People ask which study guide HERE and which newsletter they should signup for to take advantage of this 50%+ off deal which ends in a few days…my answer is as many as possible! The market is on fire and so are we, with the big $ discount, our newsletters never have been nor will they ever be this cheap again…you need guidance/good picks, that’s what we do, grab this holiday sale HERE now!)

Yesterday I wrote about a great man who died and included this video of him calling the 1987 stock market crash to a T.

All you trading challenge students and wannabe students (let’s see whose actually dedicated to getting rich) please do read that article as his life was one of luxury, education and hard work, not too dissimilar to mine and he should inspire you to see what’s possible in life.

(that’s a picture of Marty and his $70 million Pierre Hotel penthouse in NYC at the top of this blog post…yup Marty liked a bit of luxury and his stock picking success allowed him to indulge)

I met Marty Zweig once early in my career and after explaining my strategy outlined in these 7 free video lessons of short selling pumped up penny stocks, I got a little chuckle out of him.

He agreed, after all, that it was a very logical strategy, little different from buying great companies at discount prices (just in reverse) and he seemed to understand that it could be learned by the average person and truly change life…just like it has changed this young student of mine who recently crossed $200,000 in profits in less than 2 years.

But most of all Marty Zweig was a tireless researcher always looking to learn and profit from the ever changing price action of the stock market.

Again not too dissimilar to me…although his newsletter had 6,000 subscribers, I’m only at 2,000ish…but I’m just getting started 🙂

He was such a steadfast teacher that this blog post is my small tribute to him.

I’ll review and break down the trading of my top students and my own trading in February 2013, as this has been the single best month for me as a trading teacher as this bull market has offered up countless truly wonderful long and short trade setups and I’m praying night and day for us to breakout to new market highs so that the rest of 2013 will be just as, if not more, fruitful!

It was during February 2013 during which my trading challenge students topped $2 million in profits as you can see trade-for-trade here and in this awesome chart below:

For the month, students of my 4 newsletters and I made $250,501 in trading profits, but even more important than the overall $ was that several students excelled and made LIFE-CHANGING profits.

As I wrote in a Facebook (FB) post at month end:

Please congratulate 4 of my best students:

- Tim Grittani who made $33k https://tim.ly/15UazYo

- Mark Croock who made $30k https://tim.ly/12eqEJt

- This old man made $50k on GNIN/SWVI the past 2 weeks but is too lazy to post on Profitly https://tim.ly/MG4yTB

- This great trader who made $50k alone today on SWVI https://bit.ly/9UUmS2

- …and I made $22k realized and $3k unrealized pushing me over $50k in 2 months in profits, not bad given how I spend most of my time cleaning up the drool of my amateur students 🙂 https://tim.ly/ZMGYzu

That’s right the total profits of my strategy far exceeded $250k, it’s probly more like $400-$500k, but my top students like Eric Wood and LX21 don’t post their trades on Profitly regularly as they like their privacy and don’t want more people to learn and crowd the trades.

Too bad for them…what they and many others fail to understand is that because penny stocks are so looked down upon by society and Wall Street, ANYTHING that gets more people to trade them, like showing off the predictable profits that are possible when you use a strategy like mine, creates more liquidity and volatility and thus more trading opportunities.

More Breaking News

- BigBear.ai Under Investigation: Stock Faces Turbulent Times

- TRX Gold Shines with Strong Q1 Earnings and Raised Price Targets

- Credo Technology Stock Skyrockets After Impressive Fiscal Performance

- Exponent Sees Promising Growth with Dividend Increase and Upbeat Q4 Earnings

All I ask is that when I teach you how to make six figure dollar amounts, you post your profits publicly to show EVERYONE how great this strategy is…it’s called paying it forward, I help you, you help me spread my message.

But some of my top students don’t get it, they’re just ungrateful for my hard work and that’s just sad.

The good news is that students like Tim Grittani and Mark Croock DO get it, they’ve started giving webinars to other trading challenge students to mentor them and that’s why they’ve just had their first $30,000 profit months and are loving life.

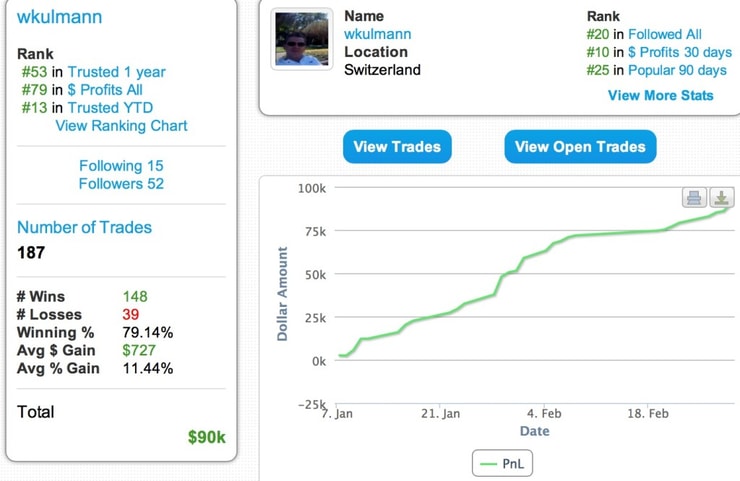

And I’m proud to announce this new trading challenge student Wojnech who I wrote about how he was making more $ than me in January has continued to excel, he’s now up nearly $100,000 in 2013 already, roughly double my trading profits and you can see all of his awesome 2013 trades HERE.

I was looking forward to meeting him during my Rome Inner Circle, but he had a snowboarding accident and was laid up int he hospital…check out what he missed as I taught a few students in person from a pimp $7k/night presidential suite.

I’ll have a detailed post with Wojnech examining his success and breaking it down to the basics to help you guys, as he’s literally been making tens of thousands of dollars from his hospital room…get excited for some hilarious pictures.

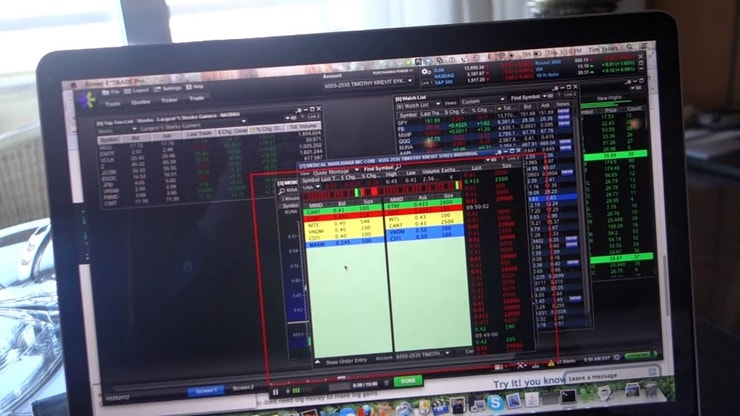

For now, please watch these videos of some live trades I captured in February from some very interesting/luxurious places proving once and for all that you can profit with my strategy from ANYWHERE in the world, whether you’re trading from a $5 million Miami Beach mansion:

(And remember even though these videos are all about shorting before 30-50% collapses, roughly a third of my trades are buys, nearly half my February profits came from perfectly calling the breakout in this hot technology stock…that’s right I buy too which is easier for beginners/those with small accounts)

…the $5,000/night Roosevelt Hotel penthouse in LA:

…or a pimp hotel suite overlooking Rome, Italy:

…as the patterns are the EXACT same as in years past as you can see in this video of a pump dropping nearly 50% in the EXACT same fashion that these recent pumps like ECAU and GNIN crashed.

Leave a reply