What You Need to Know About the Upcoming OTC Delistings: Key Takeaways

- Amendments to SEC rule 15c2-11 go into effect on September 28.

- There’s a simple zen-like mindset that can help you navigate the OTC obstacle course…

- Why you shouldn’t stress about any of this. (In fact, my students stressing about it riles me more than the actual rule.)

Why Jenny Isn’t Worried About the New Rules

I’m getting a ton of questions about the SEC rule going into effect on September 28. The SEC cracked down on a bunch of OTC “Pink No Information” companies as a way to protect investors…

Table of Contents

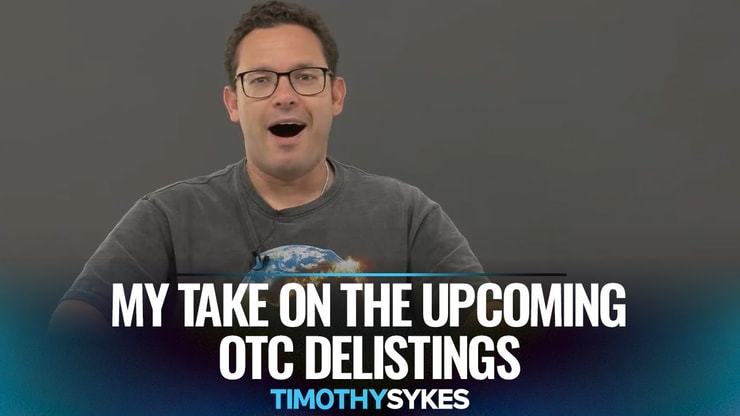

My Take On the Upcoming OTC Delistings

A lot of OTCs have been scrambling to get current. It’s pretty crazy what lengths they’ll go to, all to appear legit. But it shouldn’t be a surprise.

Remember, these are some of the sketchiest stocks in the entire market. Many are shell companies. Very few have products or meaningful revenue. Most aren’t up to date with filings.

In this video, you’ll find…

- Why you shouldn’t freak out, no matter what your broker says about which stocks you can or can’t trade after September 28. (I use these brokers.)

- Common misconceptions about a bear market that apply to the current situation.

- Why ‘in-the-know’ promoters are just as ignorant as misinformed newbies.

- How to cut through all the BS and spend your time on what really matters in trading.

What to Do If You Can’t Trade a Ticker

So, what should you do if you can’t trade some tickers after September 28?

The simple answer nobody wants to hear is…

Don’t trade them.

It’s as simple as that. If you can’t trade them, you can’t trade them. There’s NOTHING you can do to change it. Expect the worst out of every company, all the time. I can’t stress this enough.

Be cynical.

99% of penny stock companies fail in the long run. Or they survive because they change company name, ticker, and industry. And they dilute shareholders. They’re ALL junk!

Here’s another question I’m getting…

Would You Change Brokers to Trade a Stock?

If a broker allows a stock, but my broker doesn’t … maybe I’ll go to another broker. But I’m not even thinking about it except to answer the question.

I have no idea how this is gonna play out. Anyone saying they ‘know’ on social media is full of BS. Don’t trust any company or anyone saying, “This company has all the proper filings and is gonna be OK. Buy the dip.”

They’re lying. They know NOTHING.

Expect the worst at all times. Expect every penny stock to get delisted. Expect a bear market tomorrow and the whole thing to crash.

More Breaking News

- Strategic Acquisition Expands Momentus Inc.’s Horizons

- Huntington Bancshares Faces Earnings Miss, Market Considers Impacts

- KeyBanc Boosts Intuitive Machines with Higher Price Target

- Redfin’s ChatGPT Integration Enhances Home Search, Boosts Rocket Companies’ Market Presence

But THIS Company Deserves to Be Traded!

Shut up. That’s a waste of time and opportunity. Spend your time studying.

You can’t predict the unpredictable and you can’t trade the untradeable.

So, what should you do?

- Trade your patterns. The stock market isn’t going anywhere.

- Focus on what works for you. No single stock or trade will make you rich.

- React instead of predict. This might be the number one piece of advice I could ever teach you.

What am I going to do? I won’t change a thing. For me, predicting earnings, delistings, or market conditions — it’s a waste of time. It doesn’t matter.

If a stock gets delisted, and I can’t trade it … I won’t trade it.

Do You Have to Know Everything to Be a Successful Trader?

Putting it bluntly, no.

You think that to be successful you need to know everything. Stop spending your time trying to predict the unpredictable. You shouldn’t worry about something you can’t change.

Rules come and go — your job is to adapt.

I trade based on what I do know. (These are my rules.) Not based on what I don’t know. If it’s not something I already know, I have no comment and no opinion.

Tools & Education

Focus on studying. And for the love of all that is good … use the right tools!

StocksToTrade Breaking News

Use StocksToTrade Breaking News.* I use it every day — it’s the single most important tool in my arsenal right now. If there’s anything to know about the delistings, that’s where I’ll get the information.

Trading Challenge

If you want webinars, video lessons, DVDs, and chat … apply for the Trading Challenge. That’s where I do student Q&A — so you don’t have to worry about things like this in the future.

What do you think of the new SEC rules? Comment below with “I will react instead of predict.” I love to hear from all my readers, so comment below.

Disclaimer

*Tim Sykes has a minority ownership stake in StocksToTrade.com.

Leave a reply