Monday’s hit a lot different for me than most folks.

Most Americans dread their job and the people they work with. Even worse, they feel underappreciated and underpaid.

For nearly two decades now, I’ve been showing people a way to get out of the rat race through my coaching program.

From what I know, there’s no other trading coach who has helped develop more millionaire students than I have: over two dozen and counting.

I share that not to brag but to show you what’s possible.

You see, changing your circumstances starts with developing the right mindset.

And while that sounds simple, it’s a lot more challenging than you think.

Your friends and loved ones will discourage you once you tell them about your lofty goals. Maybe they tried to do something great and failed and don’t want you to experience the pain of failure. Or maybe they don’t want you to be more successful than them (that’s actually a thing).

It’s time to mute those negative people in your life and start getting serious, if you want to climb the ranks of financial freedom.

If you’re tired of losing, feel stuck, and want better for yourself, listen up…

Because I’m about to share with you the three steps, you MUST take to become the best version of yourself.

Table of Contents

Step One: Invest In Yourself

Forget about bitcoin, stocks, and real estate. The greatest investment you’ll ever make is in yourself. You do that by learning and developing skills. And the fastest way to get results is by teaming up with someone with a proven track record.

Even though I’ve made over $7 million in trading profits throughout my career, and I have more money than I’ll ever need, I still suit up every day and trade.

Why do I do that?

Because I believe in leading by example, who wants to work with a trading coach who isn’t in the game, who doesn’t apply the strategies they teach?

That would never sit well with me.

You can trial and error your butt off, but why do that, when you can lean on someone who has been there and done that, and has had success in the area you want to succeed in.

Invest in yourself by getting a proper education. You’ll save time, and potentially money from the losses you’d incur from DIY, and you’ll reach your goals faster.

Step Two: Put In Reps

A fool and his money soon part ways. I can’t tell you how many stories I’ve heard over the last year of people who started trading crypto and stocks in 2020, caught a hot market, made a boatload of cash, but didn’t take profits, and are now deep underwater.

Believe it or not, the worst thing that can happen to a new trader is having success early.

Why?

Because it gives them a belief that they’ve got the game mastered and no longer have to study charts, review trades, and journal.

No one believes they can pick up a basketball for the first time and compete with Lebron James…hop in the pool, outswim Michael Phelps…or out flip Simone Biles on the mat after watching a YouTube video.

However, so many delusional people think they can make millions in the stock market right off the bat.

Just over 1% of all adults worldwide are millionaires. If trading was that easy, don’t you think we would have more millionaires?

What trading offers is unlimited opportunity. Whether you maximize that opportunity is totally up to you. And while some think the amount of capital they start with will dictate their success, that’s not true.

Several of my millionaire students started with 4-figure accounts and grew them over time.

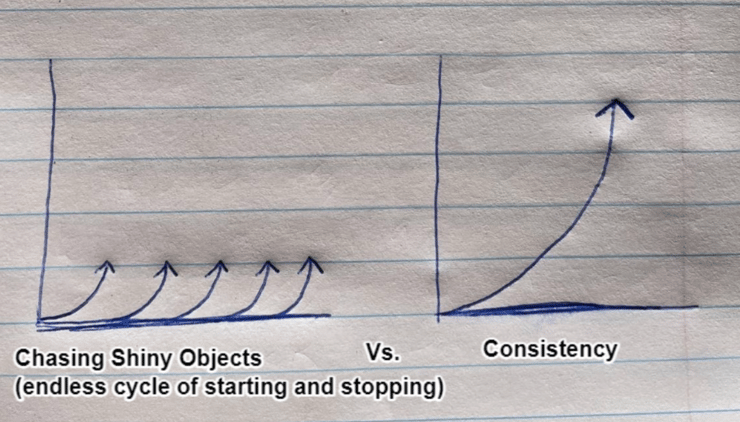

Stop chasing fast money…and start thinking long-term. The first few months, even the first couple of years, might seem like an absolute struggle.

But believe me, if you stick with it, study hard, and learn from others who are having success, your chances of winning the game are greatly improved.

More Breaking News

- GTM Stock Experiences Notable Fluctuations Amid Recent Financial Developments

- Clear Channel Outdoor’s Strategic Move: Major Acquisition Unfolds

- TRX Gold Shines with Strong Q1 Earnings and Raised Price Targets

- Ichor Holdings Upgrade Boosts Stock Amid Strong Earnings

I will show you the best strategies I’ve discovered for making money in the stock market but stop looking for shortcuts.

Step Three: Fall In Love With The Process

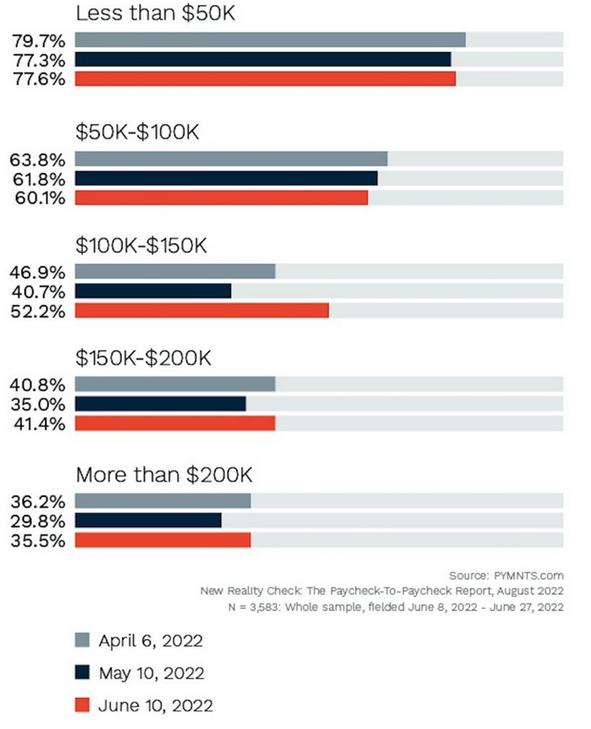

61% of Americans were living paycheck to paycheck. And while that statistic is hard to swallow for some, it’s the reality for a lot of people. Of course, everyone wants to make more money faster.

However, the stock market doesn’t care about your current financial situation. Some days, you feel like you can’t leave your screen because of all the opportunities. And there are others where you feel like the market is dead and trading is a complete waste of time.

You shouldn’t put unnecessary pressure by giving yourself profit goals. You can be trading smart but have no profits to show for it because the market isn’t giving you opportunities.

The reality is trading opportunities happen in waves. When the markets are hot, you have to strike hard. You must stay disciplined and wait for the next wave when they’re slow.

Focusing on the process is much more important than chasing money. Believe me, if you do the right things, the profits will follow. You don’t have to chase them.

How do you focus on the process?

- Work on your trading plan

- Journaling

- Studying trends that are working

- Reviewing winning trades

- Judge yourself on executing your ideas, not how much money you made or lost.

Bottom Line

The market right now is red-hot. New millionaire traders will be minted if it stays this way. However, most folks will miss out. Not because they don’t want to make it. But because they don’t have the right mindset.

If you want to develop the right mindset and finally change the course of your life, then hit me up. I’ll be waiting for you.

Leave a reply