Work-life balance is a funny thing. For me, I love to work. My work ethic has always been strong. When I wanted to be a pro tennis player back in high school, I was up at 5 a.m. every day. I practiced for an hour before school and went to class in warm-ups.

So when I got injured and turned my mind to the stock market and trading, I focused. It was natural for me. I became obsessed.

Two decades later, I see a common work ethic in all my top students. It’s not that work-life balance doesn’t matter. It’s just that freedom for most successful people comes from working your butt off.

Prepare for your future by studying now. Focus. Then two, three, or four years from now you can reset your work-life balance.

Like Roland and Huddie…

Table of Contents

- 1 Celebrating Success With Top Students

- 2 Trading Questions From Students

- 3 Trading Psychology Lesson: Make Trading Work for You

- 4 Millionaire Mentor Market Wrap

Celebrating Success With Top Students

I want to congratulate two top students, Roland Wolf and Mike “Huddie” Hudson. They both recently hit big profit milestones.*

To celebrate their success we hopped on a private jet for an excursion. How’s that for work-life balance? More about where we went and what we did in a future update.

*Please note: My results, along with the results of my top students are far from typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication under our belts. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.

Huddie just hit the $500,000 milestone.* Huddie’s one of the SteadyTrade Team mentors along with Tim Bohen. He’s also an outstanding moderator in the Trading Challenge chat room.

Roland Hits $1 Million in Trading Profits

Roland is the latest millionaire Trading Challenge student.* Congratulations, Roland!

What I love most about trading is how it can change your life. Once you’re self-sufficient you can provide an awesome lifestyle for your loved ones.

Keep reading for more about Roland’s dedication later in this post. First…

Trading Questions From Students

The electric vehicle (EV) sector has been hot recently thanks to sector leader Tesla (NASDAQ: TSLA). The stock broke out on June 30, hitting an all-time high of $1429.50 per share on July 7. Tesla now has a $260 billion market capitalization. It’s the leader not only in electric vehicles but the entire auto industry.

With that in mind, here’s the first question…

“EV sector momentum is strong, but everything trades choppy. Should I test small positions or avoid this kind of price action altogether?”

I always have trouble with electric charging and alternative energy plays. They’re so choppy. That doesn’t mean I don’t trade them, but I find it challenging.

Here’s an example…

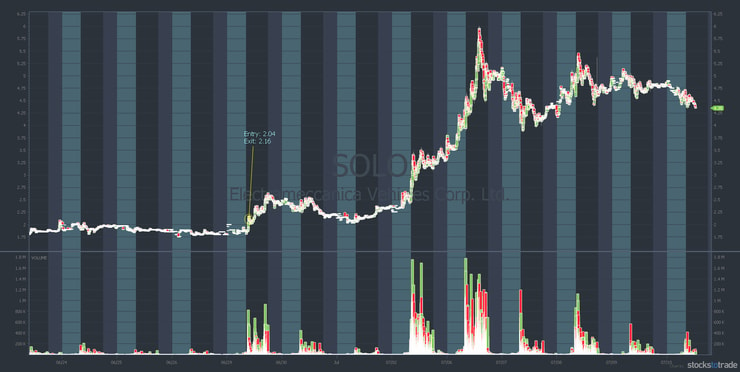

ElectraMeccanica Vehicles Corp. Ltd. (NASDAQ: SOLO)

I traded SOLO on June 29. It was being pumped as the next big electric car play. I sold too soon as it was only semi-strong and choppy.

SOLO also featured on my July penny stocks to watch list. Then, when the price action looked right, it was my Supernova Alert pick. It was a solid pick, going from $3 to $6 by the next trading day.

Here’s the 15-day SOLO chart:

Click on the chart to open it in a new tab and see my trade. The next day it turned into a 100% winner that I called, but the choppiness kept me from taking advantage of it.

Here’s another choppy EV play…

Ayro, Inc. (NASDAQ: AYRO)

I bought and sold AYRO in the low $3s. The next trading day it ran to the $8s.

Here’s the AYRO 10-day chart:

Again, the choppiness made me uncomfortable. I underestimated what turned into a full-on supernova. But I’m OK with my trades — both wins.

It’s really tough sometimes. You have to lock in profits. Never just hold and hope.

As for what you should do, it’s not an exact science. You have to figure out what’s best for you. If you’re not ready to test small positions, try the StocksToTrade paper trading module. It’s a good way to get a feel for how certain stocks trade.

The next question brings me to the focus of this edition of the update…

“What’s the right balance of studying vs. celebrating wins along the way?”

I have some upcoming videos with Roland and Huddie where we talk a little about work-life balance.

Roland used to study 17 hours a day in his first six months in the Trading Challenge. He’s in year four now, but he studied obsessively at first.

He says he still researches, studies, and prepares watchlists for up to five hours per day. So the time he spends has dropped two-thirds in a couple of years.

I think that’s like a lot of people. When you’re getting started everything is very confusing and overwhelming. You have to study to learn all the trading terms and prepare for these fast-moving stocks.

Find What Works For You

Everyone’s a little different. But by year three, four, or five you can learn everything you need to know. Then it becomes rinse and repeat.

For me, now in year 20, I could do this with my eyes closed. I don’t have to spend as much time. Now I spend the majority of my time creating videos, blog posts, and webinars. And I spend time answering questions.

So it definitely gets easier. Again, it’s not an exact science. You have to figure out your best…

Work-Life Balance as a Trader

Everyone has busy schedules these days. Which is why you get to choose your dedication level. I have part-time students and full-time students.

Finding a good work-life balance is also your choice. For example, Roland put in those 17-hour days three years ago so he could have a better lifestyle now. He had zero work-life balance. It was all work. He was grinding. Now he can celebrate.

A lot of people are shocked by one of my top students turning $4,000 into $1 million in less than 4 years but that’s just one example of passion, hard work, dedication & working yourself harder than you ever imagined to create a better life for your family…I absolutely love it!

— Timothy Sykes (@timothysykes) July 10, 2020

All these guys hitting milestones … I almost have to force them to celebrate. The crazy thing is all my top students are very humble. They don’t spend their money. They learn the value of a dollar because they grind so hard to get to $500,000 or $1 million.*

Trading Is a Business

Think of trading penny stocks as an entrepreneurial business. That will help you get the right mindset. Entrepreneurs are willing to work harder than most people for a few years. The trade-off is the ability to live a life others can’t live.

New to penny stocks? Check out this FREE penny stock guide.

Penny stock trading is a lifelong skill. And the skill happens to develop out of conservatism. The more you study, the more grateful you are for every dollar you make. It’s actually better to grind for two, three, or four years.

How to Trade Stocks With No Spare Time

All my top students have an almost obsessive work ethic. They want to be better traders. Every single day they work to refine their skills.

Compare that to some of the bitcoin traders who made so much money quickly. They didn’t study, and they didn’t appreciate it. They learned the wrong lessons and lost most, or all, of their money. Maybe they blew a lot of it. They thought bitcoin would keep going.

So it’s not just about how much money you can make the quickest. Can you learn the right way that will provide the potential for more money to come in? Can you develop good spending habits that will serve you for the rest of your life?

Trading Psychology Lesson: Make Trading Work for You

Right now I’m pretty much exhausted all the time. My top students are exhausted, too. But we keep chugging along because the market was so crazy in May and June. The volatility was through the roof. Access my no-cost “Volatility Survival Guide” here.

The market started a little slower in July. Frankly, I’m hoping it’s gonna be a slower summer because I’m tired. But we’ll see what happens.

Whatever you do to manage your work-life balance, make trading work for you. Feel free to take a day off. (I always say “no days off” but we haven’t seen a market like June in decades.)

You have to take it trade by trade. But if you need a personal day off, go for it. If you need to grind right now, go for it. Just don’t burn out.

You don’t want to be away for two weeks or a month. Do whatever YOU have to do to keep chugging along day by day. Whether you’re there 100% or you’re just watching … be ready for potential plays.

Work-Life Balance and the Trader’s Mindset

Trading isn’t like a regular job or business. When the market presents opportunities, you have to take them. The market won’t always be hot.

So don’t say … “I’m so burned out, I’m taking July or August off.” That kind of thinking is a big mistake. It’s the wrong mindset. Feel free to take a day or two off. Or take fewer trades in a day to catch up.

Be grateful for nights, weekends, and long holiday weekends. Spend time with family or loved ones.

And remember, it’s a marathon and not a sprint. Always keep in mind why you’re studying and working so hard. Then, in a couple of years, you can have more freedom to choose how to spend your time.

Trading Challenge

All my top students are part of the Trading Challenge. It’s as simple as that. They don’t all start there. But they all get there in the end. Why? Because it’s the most comprehensive trading education I offer.

As a Trading Challenge student, you’ll get access to…

- Two to four live webinars per week.

- Thousands of video lessons.

- Hundreds of hours of foundational material in a library of DVDs.

- Access to the Trading Challenge chat room. It’s an awesome trading community.

- And access to mentors to help guide your evolution as a trader.

Apply for the Trading Challenge today.

Millionaire Mentor Market Wrap

My goal is to be the mentor to you that I never had. But I also want more people to experience the freedom of financial independence. I can’t guarantee that you’ll achieve that freedom through trading. But I do know that to achieve it you have to work. Hard.

Most successful people go through a period of very little work-life balance. It’s the price of freedom. Traders like Huddie and Roland are perfect examples. All my top students have an almost obsessive dedication to studying. At least in the beginning.

What will you do?

What do you think about work-life balance as you develop your trading skills? Comment below, I love to hear from all my readers!

Leave a reply