Confessing something is never easy, and I must admit that I’m feeling quite annoyed with myself over one of my trades.

For the past few weeks, I’ve been overtrading in a weak market…

And it’s frustrating knowing that the time and effort I put in resulted in a negative gain.

This is a very common question that newer traders often ask…

However, it’s not the lack of opportunities in this market that caused me to lose money…

It was simply the lack of discipline and entering trades when I shouldn’t have.

Trying too hard can backfire, and that’s precisely what’s been happening to me.

So today, I am going to show you how lacking discipline can create negative results…

And what I am planning to do to shift my outlook to kick start next week in high gear!

Table of Contents

Lack Of Discipline

Lacking discipline can be very devastating for any trader…

One wrong move and you could be finding yourself in a situation you don’t want to be in.

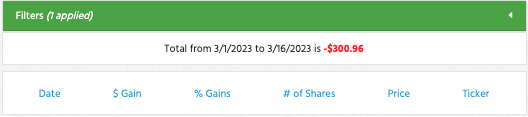

Looking back at my recent trades for the month of March, it’s clear that I haven’t been as disciplined as I usually am with my trades.

Take a look…

You can see all of my trades right here

Overtrading can cripple your account, and this could’ve gotten completely out of hand if I didn’t follow my #1 rule.

Knowing the overall situation of the market, you can’t force any trades that aren’t there.

It’s important to know when to apply the pressure, and when you should scale back a bit realizing that the market isn’t as hot like previous months…

But when you are trying too hard to profit, you get fixated on certain trades and usually, you enter them too early.

Over the last week, we’ve all heard how some banks collapsed, and how others are starting to feel some pressure…

But that’s not the reason why I am down this month.

There are plenty of trading opportunities out there, but sitting in front of my computer as much as I have been lately had caused me to force unwanted trades…

And I know I need to be better disciplined and focus on better setups.

Let’s take a look at one of my most recent trades where I completely lacked discipline and how what a potentially profitable trade…

Resulted in an unfortunate loss.

Trading Too Early

American Battery Technology Company (OTC: ABML)

Earlier this week, I broke down every inch of this trade for all of my students, showing them how dumb my approach was with this trade.

Let’s take a look at the chart over the last few days…

You can clearly see on the left the stock was a multiday runner with a solid uptrend…

It’s all part of my 7-step penny stocking framework that all of you need to master.

Multiday runners can give you some of the most predictable setups to find these dip-buying opportunities…

And a lot of these plays all start by becoming a big percent gainer.

When a stock runs for several days, you should be watching to see if it panics…

And looking at this chart, it double topped near the $1.40 mark, the stock finally panicked that evening…

Into the next morning, creating the perfect morning panic opportunity for traders to capitalize on.

Now let’s take a look at VeeMost Technologies Holdings, Inc. (OTC: GDVM) and how it panicked after a multiday run…

This is why I teach, it’s important for you to recognize how these patterns can be so predictable…

You just need to know how to spot them and patiently wait for them to panic.

Unfortunately, that’s not what I did with ABML…

Take a look.

ABML has had three red days in a row…

And I was thinking, you rarely have a 4th red day in a row, it’s got to bounce.

Wrong.

In fact, I traded it twice, and both trades resulted in a loss.

There was no reason why I should’ve traded it when I did…

I was just buying just to buy and mainly because my mind was thinking about Epazz, Inc. (OTC: EPAZ)

Look at this chart, it has 3 red days then had a 70% bounce – pretty amazing in an ugly market.

I did really well with this trade, I waited for it to break below a key level of $0.01, then I entered.

But as for ABML, I was just simply thinking I don’t want to miss it…

FOMO at its finest, because I didn’t expect it to drop the way it was, I was thinking it to bounce like EPAZ.

When I am disciplined and locked in with my trades, I am always looking back at the history of the chart…

And with ABML, I didn’t.

If you look back at the chart there is a solid support and I should’ve realized it.

When the stock had its initial run-up, it broke through a previous resistance level…

And that’s the spot I should’ve realized to dip-buy, not on the way down when it broke through its previous level at $1.00

This is why I am so proud of my students, they understand the importance of identifying these key levels and most of them nailed this trade.

More Breaking News

- Morgan Stanley’s Bold Moves Boost Cipher Mining’s Prospects

- Ichor Holdings Upgrade Boosts Stock Amid Strong Earnings

- Huntington Bancshares Misses Q4 Earnings Estimate Amid Turbulent Market Conditions

- GTM Stock Falls Amid Latest Earnings Report and Market Reactions

This shows you why you need to stay disciplined and take the time to fully review your trades before entering.

Final Thoughts

This was just stupid trading, but after reviewing my trades, I learned from my mistakes.

This market is still giving us opportunities…

You just need to be disciplined, have patience, and learn from my mistakes so you don’t make the same ones!

I will be looking to limit my number of trades next week to 1-2 a day to allow me to focus only on the best setups.

See you here next week!

Cheers,

-Tim

Leave a reply