What if I told you I knew how 99.99% of all penny stocks end?

Not only that, I could tell you PRECISELY how to trade them.

I don’t have a crystal ball…

However, I do have something even better – experience.

Through more than two decades of trading, I realized most parabolic penny stock moves follow this 7-Step Framework.

But there’s more to this blueprint than meets the eye.

Don’t get me wrong, THIS PATTERN is where every trader needs to start.

Yet, you’ll need more to become a seriously profitable trader.

I’ve said trading is part art and part science, but that’s not entirely accurate.

Trading is part science, part nuance.

For example, promoters tag me on social media more frequently when pumped stock nears its top.

Like a poker player who’s seen millions of hands, the little details I accumulated over the years improve my trading.

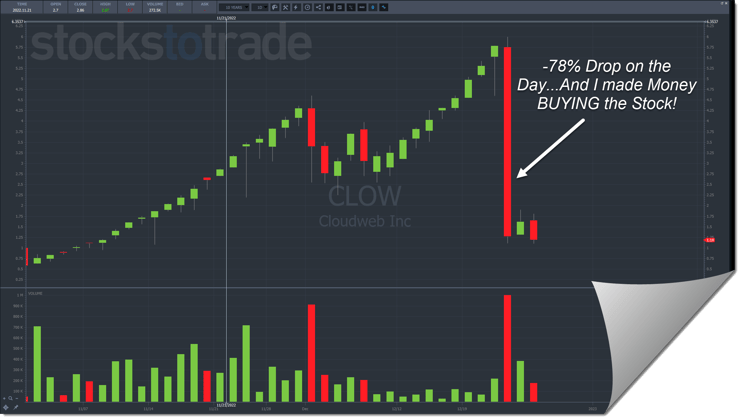

Last week, I used a little known nuance to dip buy Cloudweb Inc. (OTC: CLOW) for a nice $834 profit… (My starting stakes were $6,740)

Did I mention the stock was in freefall?

My students wondered how I pulled this off since it didn’t fall into the traditional morning panic dip buy.

I gave them the answer along with six other tidbits I’m going to share right now.

These are some of the BEST observations I made over the years that helped me achieve a +75% win rate with millions in profits.

Table of Contents

- 1 1. Pumps Can Go Higher Than You Think

- 2 2. Morning Panics Dip Buys Eventually Fail

- 3 3. Dip Buy in the Afternoon on the Second Dip

- 4 4. Breakouts from Consolidation Struggle on the Second Day

- 5 5. China’s Market is Full of Scams

- 6 6. When a Dip Buy Closes Near the Low, It Often Has One More Panic Before a Bounce

- 7 7. Trading Less Can Make You Better

- 8 And Remember…

1. Pumps Can Go Higher Than You Think

Many of my top students who love to short got smoked in Intelligent Living Application Group Inc. (NASDAQ: ILAG).

They used their patterns, but failed to remember why I stopped shorting stocks.

With shorting now easier than ever, the trades get crowded.

That’s led to huge squeezes that can send shares soaring.

Take AMTD Digital Inc. (NYSE: HKD).

This stock went from below $20 to nearly $3,000 in days.

Short sellers can lose everything on stocks like these.

Yes, they all fail eventually.

But don’t forget that there’s a reason setups include stop losses.

2. Morning Panics Dip Buys Eventually Fail

Every stock that fits my 7-Step Penny Stock Framework only ends up one way…dead.

When I dip bought CLOW, I knew that it would eventually fail.

Any stock that promoters pump up must crack.

That’s why I’m so adamant about losing small and fast.

Digging into a one-minute chart of CLOW, I can identify three spots that could have worked as dip buys.

The first bounce wasn’t bad but it wasn’t huge either.

The second spot was the best area, while the third hardly moved.

The stock eventually broke through the dip in two out of the three spots.

Given enough time, the stock will break the third spot.

More Breaking News

- Datadog Battles Price Target Reductions Amid Growth Hopes

- Valterra Platinum’s Q4 Forecast Drives Anticipation Amidst Earnings Surge

- Price Predictions Fueled by Company Moves In Market Dynamics

- Supreme Court Greenlights New Gold’s Game-Changing Acquisition by Coeur Mining

Stock pumps always end the same way.

3. Dip Buy in the Afternoon on the Second Dip

Typically, I don’t buy afternoon panics. They don’t offer the same odds as in the morning.

However, CLOW offers an example of a quirk in this framework.

When a stock panics in the afternoon, it typically tries to make a bottom and fails.

If it goes for a second bottom shortly thereafter, that’s a better spot to panic dip buy.

Keep in mind, the later in the day, the less likely this setup will work.

4. Breakouts from Consolidation Struggle on the Second Day

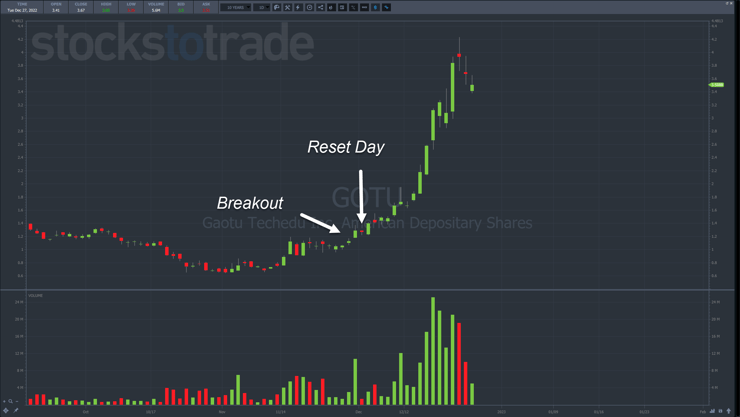

Mult-day runners start one of two ways: day one surge that keeps going (like HKD) or a surge that consolidates before breaking out.

In the second instance, when the stock finally breaks out of the trading range, it does it in fits.

The first day out is usually followed by a second day that struggles to maintain the momentum.

Gaotu Techedu Inc. (NYSE: GOTU) demonstrates this on the daily chart near the end of November.

Shares surged from below $1.00 to $1.20 before trading sideways for a week.

The day after they broke out, the stock took a breather.

You can see the same pattern on the next breakout and pullback over the next two days.

The longer a stock consolidates, the more likely it is to backtest before moving higher.

5. China’s Market is Full of Scams

Speaking of GOTU, Chinese stock markets are full of scams.

The stocks listed on American exchanges should be treated with extreme caution.

China’s regulators are far more heavy-handed in their involvement and the reporting isn’t nearly as transparent.

I trade every penny stock like I expect it to fail. That goes double with these companies/

6. When a Dip Buy Closes Near the Low, It Often Has One More Panic Before a Bounce

I want to bring up a daily chart of Global Tech Industries Group Inc. (OTC: GTII).

I put two arrows on the chart.

The left one points to a red candlestick that didn’t close near the lows.

The right one points to a red candlestick that did close near the lows.

When panic selling hits a penny stock, shares will often need a second day of selling if the first one closes near the low.

That’s why the first candlestick didn’t continue down the following day but the second candlestick did.

7. Trading Less Can Make You Better

Traveling the world for pleasure and charity work means I have less time to trade.

So, when I do trade, I make it count.

Coincidentally, the less time I spend trading, the better I perform.

In front of my screens at home in Miami, I do worse than when I’m on the road.

It’s a simple matter of overtrading.

It’s a part of me and something I will always fight.

So, I designed a lifestyle to work around it.

We all have weaknesses. And you can’t just will them out of existence.

But you CAN structure your trading to limit their influence.

And Remember…

Your output is a function of your input.

Study hard and you will go far.

—Tim

Leave a reply