Have you ever had a trade that left you feeling sick to your stomach?

It’s a feeling everyone will experience throughout their trading journey, but what sets successful traders apart from those who aren’t is how they handle these types of losses.

I’ll be the first to admit that I was dead wrong with a trade on Tuesday…

And it could’ve been a devastating blow to my confidence.

But instead of dwelling on the negative, I turned it into something positive for me and my students to learn from.

This trade made me realize I was heading down the wrong path, a path I typically don’t go down…

So today, I want to share with you how I was so dead wrong with this trade and what I’ve learned…

And what you can do to prevent a catastrophic mistake if you get stuck in a position like this.

Let’s dive in…

Table of Contents

Follow The Process

It’s easy to drift away from your game plan once you start to get frustrated with your trades.

Let’s face it, having one losing trade after another, you start to let your guard down…

And at this point, you may become so desperate for any win, so you’re content with trading any stock that comes your way.

Ignoring key indicators you know you should be focusing on, simply hoping to get back to even.

That’s how I felt on Tuesday.

The other day, you may remember me talking about American Battery Technology Company (OTC: ABML) and how I was dead on with that trade…

But I was just a little too early for the party.

And that frustration boiled over to my most recent trade on Discount Print USA, Inc. (OTC: DPUI)

With this trade, I was just dead wrong…

There is no other way to put it.

In fact, there was nothing good about this trade and I saw that, and knew that…

But yet, I didn’t trade it once, but twice, in hopes to offset my recent losses.

After reviewing this trade, there are three key things I learned from my stupidity…

1) Looking back at the chart

Every trader needs to look back at multiple time frames, it’s one of the most important lessons that I teach.

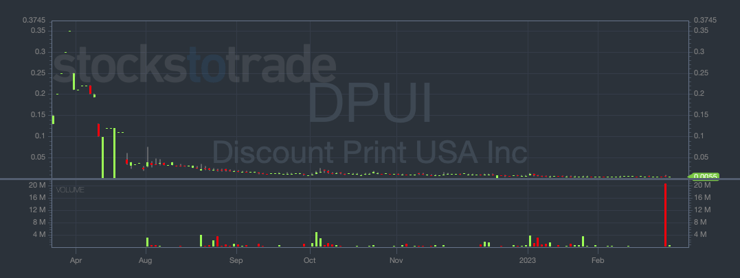

Take a look at the three-year chart for DPUI…

What do you see?

Absolutely nothing.

There was no reason why I should’ve been confident in this stock based on its chart pattern over the last few years…

It was simply just a misjudgment on my part.

This stock has proven no credibility over the years, it wasn’t a former Supernova…

And it hasn’t spiked at all, even when there were other catalysts.

But based on this most recent news, I figured I might as well give it a whirl.

So at first, I didn’t see anything great with my initial trade as the stock started to phase…

But then, I thought to myself, it might go up…

So I decided to do this.

2) Don’t size up your trade without a reason

If you are ever in a choppy stock, like DPUI, you don’t want to increase your position size the next time around.

Some traders think they need to hold and size up their trade if the stock drops a little because it has to bounce.

Holding and hoping for a stock to move in your favor is not smart.

Adding additional size doesn’t fix the problem, understanding how the process works will help you fix the problem quicker than just hoping to double up and win…

If that is your approach, eventually you’re going to get caught with your hand in the cookie jar and the stock is just going to tank.

When I tend to suffer from a few losses in a row, I know I need to cut my position size down and give myself a chance to regroup…

Try to decompress a little and get my emotions back in line before I make my next trade.

Not to do what I did with this trade.

We need to remember the market is constantly changing and what worked one day may not work the next.

We need to remember to adapt to what the market gives us, and just simply sizing up on a trade that’s dead isn’t the right approach.

Losses are ok, it’s all part of the game, but as long as you manage them and take quick profits.

Don’t add unnecessary losses to your account, and if you do have a losing trade, make sure you do this…

More Breaking News

- Prosperity of Tokyo’s Finance Hub: UOKA Shines

- Credo Technology Unveils AI Innovation and Announces 3M Partnership

- Coeur Mining’s Acquisition of New Gold Approved by British Columbia Court

- FMC Plans Debt Reduction and Strategic Growth Initiatives for 2026

3) Cut Losses Quickly

The only positive thing that came out of this trade was that I was able to cut losses quickly…

If I didn’t, it would’ve just been a bigger disaster for me, especially since I decided to increase my position size just a few minutes after my initial trade.

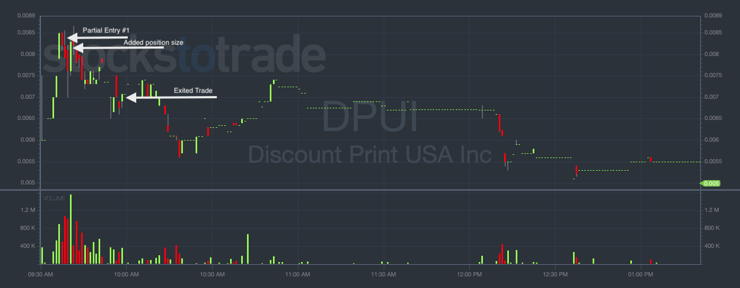

Take a look at the chart…

I entered the trade at $0.0082 and $0.008 and lost $769 on this trade.

Nothing but a constant downtrend after its initial spike early in the morning.

Usually, when you are focusing on a big percent gainer in the morning, there are a lot of questions that need to be answered before you determine your next move.

My thought process was there, but the way that I handled the situation by entering back into the trade and sizing up in hopes to negate my losses was the completely wrong approach.

There will be times when a trade will never work out as planned, so it’s important to always remember my #1 rule.

Final Thoughts

Reviewing my previous trades reminded me I need to be more patient.

Penny stocks have been weak lately, but that doesn’t mean there aren’t plenty of opportunities out there…

You just need to wait for the perfect setup.

As the week is almost over with, I am looking to end the week on a high note…

So stay prepared, be disciplined, and don’t double up your trades in hopes to get back to even!

There is always a next time, as long as you cut losses quickly!

-Tim

Leave a reply