Traders instinctively want to take EVERY runner that crosses the tape.

When they don’t see a setup, they assume they missed something.

This sends them down a research rabbit hole, looking for a strategy or setup that explains what they missed.

In the end, they take a shotgun approach, trying random strategies and hoping one sticks.

Year-to-date, I’ve taken just over 400 trades, or roughly 1.5 trades per day.

Transparency is important! All my trades are posted here.

That’s helped me cultivate a nice $131,000 profit.

But I’ll let you in on a secret…

All you need is one strategy and setup!

When folks start my MILLIONAIRE CHALLENGE, I set them on the 7-Step Penny Stock Framework.

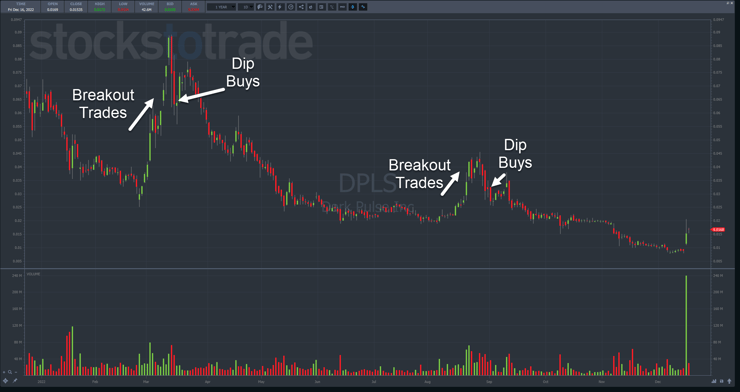

I have them study former Supernovas like Dark Pulse Inc. (OTC: DPLS), identifying the different phases.

Then, I introduce them to two setups: breakouts and morning panic dip buys.

If I offered them nothing else, they would have enough to develop a reliable, repeatable strategy.

People think this oversimplifies trading.

But I’d argue they overcomplicate it.

And I want to prove it by walking through several Supernovas from this year that set the stage for potential trades.

Table of Contents

Dark Pulse Inc. (OTC: DPLS)

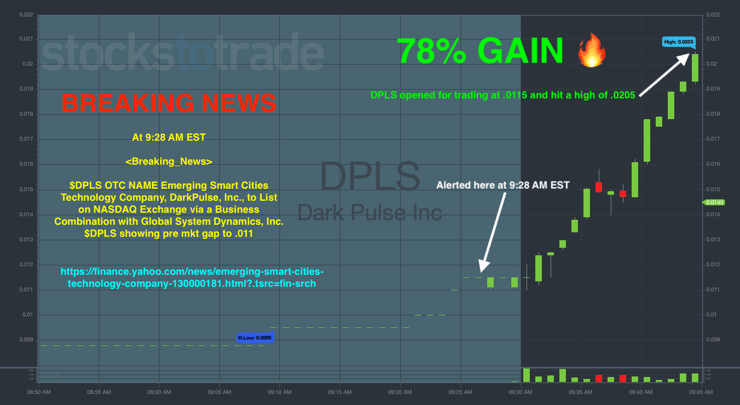

This stock hit my radar when our Breaking News Chat alerted me to it during Thursday’s premarket session.

I immediately took interest for one very good reason…this stock was a former Supernova.

You see, stocks that go Supernova have a tendency to do it again and again.

That’s why I keep them on a watchlist just in case.

And when they go Supernova, they can offer trade setups.

Notice I said ‘can’ – there’s no guarantee they will.

Supernovas give us the pattern that generates the conditions for a setup.

We still have to wait for the setup to occur.

Breakout trades work great on the front side of a Supernova.

However, morning panic dip buys are my bread and butter on both the front and especially the back side of a Supernova.

Let me give you another example.

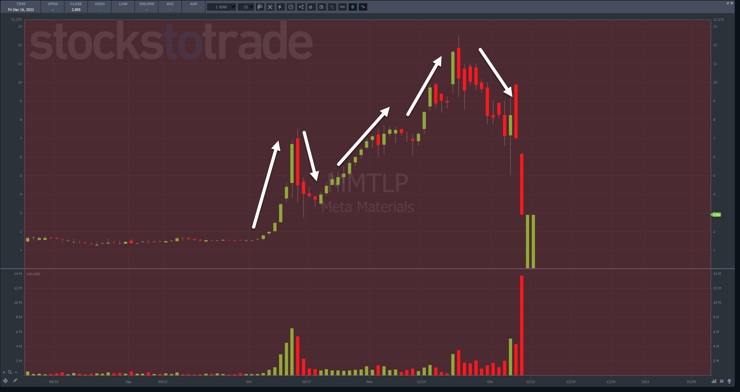

Meta Materials (OTC: MMTLP)

This was one of my favorites this year.

No joke, I got twelve trades off this stock from mid-October through early December.

This stock created multiple opportunities to look for setups.

On that first pullback, I found three panic dip buy trades, two winners and one loss.

As the stock rolled higher in November, I traded a combination of panic dip buys and breakout trades.

This stock offered up at least a trade each week for almost two months.

More Breaking News

- GTM Stock Experiences Notable Fluctuations Amid Recent Financial Developments

- Coca-Cola’s CEO Sells Shares: Market Reactions and Financial Insights

- Redfin’s ChatGPT Integration Enhances Home Search, Boosts Rocket Companies’ Market Presence

- BigBear.ai Under Investigation: Stock Faces Turbulent Times

Find a few of these and you’ll have plenty of trades to work with.

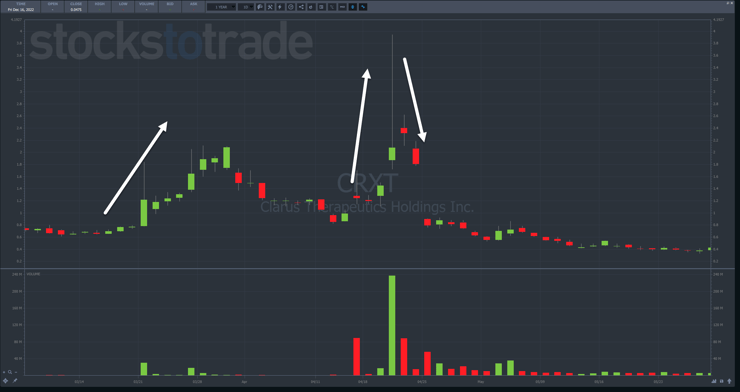

Clarus Therapeutics Holdings Inc. (OTC: CRXT)

Going back even further, CRXT was a nice Supernova that had lots of potential.

Unfortunately, this stock gap around so much that I was only able to pick up a couple of trades.

You see, not every Supernova provides quality setups.

It’s the combination of the pattern AND the setup that I look for.

Build Your Library

Think of trading as your own personal library.

Each setup you learn is a book.

The more setups you learn, the bigger your library.

However, if you rush the process, skim every book, and shove it on your shelf, you’ll never get the full benefit.

Building a personal trading library happens over time.

It starts with a foundation like the 7-Step Penny Stock Framework.

From there, you build your core setups and work them until you’re an expert.

Once you can execute them profitably, you add another setup.

Work that one until you’re an expert. Then, go back and review your core setup.

Trading is a skill that requires nurturing.

It’s a lot easier to do that when you limit yourself to the highest-quality setups and trades.

Yet, the reality is one setup, like the morning panic dip buys, can provide you with plenty of opportunities to build up your account.

So start small and work your way up.

—Tim

Leave a reply