Over the last 20 years, I have been in this market, and I have studied it inside and out…

And the most important thing I learned is that you don’t need to be glued to your chair while the market is open to find the best opportunities.

You see, the beautiful thing about penny stocks is that you can see some of the best plays happen on days 2, 3, and 4.

Trading is all about finding what works, and by studying the market, I was able to develop a few trading strategies that can work in any market…

And I want to share it with you today.

If you are wanting to know how you can change your financial situation, even with part-time work…

Here are some steps you can take to help achieve financial success.

Table of Contents

Lack Of Preparation

Preparation is one of the most important steps a trader needs to learn.

90% of traders lose due to a lack of preparation.

Doctors have to study for years before they become residents…

Professional athletes have to practice and train for years before they potentially make it to the big leagues.

But it doesn’t just stop there.

All doctors will still have to do the leg work before they make a diagnosis…

Every professional athlete will have to study films, and continue to practice multiple days a week so they can continue to perform at a higher level than their competition…

And I want all of you to have that mindset today when you are looking to trade.

Turning on your computer and just looking at a stock isn’t going to help you to buy or sell…

It’s just a step in the right direction.

Every morning I have a list of hundreds of stocks that I have traded over the year that I have kept track of…

And I am always preparing myself for my next move.

This market is constantly changing and this is why you must adapt.

Recently we have started to see early morning spikers happen, and once one starts to spike…

More can start to follow.

Just because you missed the initial run-up on day 1 isn’t the end of the world…

You need to be prepared to capitalize on what the stock may do next.

What’s Working In This Market

Since we started 2023, I’ve mentioned that we are starting to see a lot of previous Supernovas start to spike.

In fact, I am starting to notice several stocks that are starting to spike, especially early in the day.

As we start to see the January Effect come into play, I am starting to see a lot more opportunities.

Remember, if you missed these on day 1, the trade isn’t dead with these penny stocks.

Let’s take a quick look at what is happening in this market so you’re aware.

Biora Therapeutics, Inc. (NASDAQ: BIOR)

Ebang International Holdings Inc. (NASDAQ: EBON)

Over the last few days, I have been seeing a significant amount of stocks spike on day 1, day 2, and now even day 3!

This is why I encourage all of you to focus on big percent gainers, because even if you miss the first green day…

There could be more profitable times ahead.

More Breaking News

- Valterra Platinum’s Q4 Forecast Drives Anticipation Amidst Earnings Surge

- Robinhood Appointed Trustee for Trump Accounts, Stock Rises

- Supreme Court Greenlights New Gold’s Game-Changing Acquisition by Coeur Mining

- AppLovin Gains as Analysts Highlight Growth Potential Amid E-commerce Boom

Why Day 1 Doesn’t Matter

If you miss the first day a stock spikes, it isn’t the end of the world.

But I always make sure I am prepared for anything that could happen on the first day the stock starts to move.

Let’s face it, none of us want to miss out on any golden opportunity to make money…

And with penny stocks, there could be multiple opportunities for you to profit during their life cycle.

For example, some of you may have remembered my trades on Meta Materials Inc. (OTC: MMTLP)…

I didn’t trade it on day 1, day 2, or day 3…

I actually did my first trade on this big red day where I traded one of my favorite patterns.

Here’s the chart.

This is all part of understanding my 7-step penny stocking framework.

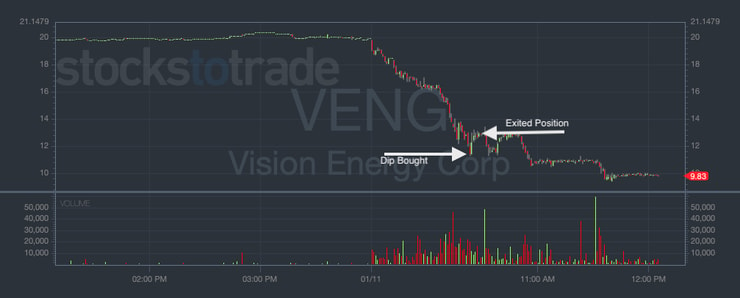

Yesterday I dip-bought Vision Energy Corporation (OTC: VENG) and prior to that trade…

My first trade didn’t happen until December 29, 2023…

You can see all of my traders right here

But take a look at the chart…

Notice how I missed several days when the stock was running, but I waited for what I thought was more predictable.

Here was my trade from yesterday where I was able to profit $625.

The first day doesn’t always matter, there will be plenty of opportunities down the road…

And you can see that VENG had multiple dip buying opportunities over its course.

But eventually, we know how all of these plays will end…

Start Small

We have so many speculative spikers again, but you must be prepared!

Don’t think it’s game over when you miss day 1…

We haven’t seen these many spikes over the last few months, and we are already seeing a better environment than we saw in 2022.

These morning spikers continue to happen in the morning, so don’t miss what is happening in the chat as these are happening fast…

But remember, there are several other opportunities if you miss the initial start of its run.

I have hundreds of stocks on my watchlist, but they all aren’t worthy of a trade…

So as I plan to be quick on these early morning spikers, and also look for those multiple-day runners that are about to panic.

Until next time.

Study up!

Tim

Leave a reply