Are you tired of letting your emotions get the best of you when a trade goes sour?

Feeling frustrated and disappointed is all too common for traders, and not knowing how to control them can leave you looking like this…

While losing money is never pleasant, attempting to recoup your losses by doubling down or going all-in is never a solution.

But don’t worry, there is a way for you to regain control of your emotions and turn things around.

On Friday, I lost $450 on Desktop Metal, Inc. (NASDAQ: DM)…

And this trade still haunts me to this day.

As this was a tough pill to swallow, I still was able to learn from this mistake.

Learning how to handle disappointing trades is all part of the journey…

Instead of letting my emotions take control of me in that situation, I took a different approach.

Here is what I learned and what I decided to do instead…

Why This Trade Rattled Me

Nothing is more gut-wrenching than knowing you were dead-on with a trade…

And thinking you made the best move possible to cut your losses quickly…

Then the stock starts to skyrocket.

This is exactly what happened to me Friday morning, and this wasn’t the first time this has happened to me…

But this one trade really had me all worked up.

Controlling your emotions can be tough…

And despite being frustrated beyond belief, I still know I had to go back and review this trade…

Not only for my own education but to help all of my students understand what I did wrong and how I should’ve handled it differently…

Let’s dive in.

On Thursday right before the market closed, I noticed Desktop Metal, Inc. (NASDAQ: DM) was closing strong…

Recognizing this pattern, I wanted to give it a shot to see what would happen overnight, given the recent hype and earnings beat.

I was expecting it to jump in the pre-market hours and into the open as the hype continued to build…

Instead, it started to fade so I decided to be a coward and cut my losses quickly, which I typically do…

But this time, the stock started to take off shortly after and I regretted it.

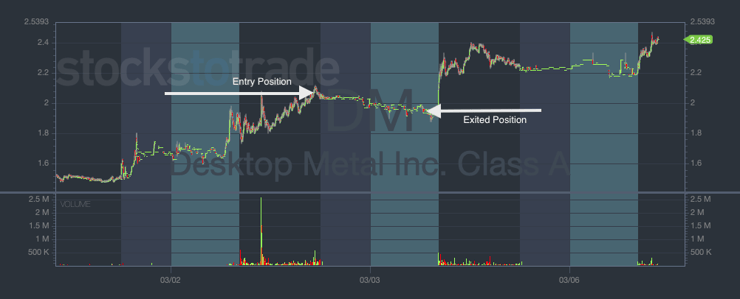

Take a look…

Here you can see my entry position at the end of the day at $2.06 and before the market opened I sold it at $1.97 for a loss of $450.

Looking at the chart, it looks like I may have made the right decision to cut my losses quickly…

And of course, that should feel like a “win” to any trader…

But shortly after I exited my position, the stock did exactly what I anticipated…

Yet, I didn’t want to run the risk of it spiking down in the open and risking even more capital.

This was a difficult decision, but it’s not exiting the trade that left me feeling miserable…

What really made me feel like I was punched straight in the gut was missing the opportunity to get back in.

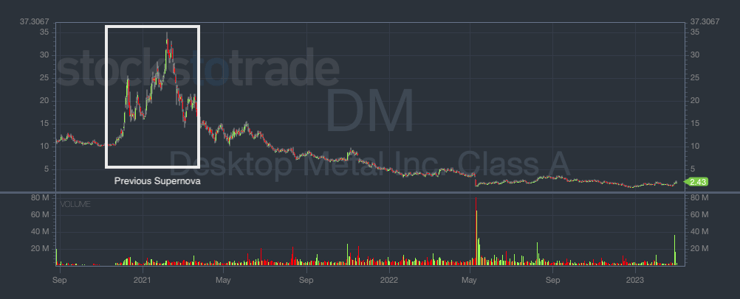

DM was a previous Supernova and it has the ability to spike if it has the right type of catalyst…

But even though I knew its potential, it still hasn’t done too much over the last few months…

I should’ve been better prepared given the recent news that has come out on this stock.

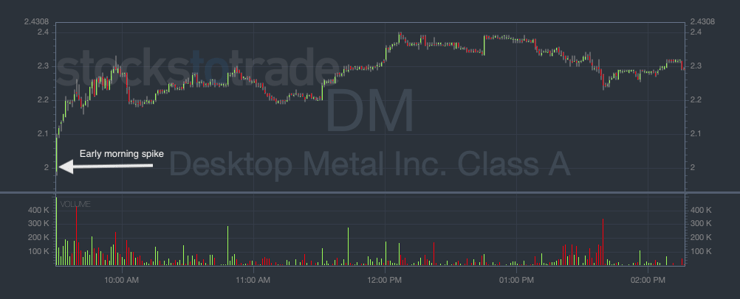

When the market opened at 9:30 am the price action was beautiful, the level 2 was beautiful…

Here’s the chart…

You need to make sure you know how to spot these opportunities and take full advantage of them!

When you notice a stock opening like this in the morning, especially after the way it closed the day before…

Plus you factor in a good earnings report…

You need to get back in…

But I didn’t.

Watching this stock break through its previous high of day around $2.12…

I had my finger on the mouse, ready to click buy…

But my mind got the best of me and I let it go.

Talk about another punch to the stomach….

My emotions got the best of me and prevented me from entering a trade I would normally be in…

So instead of vigorously looking around for another stock to trade to offset this mutilated trade…

I did this instead…

Knowing How To Deal With Frustration

Every trader is going to suffer some losses…

And there will be some plays like this where you should’ve been profitable, but instead, you are stuck on the losing end…

Sure you could sit in front of your computer, dwelling in a “should’ve, would’ve, could’ve” situation…

But instead, I did this, and if this happened to you, you should…

- Turn off your laptop, phone, and step away.

You need to have a balance between your life and trading, don’t let it control you and put you in a miserable mood.

The last thing you want to do is stay fixated on it and keep searching for other trades to offset your losses when your mindset isn’t right.

Out of sight, out of mind, I like to say…

- Do what you love

Maybe it’s going to the gym, taking a walk, eating food…

Whatever it is, do something you enjoy.

I’ve been traveling a lot for my charity, but on Friday after this trade, I decided to spend time with my mom.

Stepping away has helped me clear my mind and better prepare myself to tackle the market come Monday.

- Tomorrow’s a new day

There will always be other days when the market will give you more opportunities…

Don’t go forcing something that isn’t there.

I get it, It’s just frustrating knowing you could’ve had more money than what you started with, but that’s alright…

Just be even more prepared to take advantage of the next opportunity and keep your game plan the same…

Remember, it’s a marathon, not a sprint!

Don’t let one messed-up trade haunt you for the rest of your life…

Instead, review your mistakes and understand what you can do differently going forward…

I’ll see you here tomorrow!

-Tim

Leave a reply