Dark pools of liquidity sound scarier than they are…

But they’re just everyday backroom dealings on Wall Street.

A dark pool is a cluster of non-transparent trades that usually goes quite deep.

Banks and institutional investors move around massive quantities of stocks in these pools. They don’t want to disrupt the market with large trades, so they keep them hidden.

As shocking as it may seem, it’s not new. And it’s important for you to know what lurks under the surface.

Let’s uncover one of the market’s darkest secrets — dark pools of liquidity — and discuss how to trade with that knowledge!

Table of Contents

- 1 What Are Dark Pools of Liquidity?

- 2 How Do Dark Pools of Liquidity Work?

- 3 Why Does Dark Pool Liquidity Matter?

- 4 Advantages of Dark Pools

- 5 Disadvantages of Dark Pools

- 6 Dark Pools of Liquidity Operations

- 7 Frequently Asked Questions About Dark Pools of Liquidity

- 8 Dark Pools of Liquidity: The Bottom Line

What Are Dark Pools of Liquidity?

Dark pools of liquidity are private exchanges set up by investment firms. Their purpose is to move big blocks of shares without impacting the market.

They’re sold to the investing public as a way to add liquidity to the market. And they do that. Any time you move around massive amounts of shares, you add liquidity.

But there are other reasons for these firms.

You might already know that limit orders show up in the order book…

That’s one of the reasons why watching Level 2 quotes can be an effective strategy. It can help you see where price momentum might shift…

If you don’t know what I’m talking about, check out my “Learn Level 2” DVD. It’s six hours of Level 2 education and strategy. By the end, you should know how to identify the walls of buyers and sellers that affect price trends.

Imagine if you could somehow hide your orders. That would give you an advantage, right?

That’s what these dark pools do. These private exchanges are home to between 40%–50% of trading activity.

Uses of Dark Pools of Liquidity

Dark pools are legal and monitored by the SEC. FINRA makes dark pool data available after the fact, once the trade has been executed and recorded.

Think there’s something fishy about not being able to see half of all market activity?

Regulators insist there isn’t. They say investment firms that use dark pools of liquidity to move units do the market a favor by adding liquidity.

Without liquidity, you don’t have dependable executions … That’s the biggest reason I tell my students to stay away from low-volume stocks…

The counterpart to this liquidity is its use by market makers. Market makers helped create the tight spreads of modern trading — and they’ve done it alongside dark pools. More on this later…

Some traders have found direct uses for dark pools in their strategy. They learn the methods of dark pool ordering. That knowledge gives them a potential edge over the vast majority of traders who are ignorant of dark pools.

How Do Dark Pools of Liquidity Work?

One of my favorite trading books is Michael Lewis’s “Flash Boys.” If you’re as skeptical of Wall Street as I am, this book might become one of your favorites too.

(As an Amazon Associate, we earn from qualifying purchases.)

Lewis writes how Wall Street firms embraced high-frequency trading (HFT) in the internet age. That’s the type of trading that dominates dark pools.

HFT relies on algorithms to trade massive amounts of shares for tiny gains. They have computer programs that register tiny fluctuations in a stock’s price…

Then they put in multi-million share orders to multiply profits.

Lewis’ book also discusses the conflict of interest between HFT and the rest of the market. HFT traders have been accused of front-running because they act on behalf of the same firms that execute the orders that you and I place…

That’s a possibility when you can skip the line on the order book, knowing you can profit from the waiting orders.

Block Traders

Basically, HFT is scalping on a fractional basis — with big volume.

My students know I’m no fan of scalping. It’s a strategy better suited for big accounts. If you scalp with a small account, you probably won’t see substantial profits for a long time.

That’s why I tell my students to aim for singles … but you have to decide what that means for you. You can figure that out through education. My Trading Challenge, for example, has 7,000 video lessons covering a variety of strategies.

And know that self-sufficient traders follow a similar path.

First, they learn from more experienced traders. Then they gain trading experience…

They win some trades and lose some trades — but they don’t give up. They know to not risk more than they can afford to lose, so they don’t blow up their accounts.

This path requires DISCIPLINE, HARD WORK, and lots of SCREEN TIME. Showing up is more than half the battle.

My Trading Challenge isn’t some magic pill that you can take to get rich quick. You must be willing to put in the work. If you take trading as seriously as an actual job…

Apply for my Trading Challenge here.

Why Does Dark Pool Liquidity Matter?

We take it for granted that we can execute a stock order within seconds. But if you think about it, it’s pretty much a miracle.

Even if you KNOW someone wants to sell something, like a house, it can take months.

What if the price fluctuates every second … and the buyer and seller both want the best deal?

The difference here is market makers, who are on the other side of the transaction. Market makers can fill this role because of dark pool liquidity.

It wasn’t always this way. Once upon a time, the tightest spread was 12.5 cents! Market makers absorbed all of the risks of transactions…

They made it easier on themselves by having a big margin for error.

These days, we don’t lose much to the spread. Dark pools of liquidity number about 80 at last count…

Although the list of dark pools isn’t long, they make up about half of the market’s overall liquidity.

Advantages of Dark Pools

Dark pools can seem sketchy, but they’re not all bad. There are even ways they help smaller traders like you and me. Here’s how…

More Breaking News

- Strategic Acquisition Expands Momentus Inc.’s Horizons

- AppLovin Gains as Analysts Highlight Growth Potential Amid E-commerce Boom

- Cipher Mining Hikes Price Target Amidst Bold Strategic Moves

- Oracle’s $50B Cloud Expansion Plans Fuel Stock Surge

Private Trading

You know how poker players try not to show their hands?

What if your competitors didn’t even know you were at the table? That’s what dark pool traders get to do.

This can be an advantage for retail traders too. Some have even developed dark pool trading strategies. These can provide quite a good trading edge if you know what you’re doing…

Dark pool scanners can help ordinary traders see the tape on hidden trades. Some brokers let you filter the time and sales tracker to see only the biggest orders.

There’s even a dark pool indicator (DPI) out there that measures dark pool buying against the average.

This brings us to another advantage of dark pools…

Since market makers absorb dark pool volume, their trades don’t have to add up at the end of the day.

The rest of us don’t know what half of the market’s doing. This means that real supply and demand are different from the prices we see…

But get this — research shows that price corrects over time. For traders who know how to spot dark pool activity, this can be an edge.

Avoidance of Price Devaluation

When the market sees an imbalance in the order book, it affects the stock price.

Traders who watch Level 2 quotes use this information to try to get ahead of shifts in a stock’s trend.

If you’re trying to move millions of shares at a time, the price might shift significantly.

Increased Market Efficiency and Liquidity

We talked about this before. This is the big one. Again, without liquidity, trading becomes impossible…

Limited Market Impact

Dark pool traders move thousands or millions of shares at a time. They can do this several times a day.

If these orders showed up on the order book, they’d create a massive impact. Prices would move in response to these giant orders… not in response to the catalysts I trade on, following tradeable patterns.

I love volatility. A certain amount of it is crucial for day trading. But you can’t trade volatility if it doesn’t make sense.

Potentially Better Prices

Having ready buyers and sellers means we don’t need 12.5-cent spreads.

If you trade penny stocks like I do, this makes a BIG difference.

Lower Costs

Since the move away from commissions, this is how market makers make money.

I don’t think commissions are a bad thing. If it’s a good trade, it should be worth the fees. That said, lower costs are one less thing to work against your profits.

So what if front-running dark pool traders make 0.02 cents per share in trades they facilitate?

Disadvantages of Dark Pools

I just gave you the argument for dark pools of liquidity…

That’s what Wall Street types say on the topic.

If you follow me, you know I don’t always agree with Wall Street. So it shouldn’t surprise you that I’ve got a few bones to pick with these shady operations…

Lack of Transparency

This one’s obvious. It’s the same way I’d feel about making a business deal with someone who says, “You’ll just have to trust me…”

Nope.

I’ve dedicated myself to transparency. The stock world is full of the opposite…

Like traders and Twitter clowns who only discuss ‘big’ wins and no other details like position sizes. Or people who tell you to short stocks that no one should short.

The best-case scenario for these traders is validation…

Many are likely paid promoters trying to boost trading volume. Luckily, I’m good at spotting the BS.

Thx to promoters for all the volatility on $RSHN $DPLS $BSSP as while they say they’re going to the moon, LOL…that’s what $LTNC $GGII $HMBL $AITX $OZSC $ENZC $OPTI $ALPP $ABML promoters said too, whoooooops! Retweet this if you realize promoters are full of shit, singles add up

— Timothy Sykes (@timothysykes) June 17, 2021

Other traders aren’t as lucky. They’ll get stuck with a stock after the promoter unloads their shares…

Unfair Advantages

The reason I trade OTC penny stocks is to stay away from Wall Street. The fact that dark pools of liquidity and OTC trading don’t mix is one more reason I trade them…

If this were gambling, Wall Street would be the house, and the house always wins.

Big investment firms think OTC stocks are sketchy. So dark pool traders stay away. They won’t risk billions of dollars on these kinds of stocks.

And they’re right. OTC stocks are sketchy. That’s part of the reason I like them.

Dark pool traders have a big advantage in listed stocks. They don’t even need to front-run their trades…

They’re colluding with other institutional HFT traders on stock prices.

Possible Inefficiency and Abuse

Dark pools of liquidity came about at the same time as traders were getting on the internet…

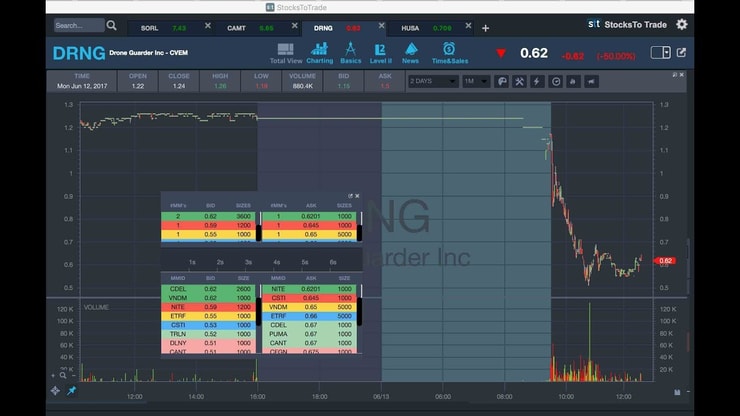

Now traders have pro-level trading platforms like StocksToTrade at their disposal. StocksToTrade is what I use to trade.**

It fits active traders’ needs, and it’s the kind of advantage I didn’t have when I started…

If you’re still using your broker’s trading platform, give it a try. $7 pays for 14 days of access — enough to see what you’re missing.

StocksToTrade gives me clean charts to spot tradeable patterns. Its stock screener shows me high-volume stocks. Its add-on Level 2 quotes show me orders that aren’t hidden by dark pools…

Tell me again why I need dark pools of liquidity to help me trade?

I trade OTC stocks just fine, and they don’t have market makers to facilitate trading.

That means I have to time my entries and exits right, make sure there’s enough volume, take singles, and sell into strength…

I have to be disciplined. I don’t think that’s a bad thing.

To me, the market would be better if more people understood what they’re doing. So many traders think that they’re gambling.

That’s the opposite of my approach.

Predatory Tactics by High-Frequency Traders

Some researchers take issue with Lewis’ account…

Front-running is a major concern in his book. The hero, Brad Katsuyama, created his own exchange to eliminate this HFT threat.

But a Berkeley study criticized the book’s conclusions. It looked at $3.7 trillion worth of trades — almost one year’s worth. It said that any profits from front-running would be vanishingly small.

This confirms what Barron’s reported just after Lewis’s book came out.

I don’t know. Why would investment banks that use dark pools pay big money for order flow if there was nothing to gain?

Commission-free trading is where a lot of brokers make money from payment for order flow. Robinhood started this trend, but most brokers have adopted it since.

Remember when brokers limited buy orders on the Reddit stocks? That’s one issue with brokers working for investment firms instead of traders.

Who’s to say that’s the only problem?

Dark Pools of Liquidity Operations

We’ve covered how dark pools affect the market. Now let’s look under the hood at how they actually work.

Iceberg Orders

Iceberg orders can really screw with Level 2 strategies.

That’s when a small part of a dark pool order is displayed in the order book. Dark pool traders decide how much of their order the public will see…

They can tinker with its size or use these orders to affect the price trend.

Price Discovery

It’s often said that the market is a discounting machine. All information is priced into the share price.

Dark pools seem to go against that principle. But their orders are made transparent post-trade … Paying attention to these in-the-know trades can actually aid in price discovery.

Market Impact

Dark pools achieve the greatest liquidity when they interact with public trading. So they often do have a market impact.

Adverse Selection

Even though dark pool traders hide their trades, they’re still doing business with each other. Such large orders can push the price in the opposite direction by virtue of this impact.

Frequently Asked Questions About Dark Pools of Liquidity

Let’s go over a few big points again…

Why Are Dark Pools Legal?

Dark pools are legal because they provide the market with liquidity. But the rules aren’t the same everywhere… check out dark pools of liquidity law in the U.K. to see what I mean.

How Do Dark Pools Affect Market Efficiency?

Dark pool liquidity makes the tight spreads of today possible. Without dark pools, market makers might not function the same way they do today.

Dark Pools of Liquidity: The Bottom Line

Dark pools of liquidity are a reality of the modern trading environment. Traders might be better off without them…

Or worse.

At this point, it’s all academic.

To me, traders are better off knowing how they work. It’s a necessary part of a good trading education.

I never want my students to be surprised by anything that happens on the market. Knowing what to watch for is the only way to become a self-sufficient trader.

What do you think about dark pools of liquidity? Let me know what you learned in the comments — I love hearing from you!

Disclaimer

**Tim Sykes has a minority ownership stake in StocksToTrade.com.

Leave a reply