URGENT: 3 Black Friday Specials HERE and HERE and HERE

No one can avoid large losses.

It happens to every trader at some point, myself included.

Our natural reaction is to sweep it under the rug…bury it deep and forget about it.

I wouldn’t recommend that.

Like repressed emotions, ignoring large losses will eventually come back to haunt you.

Believe it or not, rarely do major losses come out of nowhere.

The most common cause is staring right at you in the mirror.

Now, the first time you take a major hit, it can be scary.

That’s why I like to share the story Mariana told at our Traders Conference.

Marianna is probably the most consistent trader amongst my students that hit the million-dollar mark.

She’s so process-driven that she didn’t make any trades her first year.

All she did was study.

So, when she took her largest loss, $90,000, in one day, it threw her for a loop.

Since then, she’s bounced back wonderfully and then some.

I previously wrote about the lessons she took from the loss.

But when she spoke at the conference, she offered insights into how she handled the loss WHILE she was in the trade.

This is incredibly insightful because it gives you a blueprint into the mind.

And trust me, in the heat of a losing trade, it helps to know what to expect.

Plus, the suggestions Marianna provided can help anyone break through the fog of war and take action to limit your losses.

Here’s what she said.

Table of Contents

Emotional Takeover

Humans hate to lose.

In fact, we fear losing more than we love winning.

So, when you end up in a trade that’s becoming a massive loser, most people panic.

Now, you might assume that would make you quit the trade right then and there.

In reality, we tend to freeze up, especially when it’s a new situation.

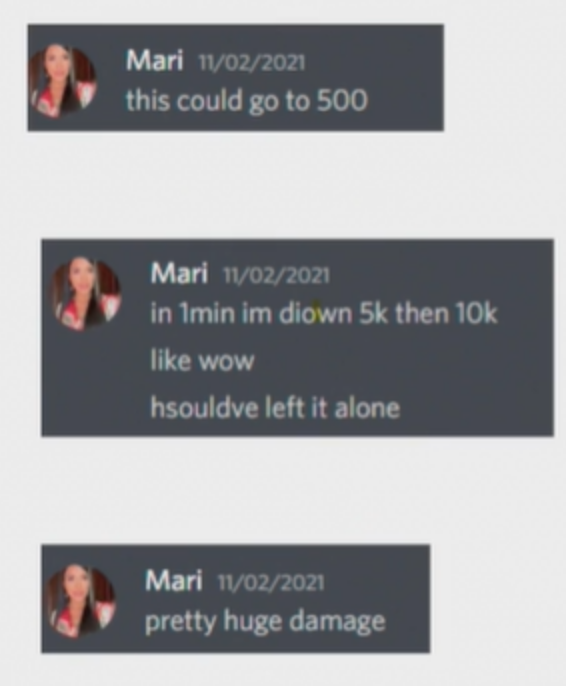

These are some of the tweets Marianna posted during the trade:

A conservative trader, Marianna wasn’t very familiar with the situation.

Sure, she’d taken losses before, but never one like this.

In retrospect, she attributes the loss to breaking her process, stepping into unfamiliar territory, and not doing it gradually.

But in the moment, it was all about the same thought we all face…

What do I do?

Which is why Mariana came up with a few suggestions.

When in Doubt, Close it Out

Occam’s Razor – the simplest solution is often the best.

Cut the trade and walk away.

Once we’re out of our comfort zone, our minds aren’t in the right place to make good decisions.

It’s like trying to drive in a snowstorm after a bad breakup.

Your risk of doing something rash increases.

I always tell my students to lose small and fast.

This not only keeps losses to a minimum but protects you from ending up in situations like Mariana faced.

And trust me, she’s not alone.

I’ve taken my eye off the ball plenty of times over the years, and it’s cost me.

That’s why I love this piece of advice.

It’s not easy to do, especially when your emotions start to take over.

One way to help avoid that is to practice losing.

I know that sounds weird.

More Breaking News

- Microbot Medical Eyes Expansion with Key Milestones in 2026

- BigBear.ai Under Investigation: Stock Faces Turbulent Times

- Ichor Holdings Upgrade Boosts Stock Amid Strong Earnings

- Datadog Battles Price Target Reductions Amid Growth Hopes

However, if you learn to exit trades with simulated funds or tiny amounts in play, you engrain the habits into your mind, so they’re there when you need them the most.

Don’t Rationalize

We’re all guilty of this one.

You’re in a losing trade and start to think about how to restructure it or explain why it needs just a little more time.

That’s not how it works.

So ask yourself the following questions:

- Is your setup broken?

- Is this your trading style?

- Do I have too much at risk?

- Do I feel like I want to vomit?

- Would I normally take this trade?

If you answer ‘yes’ to any of these questions, then you shouldn’t be in the trade.

Trading isn’t always comfortable. But you never want to get so anxious you can’t think straight.

Take Two Steps Back

Sometimes we can’t convince ourselves to just walk away from a trade.

So, why not take a small step to get there?

When you can’t decide what to do, take a step back, turn your head away from the computer, and journal for a few minutes.

Write down what you’re feeling, what’s happening…anything that helps you focus for just a moment.

This isn’t about writing your memoir. It’s about mentally breaking away from the trade, even for a moment.

Stay Positive

Like many of my students, Mariana has a wonderful attitude.

She enjoys trading and always wants to become better.

We all make mistakes.

You don’t have to atone for the losses right then and there.

There are always more trades around the corner.

You can and will bounce back from the trade.

We’ve all been there.

So give yourself a break.

You can do this.

–Tim

Leave a reply