Imagine I offered you two setups with identical payouts.

One is an overnight swing trade.

The other is a day trade lasting seconds.

Which would you prefer?

This isn’t an easy question to answer, but it’s CRITICAL to every trader’s long-term success.

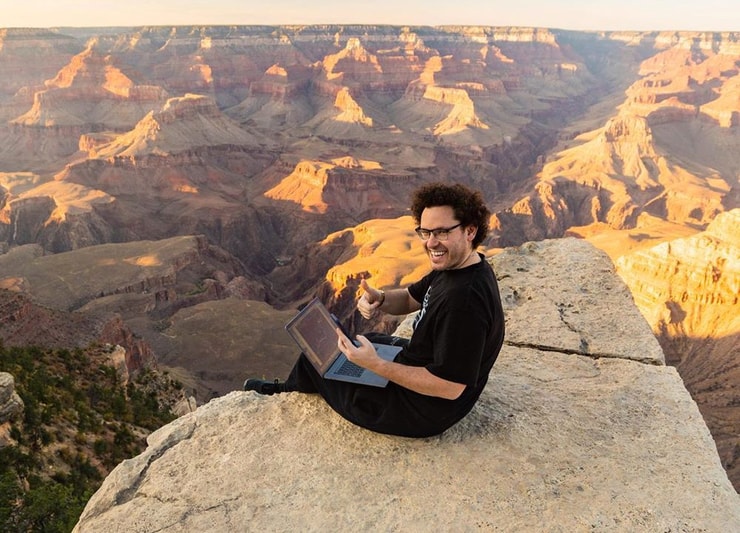

Being halfway across the world opening schools in Bali, it would certainly be easier for me to swing trade.

But that doesn’t mean it’s the BEST setup for me or you.

The better question to ask is, ‘How do I choose the right trade for me?”

To answer that, I want you to set aside any preconceived notions you have about swing or day trading.

I’m going to present you two trades I took this week:

- Vision Energy Corp. (OTC: VENG), a fast morning dip buy

- GlycoMemetics Inc. (NASDAQ: GLYC), a first green day overnight hold

The YouTube video below analyzes both in great detail.

I want you to focus on the patterns and setups, noting how both fit into the 7-Step Penny Stock Framework.

Then, I’ll cover the pros and cons of each setup so you can answer the ULTIMATE question.

Morning Panics

2025 Millionaire Media, LLCIf I could teach you anything, let it be my morning panic dip buys.

This is by far my favorite setup because it’s both consistent and common.

You can find it in NASDAQ stocks just as often as OTCs.

Plus, it works on the front side and backside of Supernova patterns that follow my 7-Step Penny Stock Framework.

VENG is a perfect example of a morning panic that played out to perfection.

As the video highlights, Millionaire Challenge students got my real-time commentary as the stock dropped at the open.

Morning panic dip buys scare a lot of traders.

The phrase ‘don’t catch a falling knife’ gets stuck in their head and they can’t see past it.

Let me clear something up.

I don’t just grab stocks in freefall hoping for a bounce.

Nor do I buy a stock just because it hit a specific support level.

I combine my knowledge of stop losses, short sellers, price action, and promoters to identify the ideal price and time to enter a trade.

While that sounds straightforward, it takes practice, like any skill.

Thus, it requires a bit more work and preparation to achieve success.

1st Green Day Swings

2025 Millionaire Media, LLCMost folks prefer swing trades because they require less work.

You have more flexibility to analyze charts and place trades on your schedule.

But they require a lot more patience.

Setups like my 1st Green Day aren’t uncommon by any stretch, but they don’t occur as often as morning panic dip buys.

Plus, I tend to only trade this pattern on OTC stocks.

GLYC presents this setup perfectly.

After a strong run, GLYC consolidated for several weeks in a narrow range.

It broke out on huge volume, creating a large green candlestick.

My idea was to buy the stock near the close and look for a gap up into the next day’s open.

Pretty straightforward.

However, there’s an additional risk with swing trades you don’t get with day trades – overnight news.

I trade penny stocks that follow my 7-Step Penny Stock Framework knowing they’ll eventually fail.

Nothing prevents that from happening one day to the next.

I can buy near the high and wake up the next day to a huge gap down.

With day trades, the risk is easier to define and stop out for a small loss.

You don’t get that luxury with a swing trade.

When you hold overnight, you’re stuck with the stock until the premarket the following day.

That can lead to larger losses than day trades.

If you look through my track record, you’ll notice that my losses on panic dip buys are often small. Sometimes I even manage a tiny gain.

I have more control over where I enter and exit a day trade than I do with a swing trade.

More Breaking News

- SoundHound AI Stock Slide: Investors on Alert?

- Red Cat Holdings Stock Gains as Drone Market Expands

- Oscar Health Inc. Shares Plummeting Dramatically!

That makes it easier to lose small and fast.

Common Elements

2025 Millionaire Media, LLCRegardless of which setup you choose, realize they both follow the same framework.

Millionaire student Kyle Williams loves to short-sell.

Mark Croock likes to trade options.

Former NFL Star Ellis Hobbs III plays both sides.

My Millionaire Challenge is designed to provide you with the tools to construct your own path.

With thousands of hours of content, there is something for everyone, regardless of your account size, experience, or success.

—Tim

Leave a reply