Every trader has searched for the ‘holy grail’ of indicators…the one that tells you exactly how to trade for pure profits.

Hopefully, most of you realize no such thing exists.

For years, I tried to find the secrets of the market.

It turns out they were right in front of my nose the entire time.

You see, there are only three pieces of information any trader ever needs from a chart:

- Price

- Volume

- Time

The relationship between these components is critical to understanding how to identify and trade setups out of patterns like my Supernova.

News stories and other catalysts are critical as well. However, they don’t come from the chart.

Price, volume, and time are all we ever get.

And learning how to interpret each is critical.

While I could probably write a library on the topic, I want to give you the key points for each.

These will improve your chances of quickly identifying and evaluating entry and exit spots within a pattern.

You Can’t Have One Without The Other

Most folks like to think that price is the only thing that matters.

However, we know that stocks with low trading volume often have wide spreads that cost large amounts of slippage.

We know that premarket trading volume is different than the regular session. Even the main session tends to see more volume at the open and close rather than in the middle of the day.

All of these are fairly obvious.

But let’s take this deeper and look at dip buys.

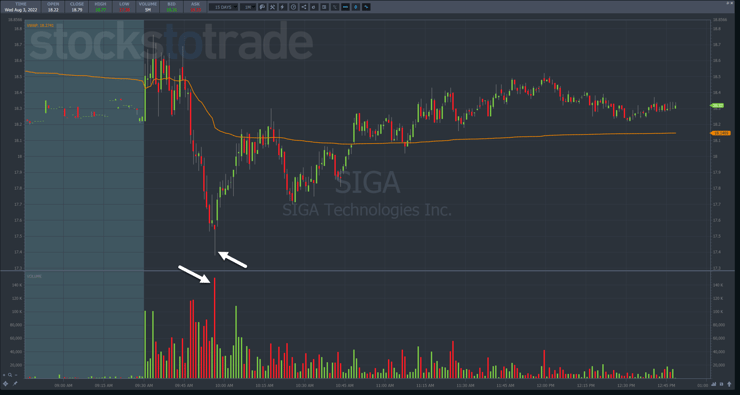

This is a chart of SIGA Technologies Inc. (NASDAQ: SIGA), one of the biggest winners off the Monekypox news.

I drew a couple of arrows that point to a long tail candlestick and the associated volume.

This pullback happened within the first hour of trading but was well off the day’s highs.

Notice the shape of the candlestick.

The open is near the high of the candlestick along with the close. Below that is a long wick.

Think about this as a narrative.

Sellers came into the stock hard at the beginning. Yet, buyers stepped up with enough force to overcome those sellers and close the candlestick back near the highs.

Now, that could’ve happened because there weren’t a lot of sellers.

However, that’s where volume offers another clue.

The volume on that candlestick was the highest out of any that day.

So we know this was a big decision point where buyers and sellers battled for dominance.

Volume and price movement of this magnitude provide a potential trade setup if I want to dip buy this stock.

Ok, so what about time?

Think about how and when this occurred.

This wasn’t right at the open when the trading volume is almost always higher than the rest of the day.

It happened after volume had already died down.

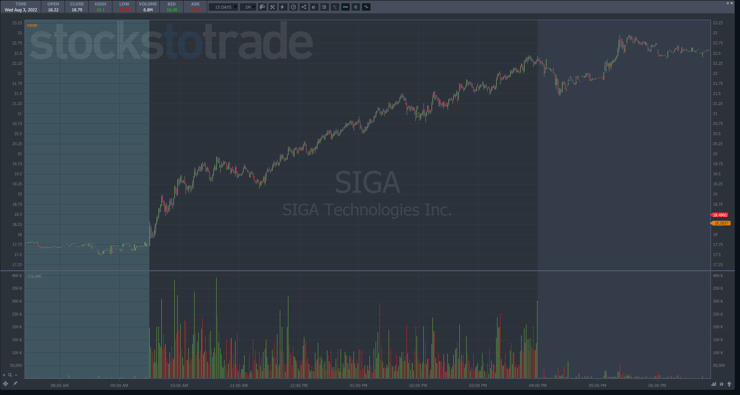

Compare that to another chart of SIGA below.

On this day, volume started and stayed high all day while shares kept moving higher and higher.

In fact, the pullbacks, although short, tended to coincide with lower volume.

So it wasn’t much of a surprise when volume dropped the following day that price slid lower.

Understanding Time

Price and volume are typically easy for folks to wrap their heads around.

Time is a bit harder.

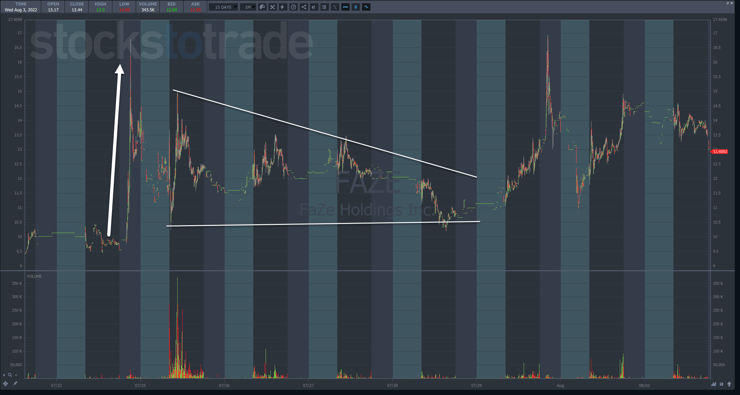

So let me explain it using a chart of FaZe Holdings Inc. (NASDAQ: FAZE).

Back on the 22nd, shares jumped in the post market, with the stock trading in a wide range on heavy volume the following day.

For the next several days, price traded on elevated volume in a tight range.

If a stock can hold the higher end of its trading range after a huge move, chances are it will make another move higher.

And the longer it takes for this to happen, the more likely it is short positions will build up and create the conditions for an epic squeeze.

Final Thoughts

Next time you’re about to enter a trade, try to build a story in your mind like I did here.

Ask yourself who’s in control and how long they’ve been in control.

These answers will help you decide whether the setup is likely to work or fail.

–Tim

Leave a reply