“If you get the process right, money is a forgone conclusion.”

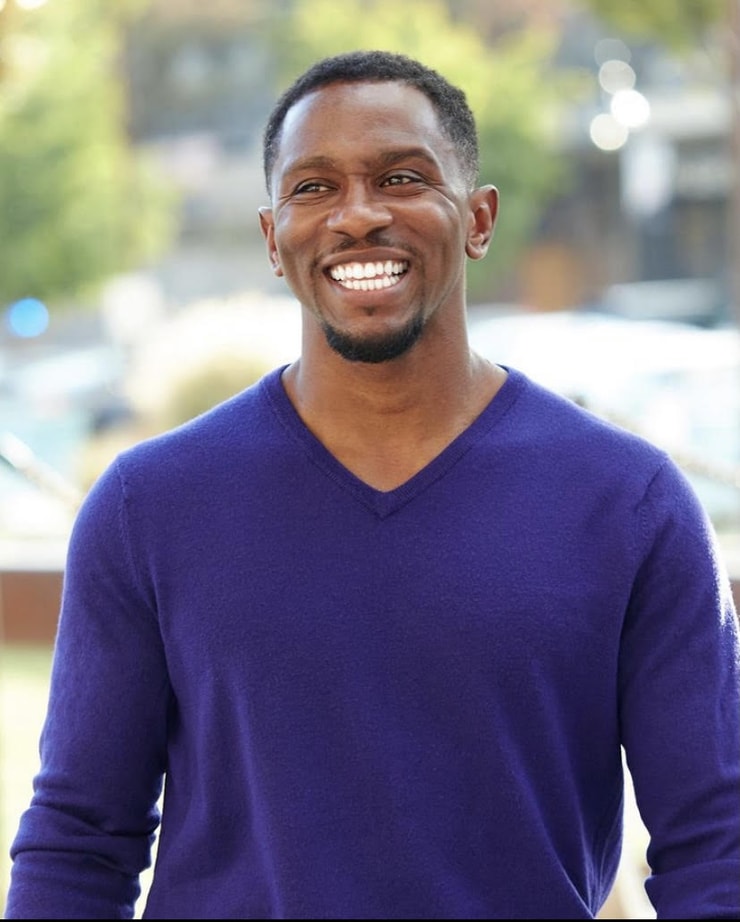

Ellis Hobbs stunned a room full of traders into silence with these words.

In his mind, traders struggle not because of a bad strategy or poor timing.

Traders struggle because they focus on the wrong end game.

And he’s right.

Every person who signs up for my Millionaire Challenge wants to make money.

But that doesn’t mean you put the cart before the horse.

Some people complain because trading can be unpredictable.

However, you’re in control of the stuff that matters. For example, the setups you choose, the risk you take, and how you execute the strategy.

Do enough of the right things, and the results should follow.

As Ellis spoke at our Trading Conference, he delved into the unique mindset and approach he brings to trading.

One thing you should know about Ellis is he lives firmly in the present.

He treats trading like a business, but one that you must appreciate along the way.

And if you Google ‘Ellis Hobbs neck injury,’ you’ll understand why.

The unique insights Ellis imparted in that room of traders are worth repeating here.

Take notes of what I’m about to share because these lessons will make you a better trader and more fulfilled.

Table of Contents

Make Trading Real

Social media is terrible for a trader’s confidence.

All you see on there are keyboard jockeys bragging about their big wins.

Meanwhile, you eeked out a $25 profit and get down on yourself.

But that’s $25 you didn’t have before.

Make that $25 real for yourself.

Think about it in terms of paying for lunch or part of a phone bill.

The same thing applies to losses.

Once you start seeing trade outcomes in this light, you’ll become more focused on risk management, which is key to becoming a successful trader.

Treat Trading Like a Business

Would you rather have a professional pilot for your trip to Hawaii or someone who flies small two-seaters for fun?

I know who I’d prefer.

Trading is a business, and you should treat it that way, even if you consider it a hobby.

That means creating trade plans, identifying patterns, practicing setups, reviewing your trades…all the things you would do whether you manage $1,000 or $100 million.

You might be successful in the short-term flying by the seat of your pants.

But reality will eventually catch up to you.

That’s why 2020 was so dangerous.

New traders jumped into the market right as one of the biggest and fastest bull runs began.

You could buy almost anything and watch it go up.

More Breaking News

- Avantor Faces Scrutiny Amid Fierce Legal Challenges and Financial Woes

- Datadog Sees Price Target Shifts Amid Market Changes

- Ecobee’s Significant Milestone: Generac Steers Renewable Growth Amid Market Shifts

- Shopify Stock Receives Multiple Upgrades Amid AI Growth Expectations

It created a false confidence that led to bubbles in meme stocks, cryptos, and other areas that eventually popped.

Build Momentum

I’ve seen many traders over the years try to hit home runs and strike out instead.

Making $1 million in the market starts with making $1.

Traders need to build confidence in their process and strategy before committing more capital.

Putting together small wins over and over can help traders build momentum to move to that next level.

Now, some folks struggle to increase their size over a certain amount.

I’m one of them.

I do better with a smaller account than with one that has millions.

However, if you struggle to go from risking $500 to $1,000, do it in small increments.

Trying going from $500 to $510 for a week or two. Then $520.

There is no rule that you must earn a certain amount by a given date.

Heck, Bryce Touhey restricted himself for nearly two months to risking just $2 per day.

Now, he’s on his way to becoming my next millionaire student.

As Ellis put it, make yourself comfortable with trading.

Don’t risk so much that you can’t think straight.

Start small and work within your means.

Don’t worry about other people.

Appreciate Every Moment

Ellis is probably most famous for having one of the longest kick returns for a touchdown in the NFL.

You can see a YouTube video of it here.

Yet, his career ended abruptly when he suffered a second neck injury in 2010.

He’s now a trader, motivational speaker, and inspiration to folks from all walks of life.

Ellis loved his time in the NFL.

And he loves what he does now.

He appreciates every second of his life and doesn’t take anything for granted.

It’s so easy to get caught up in trades that we forget to enjoy ourselves.

Sure, there are hand-wringing losses just like there are joyful wins.

But, as discussed earlier, those are outcomes.

It’s the process that matters.

The process is what we control.

And it’s where you want to take time to appreciate the journey, from the mistakes you make to the lightbulb moments where you exclaim ‘AHA!’

–Tim

Leave a reply