What would you do with $10 million?

Would you quit your day job?

Travel the world?

Take care of your family?

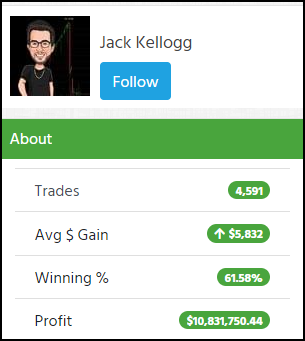

Jack Kellogg jumped headfirst into my Millionaire Challenge in 2017.

This year, he surpassed $10 million in lifetime trading profits.

All his trades are posted right here…

Jack stood up in front of hundreds of traders at our Traders Summit in Miami and relayed his story.

He described the thousands of hours he spent studying the material available.

No joke, you could watch videos and read posts available to Millionaire Challenge members 24/7, and it would take you more than a year.

The thing is, that’s Jack’s story.

I can teach anyone how to reach those same heights.

But only YOU can determine the path to get there.

Jack started young, before he could legally buy beer, and used that to his advantage.

He created a schedule that allowed him to spend hours upon hours studying hard to reach his goals.

But what about someone who’s the breadwinner in a nuclear family, supporting a spouse, 2.5 kids, and a mortgage?

What does their journey look like?

That’s what I want to help you discover today.

You see, the work we do and the concepts we study don’t change.

All we need to do is design a plan that fits into our lives that reaches the same endpoint.

Here’s how you do that.

Rank Your Priorities

Mark Croock is a great example of a student with a different life and set of priorities.

I met Mark as a Millionaire Challenge student way back in 2010.

He’d always been interested in trading, starting with his bar-mitzvah money, just like me.

Before becoming a full-time trader, Mark was a public accountant.

When he decided to dive in, he took the ambitious step to quit his job to free up his time to trade.

Despite bumps and starts along the way, Mark stuck with it until he hit that $1 million milestone in 2018.

Today, when Mark isn’t trading, he’s spending time with his family.

Both Mark and Jack made trading their #1 priority.

If you’re decades into your career and paying to put kids through college, quitting your job to trade full-time may not be feasible.

That doesn’t mean you can’t get to the same place.

It just means trading becomes your first priority after necessities.

So, if you’re paying for a mortgage and putting kids through college, keep at it.

But your free time should be spent learning to trade.

Schedule Your Study

Humans crave structure.

Don’t just say, “I’m going to study 8 hours this weekend.”

Actually pencil in the time to do it.

Give yourself specific hours to work on trading.

Keep in mind, there are different types of education available in my Millionaire Challenge.

I included everything from videos to blogs and even webinars you can listen to in the car.

And make the time you study a regular event.

More Breaking News

- HIMS Stops Compounded Pill Amid Legal Threats

- Skyward Surge: Momentus Inc. Soars and Faces Market Dynamics

- BigBear.ai Expands Partnerships and Strengthens Financial Position

- Pagaya Technologies Sees Stock Fluctuations Amid Strategic Moves

It’s fine to slip in extra hours here and there. But make sure you set up a realistic schedule you can commit to.

Plan Your Path

There is A LOT of material to cover on your way to becoming a millionaire trader.

Some of you have no experience while others have years under your belt.

Create a plan with milestones that cover the topics you need to round out your trading education.

For example. Many traders come to me with years of experience but lack the ability to turn a profit.

Start simple.

Learn how to identify the 7-Step Penny Stock Framework.

From there, start to learn simple strategies like panic dip buys.

Practice those over and over until you can consistently turn a profit.

Use the material provided to students to answer any questions you come up with along the way.

Set a goal for each month. Then, back into a plan to get there based on your schedule.

Keep This in Mind

The only difference between where you are and the success you want to achieve is time and effort.

—Tim

Leave a reply