Could 5G penny stocks be the next hot sector? Will we see them run like hot marijuana penny stocks and shipping stocks did in the past?

A lot of traders are always looking for the next hot penny stocks to buy. They get excited about new technology and want to jump in right away…

I don’t try to predict the market, and I don’t think you should either.

I prefer to study the past and be prepared to react when the next hot sector presents itself. So get ready…

In this post, I’ll get into what the heck 5G technology actually is, some 5G penny stocks to watch, and I’ll answer some frequently asked questions. Read on to prepare for action in 5G stocks.

Let’s do this!

Table of Contents

What’s 5G?

5G means fifth-generation wireless technology. It comes after 1G, 2G, 3G, and the most recent 4G. It’ll be faster and capable of supporting more wireless devices than previous technology. So … why should you care?

Because it promises higher peak data speeds, more connectivity and reliability, and higher performance…

Higher speeds and more connectivity will likely pave the way for new developments in tech. That means growth, competition, and more companies.

There are still a lot of unknowns about when 5G will be widely available. But in the meantime, there could be more excitement in the anticipation of the technology than when it actually arrives … That’s key for traders to understand.

Remember when marijuana stocks were the hottest sector in the market? They went on a crazy run in 2017 in anticipation of Canada’s legalizing recreational marijuana nationwide. Then when legalization day came, the stocks failed and crashed.

It’s a ‘buy the rumor, sell the news’ scenario. By the time a news release, new technology, or new product actually comes out, the hype is already priced into the stock. Then there’s no room for the stock to run, so it crashes.

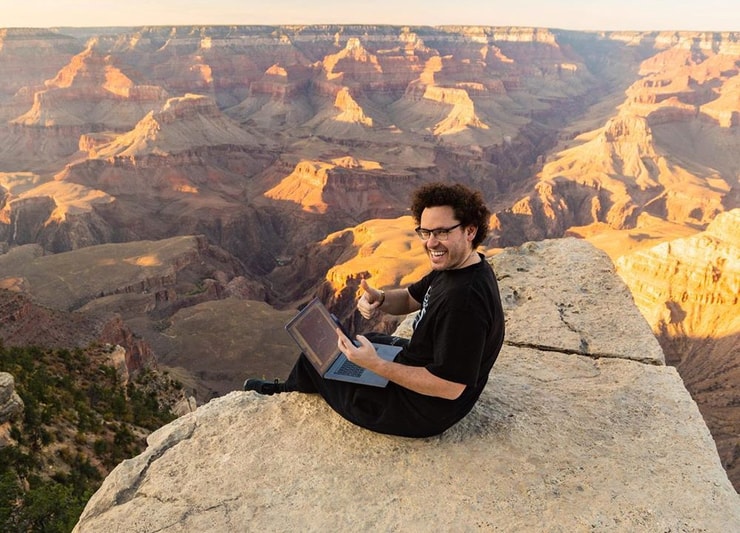

It’s easy for people to get excited about new technology that could improve our daily lives. And we’ve seen a lot of changes this year in how people live and work due to the coronavirus pandemic.

So many people have switched to working from home and on the go, rather than being chained to an office desk from 9 to 5.

So it’s now more important than ever to be able to connect from anywhere with high speeds.

Before You Buy 5G Stocks

This year’s economic changes also brought a lot of new traders to the market. Some are hoping to make it rich quick, but others see the potential to make this a real career.

My millionaire students and I are proof that making money in penny stocks is possible.* But that doesn’t mean it’s easy. It takes time, dedication, preparation, and practice.

Before you jump into trading 5G or any penny stocks, make sure you have some trading education.

Trading isn’t something you can just jump into without an education. It takes time. There’s a process. It’s not a get-rich-quick scheme. Even though you can make a lot of money in a short amount of time, you have to know what you’re doing first.

My students and I don’t gamble. We trade specific patterns, then rinse and repeat. There won’t always be a big play every day but our small gains add up over time.

Wondering where to start? Join my 30-Day Bootcamp. It’s a month’s worth of lessons with daily assignments and homework. You can work at your own pace and repeat it as often as you like.

It also comes with “The Complete Penny Stock Course” book and my “Pennystocking Framework” DVD.

Start building your trading education foundation today with the 30-Day Bootcamp!

(*Please note: My results, along with the results of my top students, are far from typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

List of 6 Top 5G Penny Stocks Worth Watching in 2020

A lot of the “best” 5G stocks aren’t penny stocks. The 5G companies pushing the advancement of 5G tech include big players like QUALCOMM Incorporated (NASDAQ: QCOM), Verizon Communication Inc. (NYSE: VZ), and T-Mobile US, Inc. (NASDAQ: TMUS).

Those aren’t my style. I prefer lower-priced stocks, so I put together this list of cheap 5G stocks. Use this list as inspiration for your own watchlist. And always do your research before every trade.

Hewlett Packard Enterprise Company (NYSE: HPE)

Hewlett Packard Enterprise Company (NYSE: HPE) offers servers and cloud connections, hardware and software, and products through its affiliates.

HP’s new laptop, the HP Elite Dragonfly G2, is made of 80% recycled material. This is something I like since it’s better for the environment. And it will include Qualcomm’s X55 5G modem support that was available in mid-2020.

More Breaking News

- Vertiv’s Stock Surge: Expectations Soar with Updated Price Targets and Cooling Solutions

- Datadog Soars with Strategic Price Adjustments Amid Optimism

- Potential Securities Fraud Looms Over BigBear.ai Amid Revenue Decline

- Bitmine Immersion Technologies Secures Strategic Edge with $14 Billion Crypto Holdings

Telefonaktiebolaget LM Ericsson (NASDAQ: ERIC)

ERIC has its headquarters in Sweden but operates internationally. It offers a variety of information and communication solutions.

It recently announced third-quarter earnings and announced the successful acquisition of Cradlepoint, a U.S.-based leader in wireless 4G and 5G solutions.

KT Corporation (NYSE: KT)

KT Corporation (NYSE: KT) was formerly known as Korea Telecom Corp. It provides telecommunication services worldwide.

Last month, KT announced its satellite-operating subsidiary demonstrated the world’s first connectivity between satellite and a 5G hybrid router.

If you want to be notified of which stocks I’m watching each week, subscribe to my no-cost weekly watchlist. Use my watchlist for ideas on the kinds of stocks I’m interested in and why. It can help you learn to find your own penny stocks to watch.

You can also check out my monthly penny stocks to watch blog post here.

Now, let’s look at some lower-priced 5G penny stocks to watch…

3 Cheap 5G Stocks

These are stocks for your 5G penny stock watchlist. Don’t buy or trade them without a catalyst, volume, or a trading plan.

Communications Systems, Inc. (NASDAQ: JCS)

Communications Systems, Inc. (NASDAQ: JCS) manufactures and sells connectivity infrastructure products for broadband networks. Its products are used in North America and internationally.

The stock had a nice run at the end of 2019. I always watch former runners. These stocks can run again with the right conditions. The stock also has a low float of under eight million shares. If volume comes in, it could create opportunity.

This is also a penny stock that pays dividends.

ASE Technology Holdings Co. Ltd. (NYSE: ASX)

ASE Technology Holdings Co. Ltd. (NYSE: ASX) provides semiconductor packaging and testing, as well as electronic manufacturing services. The company is based out of Taiwan but does business internationally.

It has a larger market cap than the stocks I usually trade. It will take a lot of volume for this stock to make a big move. But it released its third-quarter earnings on October 30. It’s another penny stock that pays dividends.

Nokia Corporation (NYSE: NOK)

Nokia Corporation (NYSE: NOK) is another large-cap stock, even though it trades at a low price. It’s trading in the $3s following a big drop in prices after the company lowered its profits forecast.

There are some changes going on in the company. It recently announced a new three-phase strategy to reposition the company in changing markets and to meet customer needs. Only time will tell if the restructuring works…

I won’t try to predict a move. I’ll wait for news and volume, and react if there’s a play.

Trading Challenge

I developed my Trading Challenge to help everyday traders find their own way in the markets. When I started trading, there weren’t resources like this available.

And I saw a huge lack of transparency in this industry. This is why I teach now. I want anyone who’s dedicated to learning the process to find the support they need all in one place — the Trading Challenge.

It’s where all my millionaire students started*. It’s where you can gain access to all my DVDs, video lessons, webinars, mentorship, the best chat room ever, and so much more.

Are you ready to do the work and learn how to trade the sketchiest stocks to potentially grow your small account? Apply today. But only if you’re truly ready to work your butt off.

Frequently Asked Questions About 5G Penny Stocks

Why Is 5G a Big Deal Now?

The technology is new and still growing. That means more companies are developing new smartphones, devices, and tech with 5G capability. It can create opportunities for innovation and companies to compete to develop more advanced technology.

Who’s Leading in 5G Technology?

There are a few companies competing in the race to be the top 5G pioneer. The leading companies include Samsung, Ericsson, Huawei, Nokia, Qualcomm, and LG. If you’re looking for top 5G providers, look at T-Mobile, AT&T, and Verizon.

How Do Traders Decide Which 5G Penny Stocks to Trade?

I never blindly buy stocks based on a sector. And I don’t invest in stocks. I day trade them using the rules I’ve developed in over 20 years of trading. When I’m looking for opportunities, I scan for a stock that’s a big percent gainer, with a catalyst, and higher than average volume. Then I make a trading plan for every trade.

Where Can I Trade 5G Penny Stocks?

You can trade 5G penny stocks on any of the major exchanges or the OTC Markets. You can access these stocks through your brokerage account. But you need to make sure you can trade all penny stocks with your broker. Be sure to do thorough research before choosing a broker and make sure it fits your trading style.

Conclusion: Should I Trade 5G Penny Stocks in 2020?

I don’t make my trading plans based solely on sectors. I look for big percent gainers with volume and a catalyst.

If a 5G stock offers a trade that matches my strategy, then I’ll take it. And if it doesn’t, I won’t force a trade.

I want to stay focused on trades that offer the best opportunity to make a quick 10%–20%. Then I get out. I don’t hold stocks long term.

If you want to learn my trading strategy, apply for my Trading Challenge. You’ll get access to all my educational resources like my video lessons, weekly webinars (plus archived webinars), my DVDs, and my Challenge chat room.

All of my millionaire students have come from my Trading Challenge* … Will you be next?

What do you think of 5G penny stocks and this new technology? Let me know in the comments. I love to hear from you!

Leave a reply