It’s Tax Day, and it’s my birthday … but maybe the real question this week is “Where in the world is Tim Sykes?”

Your guess is as good as mine. I just did 7 cities in 7 days … from New Orleans to Toronto to San Diego to LA to New York to Las Vegas, then back to LA again. Insane!

What Was I Up To?

My adventure started in New Orleans, where I did a talk at my old college and appeared on “Great Day Louisiana.” Watch it here.

Then, I moved on to Toronto, where I met with an extremely inspiring student with an incredible story. A few years ago, Anthony slipped and broke his neck while swimming, causing paralysis.

Against all odds and what doctors told him would be possible, he re-learned how to speak and to move his arms … and how to trade! He’s become one of my most dedicated students and serves as an inspiration to everyone both as a trader and a human being.

Check out my Instagram post where you can see a video featuring the mighty Anthony. Super inspiring.

View this post on Instagram

It’s not often you meet someone who inspires you greatly, but that’s how I feel after meeting my student @anthonysimas who was swimming with his friends, but slipped and broke his neck a few years ago, and against all odds — and against what doctors told him he would be capable of — he re-learned how to speak and move his arms and now he’s sharing his story of adversity and dedication to inspire others. Too often we take what we have for granted and it’s only when the unexpected happens do we realize the error of our ways so I LOVE that Anthony is keeping his head held high and every single day defying the medical odds while also learning to trade stocks from my team and I and also proving himself to be a very dedicated student! I‘m excited for you to see the full video @valdays and I filmed with him (and he also showed me his favorite sushi place which rocked!) and even though his story is tragic, Anthony’s mindset is so incredibly uplifting he says “life can only break you if you let it. You can either rise or you can fall when the hard times come. You can choose to truly live your life the way you dream or live based on others expectations. It’s ALL up to you. Odds against me I made it and made it with a smile. There’s so much to smile and so much to live for. You don’t need anything taken away to see that. Society unfortunately makes us forget these simple things. You want something? Go get it. It’s literally that simple!” So, get inspired and please share this post to help remind others to count every second as a blessing and to be positive no matter what’s happening in their life as you cannot control everything, just how you react and deal with the obstacles life throws at you! #overcomingadversity #ilovemyjob #edjewcation

Next, I headed to San Diego, where I was interviewed for a podcast with WealthFit about my trading and my charity work … check it out here.

After that I headed to LA for some meetings, jetted over to New York for the Game of Thrones premiere, then flew to Las Vegas to go to some nightclub openings with my Karmagawa partner Matt.

Finally, I found myself back in LA, where I helped out with a great charity event in partnership with Project Kitchen Soup. Whew!

The Week in Trading

Due to travel, there were no significant trades this week. I did dip buy Perkins Oil & Gas Inc (CVEM: OOIL), but it was a mistake. I should have shorted like some of my students, who properly executed the trade while I was left cutting my losses.

The crazy thing about my two OOIL trades is they were almost like revenge trades. I felt guilty because I’d missed two good morning dips on this stock. And even though I recognize the pattern for short selling — it’s straight out of my DVDs and video lessons — I’ve not been shorting the last couple of years.

I’ve been so focused on dip-buys that I missed the big picture. When you get too comfortable with one pattern, it’s very difficult to adapt. It’s difficult thinking outside the box. Sometimes as a trader you lock yourself in a box.

I was thinking: dip-buy, dip-buy, dip-buy …

I’ll show you the big picture I was missing in a moment. First, here are the two dip-buy trades I made.

This one was on April 9. I nailed it on my watchlist. I took a very small win when this bounced into a wall of sellers in the 1.80s. Being midday, this was a speculative setup as I’ve been focusing on morning bounces.

The second was after the stock got crushed and the short sellers banked. Again, this was a speculative trade. It was fast moving and reached my goals before I had the chance to alert my students of a possible opportunity.

Here’s the chart:

I took a super small position on this one as it was so speculative. It’s okay to try SMALL trades like this once you have the basics and are comfortable with the patterns I teach.

But please learn the basics first.

You’ll find a special offer on all my DVDs waiting for you here.

Now let’s get back to the big picture …

While several students reportedly banked, I had the wrong mindset as a dip buyer and got too narrow-minded. This happens in trading … the best I can do is learn from my mistake, keep notes in my trading journal, and try to do better next time.

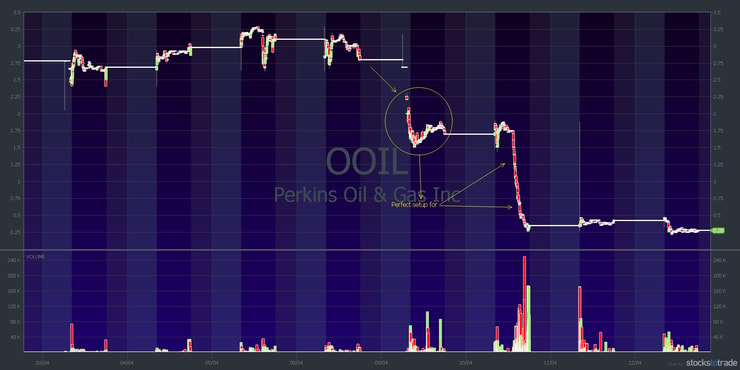

Check out the one year chart for OOIL below. This could have come right from my DVDs or video lessons. I’ve been seeing this for 20 plus years — and done very well with it in my own trading.

Here’s the chart:

The next chart is a shorter time frame so you get an idea of the dip-buys I felt guilty for missing. Those are off to the left of the chart. You also see the perfect setup signaling a short (circled).

Sadly, I didn’t even consider short selling because … I’ve not been short selling. That’s how trapped in my own thoughts I was. Thoughts of my own making. I always say study hard, don’t get lazy. I got lazy. Props to all my students who shorted it.

The big lesson: Don’t get too comfortable with any one pattern. If you’ve never shorted, paper trade using StocksToTrade to get practice first. I don’t recommend shorting for newbies and those trading with small accounts. But you can practice. So get on it.

Am I feeling FOMO because I didn’t have any big trades this week? No way. Because traders need to have lives, too.

I didn’t see any great plays, and I’ve got enough experience as a trader to know that if I’m not able to do thorough research and create a detailed trading plan, the best trade is probably no trade.

More Breaking News

- Under Armour Battles Data Breach Amid Revenue Challenges

- Skyward Surge: Momentus Inc. Soars and Faces Market Dynamics

- China SXT Pharma Launches AI Supply Chain Overhaul for TCMs

- ALAB Stock Climbs Amid Strategic Moves and Strong Financial Indicators

The fact is that there will always be more opportunities to trade, so don’t go down the FOMO wormhole that causes so many traders to make rash moves in the market and wipe out their accounts!

What Now?

Can you Belize it? Right now I’m beaming in from the Hamanasi Resort in Belize. But I don’t have too long to relax: My next stop is Seychelles to do some filming for Save The Reef, and I haven’t even booked a place to stay! What can I say, a rolling stone gathers no moss …

Happy Birthday to Me

Yep … it’s my birthday today!

I’ve already gotten a bunch of requests about what I want for my birthday. Honestly, I have everything I want — so my real birthday wish is for you to go to Karmagawa and pick up some merch! 80 percent of all sales goes to charity, and the remainder goes to the manufacture of more merch, so you can rest assured that it’s going to a good cause.

And if you buy some merch, wear it and post it on social media! It spreads awareness for this super-important cause, and it’s the best birthday present you could give me.

Thanks for all the birthday wishes! Share your comments below. I read EVERYTHING. Cheers!

Leave a reply