I’m gonna lay this out right from the beginning. I teach my Trading Challenge students to become self-sufficient traders. The idea of blindly copying some investment guru or trader (even me) is, to be quite frank, lazy.

But it seems to be ‘a thing.’ People want to know what stocks Warren Buffet is buying. They want to know what company some other billionaire invests in. News of big investors taking positions in penny stocks can drive price action. While this kind of news is good to follow, you should still do your own research and trade based on strategy.

In this post, rather than tell you who to follow, I’m going to explain a little more about copycat trading. Then I’ll lay out a case for copying strategies rather than individual trades. The last thing I want is for you to focus on hot tips. I get students like that — many of them don’t last very long as traders.

Table of Contents

What is Copycat Trading?

Copycat trading is making the same trades as another trader. It could be your guru, a chat room personality, or a newsletter publisher. The idea behind this kind of trading is, if the person you copy is really good, you’ll hopefully make money just like them.

There’s another way of looking at this — a perspective I like better. Instead of copying every trade, sometimes called mirroring, learn a trader’s strategies. The important thing about strategies is you’re learning more than mechanics. You learn how to do the research, create a plan, and execute the plan.

Benefits of Following a Copycat Trading Model

In theory, with copycat trading, someone else does all the work and you profit …

I call BS! When something seems too good to be true, it probably is. If you blindly copycat individual trades and think you’re going to hit home runs every time, good luck with that.

I’m not saying you can’t learn from watching other people trade — many of the Trading Challenge webinars show live trades. And you get explanations about the setup, entry and exit points, and how the trade progressed.

But if you’re so lazy that you can’t do the research and you want to blindly follow someone else’s trades …

… why not just pay them to trade for you?

There are services out there that will mirror your account with an experienced trader’s account for a fee. But, really? Wouldn’t you rather learn the skills you need to trade?

That said, I told you I’d explain it a bit more so here goes…

Who Should You Copy?

If you absolutely have to copy somebody, focus on successful traders or investors. But why copy if you can learn to be a self-sufficient trader? (Apply for the Trading Challenge now!)

Successful Investors

I suppose if you’re a buy-and-hold investor, you could find a successful buy-and-hold guru or fund manager and copy them. But beware, mutual fund managers have to follow certain rules. They have to be something like 65% invested (some even higher) at all times.

Let’s say you want to follow a fund manager or famous investor and you’re only going to buy their top 10 stocks. How do you know when they sell all or part of their position? You don’t.

The exception is money managers in charge of over $100 million in assets. They’re required to report their trades — using SEC Form 13F — but only quarterly. In other words, good luck with that.

Successful Day Traders

Let’s say you decide you’re going to copycat me. You’re going to make every trade I make. How are you going to do that?

Yes, you could do your best to follow my Profitly posts and Twitter feed but you’re still going to have time lag trying to mimic me.

So I repeat, how are you going to copy a day trader? You think they have time to explain everything to you during the trade? If you’ve seen the videos I’ve made during live trades, you know it can be tough to explain and trade at the same time.

I suppose you could pay a trader to hold your hand. But why? Join the Trading Challenge and learn how to trade. It’s hard work. You’ll have ups and downs. But you know what? You’ll learn strategies that can help you become an independent trader — and that’s awesome.

Then you could be posting over on Profitly. Or hitting me up on Twitter with your wins and showing the world how you cut losses quickly. I’d love to see this happen for you!

Great Traders to Inspire Your Copycat Trading Strategy

Ha! There are some great traders — and I agree you should use them for inspiration. But copycat? It’s such a difficult thing to get right. Your time is better spent studying their trades so you understand the strategies. Don’t attempt to mimic each trade.

When you’re a member over on Profitly you get my alerts. But even with my alerts you still have to determine your trade setup. You have to plan. If you blindly trade based on an alert, you could get yourself into a big mess.

One more thing about copycat trading …

Don’t try to copy the strategies of a bunch of traders all at the same time!

Hell, don’t even try to copy all the strategies of one trader. Find one strategy the trader uses and master it by studying.

All the more reason to be part of a badass community of traders like my Trading Challenge students.

More Breaking News

- European Wax Center Signals Confidence with Financial Projections Boost

- Skyward Surge: Momentus Inc. Soars and Faces Market Dynamics

- Under Armour Faces Data Breach Affecting 72 Million Customers

- Breaking News: Ondas Navigates Market with Enhanced Strategy

Knowledge Disseminated by Warren Buffet

Warren Buffet is, perhaps, the greatest buy-and-hold investor of all time. Did you know his early investing philosophy came from Benjamin Graham? Graham wrote “The Intelligent Investor.” It’s considered by many to be the best book on value investing ever written. He was also Buffett’s mentor.

So, you want to attempt mirror investing Warren Buffett’s portfolio?

My question to you is: Are you willing to do the research Warren Buffet does before investing in a company?

Check this out …

… Buffet sometimes spends years studying a company. He analyzes its fundamentals. He understands the accounting practices and knows the executive and board compensation plans. He knows things about a company that even some of the company’s board members don’t know!

So, yeah, you could find a lot worse person to copy. Are you willing to do what Buffett does — buy and hold forever? That’s his basic premise. He buys stocks and holds them. If the price drops on a stock he owns he usually buys more because it’s better value.

Buffet often buys right up to the point where he’s required to file beneficial owner reports with the SEC. Then he holds his shares. He only sells if market capitalization puts his holding over the 10% limit which requires further filings.

If you want to copy Buffett you’ll need a long timeframe and you’ll have to study his investing strategy and principles. You could just invest in Berkshire Hathaway stock. But you’ll probably have to invest in Berkshire’s Class B stock. Their Class A stock was trading at $295,811 per share at the time of writing!

Knowledge Disseminated by Bill Miller

Lot’s of investors copied Bill Miller in the early 2000s because his record was so strong. The fund he managed, the Legg Mason Capital Management Value Trust, beat the S&P 500 15 straight years.

Want to know what happened eventually? His fund lost 20%. Anyone who continued to copy his investments after 2006 lost their shirt. He turned over management of the fund to someone else in 2012. In 2016 he left the firm altogether. He’s running his own fund now. There you go.

Look, I’m not saying you shouldn’t learn about successful investors and traders. When I was in high-school and decided to invest my bar mitzvah money, I read every financial book in my dad’s extensive library. It gave me a strong foundational education in finance and the markets.

If you want to be a self-sufficient trader then you need to do your homework. You can’t cheat success. What are you going to do? Follow someone around and hope they do the right thing? Don’t be a mindless fanboy or fangirl. That’s lame. I believe you’re better than that. If you’re going to copycat — copy strategies. Burn them into your brain.

How to Be a Copycat Following My Trading Strategy in 5 Steps

Here’s how to use copycat trading to copy me. Not trade for trade — I don’t want you to do that! As a matter of fact, I want you to become a better trader than me. Follow these strategies and screw the mirror trading stuff.

#1 Cut Your Losses Quickly

This is — and always will be — my number one rule. I teach this to all my students right from the start. Protect your trading capital by cutting losses quickly. If you want to trade penny stocks for a living you need to accept there will be losses.

The key to longevity is to make those losses as small as possible. If you have a plan for every trade (which you’ll learn to create when you join the Trading Challenge) then your downside risk is clear. In other words, you know going into the trade how much you’re willing to lose.

#2 Trade Only Volatile Stocks

Volatile stocks allow you to take advantage of big price swings. It’s price action that makes it possible for you to build a small account into a big account. You won’t get there by trading stocks where the price action is sideways (within a narrow trading range).

You need stocks with big swings. Caution: this means you need to be even more prepared. You can lose more on heavy price movement, right? That’s another reason to be able to recognize patterns …

#3 Trade Easy Patterns That You Already Master

Have you heard the phrase “there’s nothing new under the Sun?” Stock market patterns are a lot like that. I’m not saying there will never be another new pattern. But from my experience, the same patterns keep coming up again and again.

The market goes through phases and some patterns ‘go out of style.’ Then the market shifts and old patterns re-emerge … potentially … nothing is certain (that was for the lawyers — they love me).

If you want to copy me, let me give you a big hint: I like to keep things simple. I don’t want to complicate things. I look for patterns that are easy to recognize and that I’ve used before. Day trading penny stocks is hard enough without adding layers of complexity. Learn easy patterns, master them, and make them your bread and butter.

Start with one pattern. Don’t try to learn too many things at once. At first, you only need to learn one. When you’ve mastered one then move on. The only real exception to this would be if there was such a shift in the market that your chosen pattern is not in play. Sometimes that happens.

#4 Follow News Catalysts

News is often the catalyst behind big price swings. How do I know which stocks to put on my watchlist? I look for biggest percent gainers throughout the day. Then I start doing research; I look at the news and check SEC filings. Maybe it’s an earnings winner or a contract winner. With the right news catalyst, I get interested.

I also look for stocks with a history of spiking. A news-based hype play that has spiked before — that piques my interest. A stock with a history of being able to triple by 10 a.m. — with a strong news catalyst — is worth a place on your watchlist.

#5 Take Advantage of a Stock Screener

A high-quality stock screener makes life a lot easier. It’s like having all the information you need right at your fingertips. Looking for low-float stocks with high trading volume that ended the last trading session up 10%? You could hunt this information down in various places.

Or you could use the one stock screener to rule them all …

StocksToTrade Features

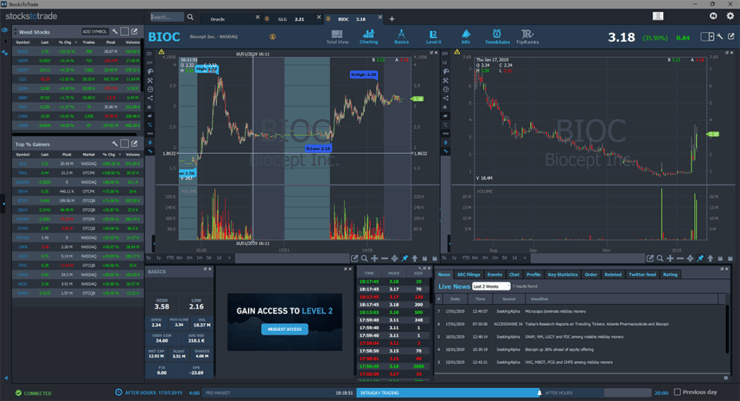

StocksToTrade is amazing. I’m not just saying that because I helped develop it. I’m saying it because I use it to screen stocks and do research every single day. I feel blessed and grateful to have this platform available.

Back in my early days of trading in high school, I used several computers in the school library at the same time. It was the only way I could get the information I needed. Now, with StocksToTrade, I get it all in one place. In real-time.

StocksToTrade features built-in screens so you can find the kind of stocks I look for every day. Copycat trading, right? It features Oracle, our proprietary watchlist building tool. You can create an unlimited number of watchlists.

It has TipRanks, which gives you information about insider trading and analyst ratings. There’s a chat room. You get information about orders and prices paid. Plus, instant access to basics such as daily high and low, float, volume, and 52-week high. You have access to news about stocks you’re watching. All this information and more is at your fingertips in real-time.

Key Tips on How To Implement a Copycat Trading Strategy

Be Humble

One of the worst things that could happen if you copycat trade is you somehow manage to get lucky and have nothing but wins for a while. It’s a recipe for disaster because you start to think you know everything you need to know for success.

If you stay humble you’re more likely to follow your plan, cut losses quickly, and learn from every trade. You’re less likely to chase trades based on an oversized ego. As soon as you think you know it all, you’re in trouble.

A word of warning about humility and ego in general …

One of the biggest problems with most traders is greed. It’s so easy to get your psychology screwed up by big wins and big losses. Make sure you follow the five rules up above. Don’t let your ego get in the way — don’t go for home runs. Take singles. Cut losses quickly. I hope this is really sinking in. The stock market has no emotion. Remember that.

Develop the Right Mindset

Mindset can be the difference between success or failure. There’s a lot of psychology when it comes to being a trader. From your acceptable level of risk to what you do after a big loss, it all makes a difference.

Develop a mindset based on self-discipline and small wins. That way you can potentially keep winning for a long time. Go for singles. Home run chasers strike out a high percentage of the time.

Successful Stock Portfolio to Follow

Keeping tabs on a successful investor’s portfolio is like a watchlist. Consider it a watchlist of a basket of stocks. If you really want to hone in on a specific money manager’s strategies, then this could be a good way to do it. Again, it’s not really my thing. I use the strategies I use because they work.

Never Stop Learning

Study up. You have to study your butt off to develop a base of knowledge. Then you need to practice trading as much as possible. Then, as you continue to study and continue to practice trading, your experience adds a new dimension.

What to do when you start trading with a live account? The same thing: Keep studying, learn from every trade, continue to work on a solid foundation of knowledge and experience. It’s a never-ending process.

Trading Challenge

All my top students are a part of the Trading Challenge. The best of the best are involved as teachers and the rest are still learning. It’s an incredible program. You get access to live webinars, archived webinars, mentoring, training videos, and the coolest community of traders on the planet.

Conclusion

Copycat trading is great if you copy winning strategies AND study like crazy.

But if you only want to copy individual trades without knowing why you’re making the trade? Lazy loserville. You’re asking for pain down the road. There’s an ancient saying: “Pain that has not yet come is avoidable.” I’m down with that.

Are you a trader? Have you used copycat trading? How did it work for you? Let me know in the comments below. I love to hear from my readers!

Leave a reply