Wall Street likes to talk a lot of smack about penny stock traders.

They’ll tell you that it’s all rigged or you can’t generate real wealth trading stocks under $1.

Yet, I, and more than 20 of my students, have done just that.

These charlatans want you to hire them, charge an exorbitant percentage of your assets, and deliver subpar performance.

I trade penny stocks, and teach others how to, because I found it MORE CONSISTENT than messing with large-cap names.

But that doesn’t mean what I teach can’t be applied elsewhere!

The analytical techniques I teach work on any asset, including the major indexes.

Case and point…

This is why I love teaching, watch this dead on video from my https://t.co/occ8wKmlgm webinar yesterday where I warned what would happen to the $DIA $SPY $QQQ with bad #CPI data & why I had no overnight longs. Retweet/favorite this if you promise to be prepared & STUDY HAAAAAARD! pic.twitter.com/1MVRiljJU5

— Timothy Sykes (@timothysykes) September 13, 2022

Heck, I even pinpointed the support level using the same methods I teach my students.

And for those of you who doubt me, I’ll show the two I used to nail this call.

10,000-Foot View

Everything starts with a 10,000-foot view, whether I’m looking at a penny stock or the broader market.

When I identify potential dip buy trades on penny stocks, I’d much rather do it on a multi-day OTC runner than a one-and-done play.

Same thing goes with the broader market.

When stocks are in a downtrend, the reversals can be violent.

I mentioned to my students to be on guard in September and October.

The biggest market crashes tend to happen during these two months.

So when markets bounce for several days in a row without much of a pullback, chances increase that one is just around the corner.

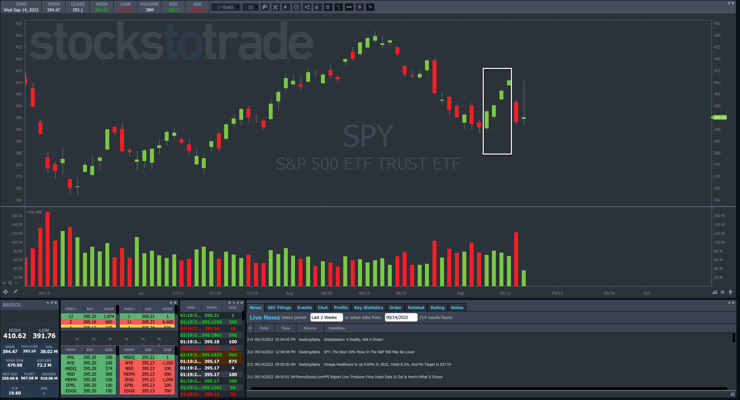

The daily chart of the S&P 500 ETF TRUST (NYSE: SPY) shows four bullish days that sent the market up almost 6%.

Essentially, the market overextended itself.

Penny stocks do this all the time when they go Supernova. And we all know how that ends…

Practical Support & Resistance

I’m going to let you in on a little secret.

You don’t need any proprietary technique to identify support and resistance levels.

All you need is common sense.

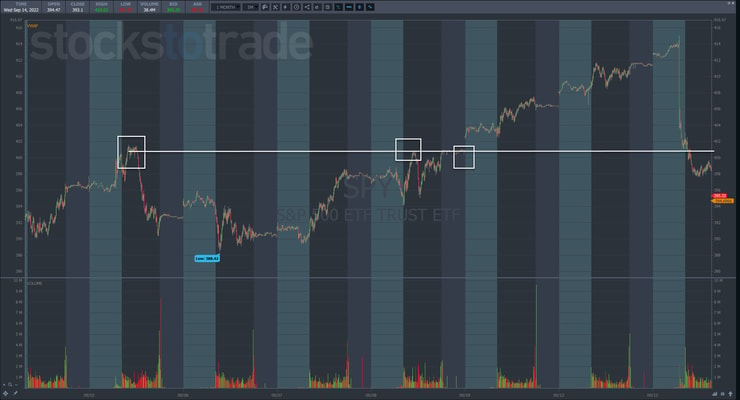

Take a look at the intraday chart of the SPY below.

I drew white boxes around two highs the market made and a third box on a gap in price.

All of these came in near the big $400 price.

So, it makes all the sense in the world that this would act as support in and around that area.

If you want to make it easy on yourself, just draw a box around the high and the low of those spots and extend it right.

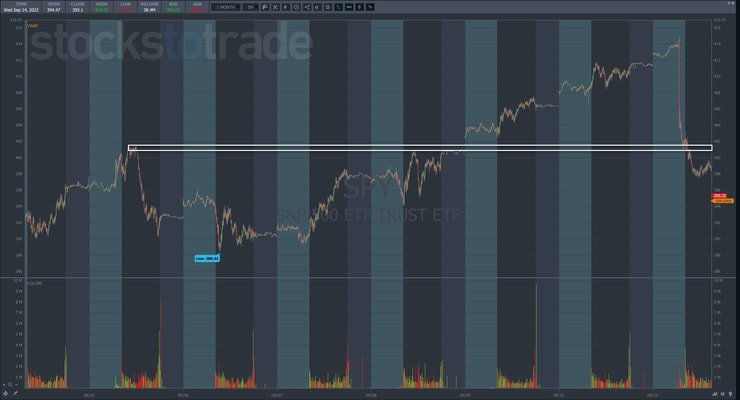

If you zoom into that area, you’ll see the SPY find support right in that zone.

Is this the ultimate low for the day?

Not at all.

But you don’t need that to create trades.

If this were a penny stock, I would aim for a 5%-10% gain with proper risk management.

And if this was a multi-day runner, I could let a portion run and see how far it might go.

In fact, I find penny stocks even more likely to develop strong reactions off support and resistance areas.

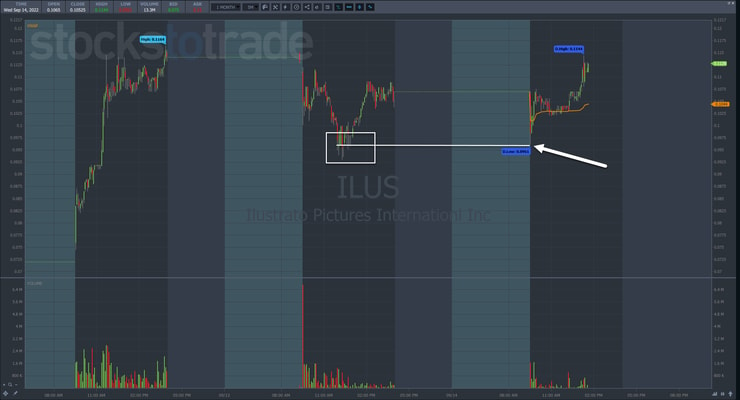

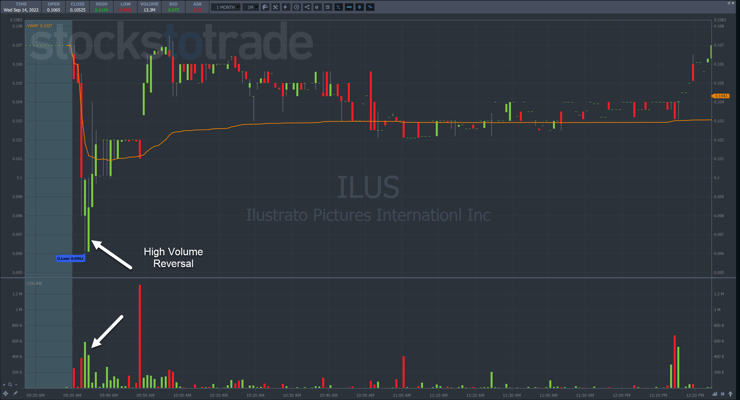

Take Ilustro Pictures International Inc. (OTC: ILUS), for example.

When the stock fell on the third day after a huge gain, shares found support just above the prior day’s low.

Sometimes it hits the support levels dead on. Sometimes it comes up short. Sometimes it spikes through.

As a trader, if I know where to look for support, then I can place buy orders. They won’t always get filled. But the ones that do have a high likelihood of turning around.

Plus, with small cap stocks and OTCs, the price action is much cleaner.

Let’s dig in even deeper to ILUS and go to the one-minute chart.

Imagine that the prior day’s low was at $0.098.

The stock comes into that spot and then reverses on heavy volume as shown above.

That combines support and resistance with price action to give me an incredibly powerful setup.

I can buy the stock against the lows and look for a rebound.

If shares don’t move higher within a few minutes, I can cut the trade and move on.

Rinse and repeat this analysis, and you’ve got a full-fledged trading plan.

Now, this is just part of a broader set of skills and setups anyone can learn.

Sign up for my Millionaire Challenge to get the full schematic that takes your trading to a whole new level.

—Tim

Leave a reply