If you want it bad enough, you MUST overcome laziness. Every successful trader I know works hard at it. There’s no easy button.

Sadly, as the markets hit all-time highs, laziness and lies are at all-time highs, too. Promoters tell lies to lure in newbies. And newbies want ‘free and easy’ instead of hard work.

Yes, I’m being a little harsh. But it’s for your own good…

Every morning I wake up to hundreds of messages from people claiming they want to be rich & take care of their families, but when I show them how much studying & work is involved in actually making it happen, most come up with excuses why they can't do it…LAZINESS IS NOT OKAY!

— Timothy Sykes (@timothysykes) March 11, 2021

Keep reading for three tips to overcome laziness. First, last week was another solid week trading. And I got to travel again. But the most exciting thing about the week was this…

Table of Contents

Karmagawa Announces the Matt Monaco School

When I set up my charity, one of my goals was to build 1,000 schools. Things evolved. Now Karmagawa has a much bigger mission. But 1,000 schools is still one of our top goals.

Sometimes the schools are brand new and sometimes we renovate old buildings. But the most important thing is giving children the opportunity for a good education. These kids often have no books, no pencils, no toys … and no place to get inspired to learn. That’s what we want to change.

What happens when we finally hit 1,000 schools? We’ll just keep going. Hopefully, I’ll have enough top traders to name them all.

Why I Name New Schools After Top Challenge Traders

It’s fun to name the schools in honor of my most successful students. Usually, we travel to the school for the official opening. And when we can, we will. For now, in honor of Matt Monaco, check it out…

Here are some more pics from my charity's 75th school in honor of my hardworking student @mono_trader & we'll visit his school when we're able to so he can see firsthand how amazing these schools are as we build them in communities most in desperate need of better schooling! pic.twitter.com/VcP5WmpcPR

— Timothy Sykes (@timothysykes) March 12, 2021

That’s 75 out of 1,000. Let’s go!

Congratulations to Matt for seeing his incredible dedication and hard work pay off.* Matt had an amazing year in 2020. So far, 2021 has been even better because of the crazy market. See Matt’s profit chart here.* But what many people don’t understand is how much time and effort Matt put in over the past four years.

(*These results are not typical. Individual results will vary. Most traders lose money. Traders like Matt and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose. I’ve also hired Matt to help in my education business.)

One thing you’ll never see from Matt is laziness.

Trading Mentor: Laziness Is NOT Okay

I’m overwhelmed with emails and DMs from people asking to learn. But when I point them to my DVDs or the Trading Challenge, they say they want free mentoring. Or they ask why I charge for my educational materials.

Let’s put it to rest … I charge fees to weed out the lazy and the liars.

If you really think it’s possible to learn everything from so-called free chat rooms, go for it. Good luck. I value my time. As you’ll learn, this industry is full of scumbags. Expect the worst out of everyone and you won’t be disappointed.

And remember, excuses are lazy thinking.

Everyone is in a different place, I get it. Some people want something for nothing. Others are genuinely struggling financially and investing money in education is tough. So I’ll link to my top no-cost trading education resources. (Like my FREE penny stock guide.)

But let me make this very clear…

Laziness is NOT okay. You won’t get anywhere if you’re not willing to put in the time and effort.

Those promoters who say, “Follow my alerts and I’ll get you to the promised land” … They’re full of crap. Stop being lazy.

The problem is, we’re habitual creatures. You’ve probably heard this before, but I want to say it again…

Your habits determine your success.

With that in mind, here are…

3 Tips to Overcome Laziness

Before I get to the tips … I could come up with a bunch of tips off the top of my head. But most people won’t follow them. So I’ve chosen three tips to overcome laziness that apply directly to trading. Heed them well. Or not. It’s your choice.

Tip #1: Overcome Laziness With an Action Plan

It seems obvious, right? Make a plan. Never enter a trade without a plan. I’ve said it again and again in different ways. Too many people try hard at the wrong things, using the wrong strategy, with no plan. That leads to frustration.

How to Prepare BEFORE You Enter the Trading Battlefield

So make an action plan. Whether it’s saving to fund your trading account, studying, or preparing for the open, you MUST have a plan of action. Start by watching the no-cost “Volatility Survival Guide” I mentioned in the video.

More Breaking News

- QuantumScape Takes a Big Leap with New Battery Line

- Valterra Platinum Strengthens Position with Impressive Earnings Surge

- AppLovin’s Stock Jumps Amid Optimistic Analyst Upgrades

- Credo Technology Unveils AI Retimer Amid Strategic Partnerships

Tip #2: Overcome Laziness by Accepting Losses Are Part of the Game

High achievers set goals, but in trading that can be dangerous. It could be your downfall. This is a very tough skill to achieve.

It’s counterintuitive, but set a goal to learn as much as possible. Don’t set goals about how much you want to make from trading. It leads to swinging for the fences. Singles add up over time. (See my trade review below.)

Too many people expect fast success. We live in amazing times where it looks like people are getting rich quick. But they’re not. I don’t know anyone who got rich quick. Every successful person I know worked their butt off.

And every successful trader learns that losses are part of the game. Set a goal to trade better over time. Learn to react.

Trading Is Hard

But it’s not enough to just understand it. You might say, “OK, Tim, I get it. Losses are part of trading.” Then, after five, 10, or even 20 losses in a row, frustration sets in. That’s exactly when too many people give up. They get lazy because trading isn’t easy.

No matter what the BS promoters and Twitter pumpers say — trading is hard.

So learn to accept the losses. Don’t expect perfection. BUT most importantly…

LEARN from your mistakes and losses. Most traders lose because they’re not prepared. But they give up because they’re not willing to study and learn from the mistakes.

We all make mistakes — they go along with losses. The question is what can you learn? I made a mistake that turned into my biggest loss ever — roughly $500,000. That was painful, but I came back a better trader.

Download my book “An American Hedge Fund” free of charge. Read chapter 11 “The Year That Cygnus Built” to learn about my big mistake (page 193).

One final tip to overcome laziness…

Tip #3: Overcome Laziness by Hustling and Adapting

If you’re hustling you’re not being lazy, right? Maybe…

There’s a saying, usually attributed to Thomas Merton but made popular in recent years by Stephen Covey…

“People may spend their whole lives climbing the ladder of success only to find, once they reach the top, that the ladder is leaning against the wrong wall.”

It doesn’t matter who said it first. What matters is that it happens. People waste a lot of time and energy. So choose your strategy wisely. Choose your job wisely. Choose who you follow wisely…

I'm a big believer in studying hard to improve your life, but you must also be careful with who you give your time to as negative, toxic & lazy people will only bring you down with them. Instead, prioritize positive, inspiring, hard-working people so you can raise each other up!

— Timothy Sykes (@timothysykes) February 22, 2021

Hustle, but hustle smart. What can you do this week, this month, and this year to position yourself for two or three years from now?

And no matter what…

Learn to Adapt

SO many traders lose everything because they fail to adapt. I can’t tell you how many I’ve watched over the years find success only to lose it. Or take such a devastating loss that means years of recovery.

Even if you find success it doesn’t mean you’ll always be successful. The world changes and markets shift. Today’s hot pattern might be tomorrow’s trap. Industries change over time. You MUST adapt or perish.

Trade Review: How to Win While Underestimating a Supernova

Today’s lesson is all about overcoming laziness. So here’s a thought…

Laziness is what causes people to swing for home runs. Gunslingers are lazy. They want the big win for their ego, to make themselves look good.

You earn your confidence. The best traders earn their way up. Too many traders size up before they’re really ready. It’s not based on confidence — it’s laziness.

Overcoming laziness also means knowing when to size down or trade conservatively. This trade shows how I underestimated, traded conservatively, and still did well*…

MDM Permian, Inc. (OTCPK: MDMP)

MDMP was one of the biggest movers in the entire market last week. On March 10, the company uploaded this update to the OTC Markets website. It wasn’t even fresh news, but the company tweeted about it and the stock started spiking.

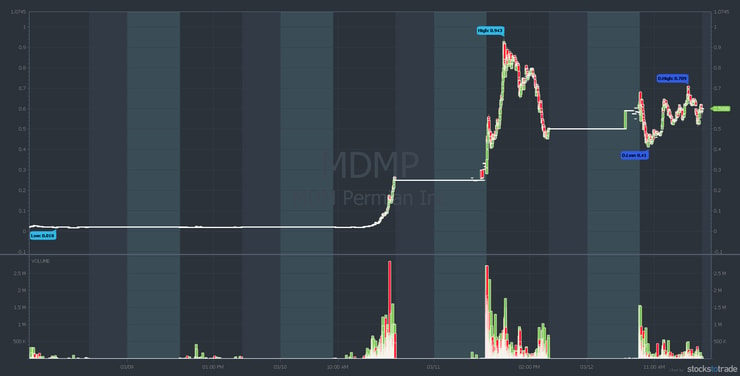

First, check out the MDMP five-day chart from March 8–12…

MDMP spiked 4,390% from its March 10 open to the high on March 11. That’s amazing volatility. When a stock spikes that much, you don’t even have to be first.

StocksToTrade Breaking News Chat alerted MDMP at 7 cents. The chart below says the stock went up another 700%. But less than an hour after we made this chart, it topped at 1,247% from the alert…

You Don’t Have to Be First

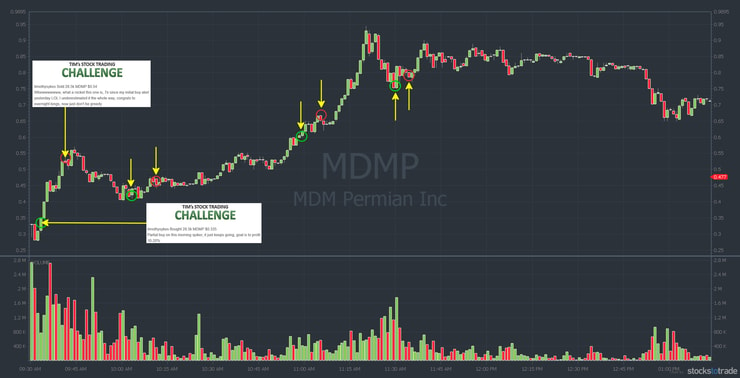

With a supernova play like MDMP, you don’t have to be first or hold through crazy swings. It’s possible to trade something like this conservatively. Check out this chart with my trades from March 11…

As you can see, I bought the morning spike after a very fast dip. At 61.19%, it was my biggest win last week for a $5,842 profit.*

(*Please note: My results are far from typical. Individual results will vary. Most traders lose money. I have the benefit of years of hard work, dedication, and experience. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

But also look at my other trades. (See the yellow arrows and green/red circles.) I underestimated MDMP three times and still made another $5,734*. See details of all my MDMP trades here.

Before we wrap this edition of the update…

Why I Use StocksToTrade Breaking News

StocksToTrade Breaking News is my favorite source for catalysts. But it’s more than that. I use STT Breaking News as an educational tool to see what the market’s rewarding.

(Quick disclaimer: I proudly helped design and develop StocksToTrade and am an investor in it.)

What kind of news is driving stocks the most? I want you to have the right mindset. Focus on education first. Learn to react to the market instead of trying to predict. STT Breaking News Chat saves me a ton of time and energy.

Want to see how, and why, I use STT Breaking News? Watch my no-cost “Holiday Guide.”

Again … I’m making it easy on you. Will you be lazy or will you watch the guide? It’s up to you.

Millionaire Mentor Market Wrap

Overcome laziness now.

Laziness leads to getting crushed in the markets. It slows learning and causes confusion.

You have NO EXCUSE with the free and no-cost resources I’ve linked in this post. But as a thank you for reading this far, here are the links AGAIN…

The no-costs guides require an email address. If you don’t feel you’re getting value from my emails, unsubscribe later. But I’m confident in the value I provide.

Let me add two more resources to the list…

- My YouTube channel has 1,435 FREE videos. My team and I add new videos regularly.

- Get my weekly watchlist sent straight to your inbox. There’s no-cost except the time and energy you’re willing to put into learning.

Now go study. Overcome laziness. No more excuses. Let’s GO!

What will you do today to overcome laziness and change your life? Comment below — I love to hear from all my readers!

Leave a reply