? Comment below…

Leave a reply