It’s fun to catch a stock near the bottom.

You get to brag about picking it off within pennies of the low, and it can pay off big time.

It’s also a great way to lose money.

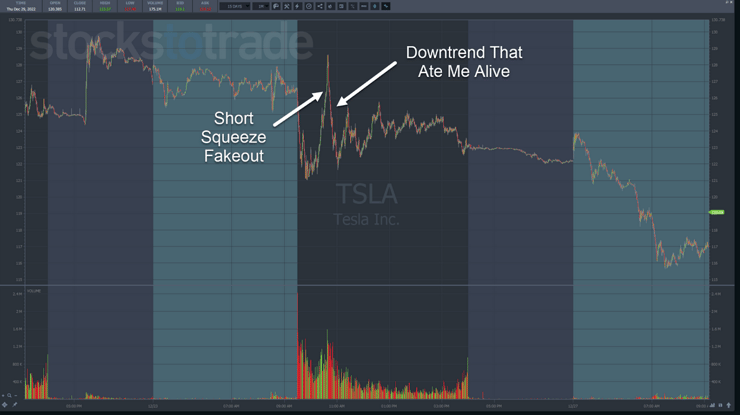

I lost over $3,000 trying to pinpoint a turnaround in Tesla (NASDAQ: TSLA)

Now, I know what you’re thinking…

Tim, you talk about buying panic dips all the time. What gives?

One word – discipline.

My morning panic dip buys follow my 7-Step Penny Stock Framework.

This trade did not.

I mistook a short squeeze for the beginning of a new trend.

Funny enough, this isn’t the first time this has happened to me.

In fact, my top six losses in 2022 all followed these same blunders.

That’s fine. We all make mistakes.

But I made it worse by averaging down until I had a massive position of 1,000 shares!

Promoters on Twitter only show you their wins.

However, losses can teach us just as much, if not more.

And this one has three great lessons that can help you avoid huge drawdowns and win more trades.

Table of Contents

1. Know Thy Setups

I could have won big on that Tesla trade and it still wouldn’t change the obvious…

My setup was awful.

Do I pick off my share of stock bottoms? Absolutely.

But I do it in a methodical way that follows my 7-Step Penny Stock Framework and uses extensively tested setups.

For example, this YouTube video covers a simple pattern I call the 1st Green Day that I teach my students for OTC plays.

No one is saying you shouldn’t explore new ideas.

However, there’s a right way and a wrong way to do it.

Many traders let their excitement push them into questionable setups with huge positions, ultimately creating massive losses.

I know how hard it is to listen to the news, read message boards, and see everyone under the sun talk about ONE stock.

You need to put all that out of your mind and focus on what’s in front of you.

If you don’t have a setup, you’re guessing.

Before every trade, ask yourself whether you’re following a battle-tested strategy or simply following the crowd.

2. Averaging Down vs. Doubling Down

There was a great scene in Glass Onion: A Knives Out Mystery where Benoit Blanc, played by Daniel Craig, says to Birdie, played by Kate Hudson:

“It’s a dangerous thing to mistake speaking without thought for speaking the truth.”

Traders confuse averaging down with doubling down.

Averaging down follows a deliberate structure that adds to a position at key intervals while managing to a specific risk.

Doubling down adds to a position in the hope you can recover from your current losses.

Averaging down is controlled and planned.

Doubling down is undisciplined and reckless.

I can’t tell you how often traders tell me their worst losses happen when they add to a losing trade.

More Breaking News

- UiPath Faces Market Scrutiny as CEO Daniel Dines Offloads Shares

- Oracle’s $50B Cloud Expansion Plans Fuel Stock Surge

- Red Cat Holdings Poised for Growth as Drone Orders Surge

- TeraWulf’s Strategic Expansion Ignites Market Interest

If you run into this problem, I have a simple solution – pick one entry and size.

3. Acknowledge Your Weakness

I titled the review video for my Challenge students The Ghosts of Christmas Past.

You see, long ago, I was a very undisciplined trader.

What you see now isn’t where I started.

Becoming a mentor to Millionaire Challenge students forced me to open up my trading.

I had to lay them all out there for everyone to see.

And let me tell you, it’s pretty embarrassing to write about your mistakes.

So yeah, shame played a part in it.

But, writing down my trades helped me to acknowledge my strengths and weaknesses.

I journal every one of my trades on Profitly.

There is no single tool that will improve a trader’s performance faster than a journal.

You can’t improve your skills if you don’t know where to start.

I realized early on that I didn’t do well with large accounts.

That’s why I reset my balance to $100,000 every year.

I didn’t realize until I made the video about the Tesla trade that my six largest losses in 2022 all followed the same pattern,

Our weaknesses are a part of who we are.

You can’t start to deal with them until you acknowledge them.

Once you do, then you can decide whether you want to put a plan together that works through them or around them.

And Remember…

Bad habits never truly disappear.

They’re always lurking in the background.

Don’t get down on yourself for repeating a mistake you made in the past.

Accept it. Learn from it. And work to reduce its influence.

—Tim

Leave a reply