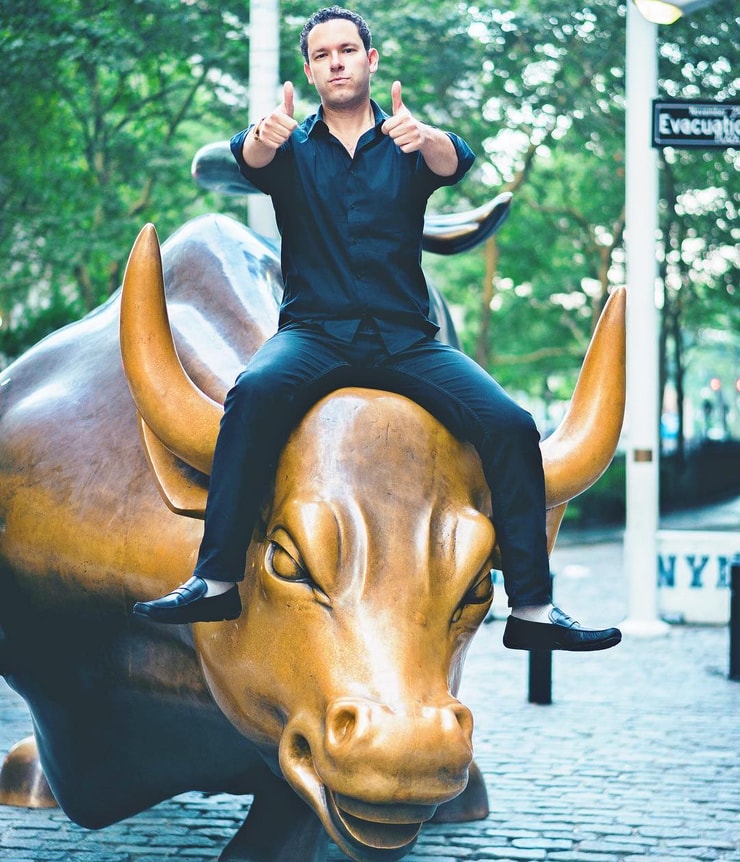

It might not feel like it…but we’re in a bull market.

Last week the S&P 500 closed above its October 2022 lows, a gain of more than 20% and the mark of a new bull market.

Even if economists believe we’ll experience a mild recession, investors remain optimistic, thanks largely to the buzz surrounding AI and its transformative technology.

I made 630% in three years during the last bull market…

And I hope to make some ground after a slow start to 2023.

First things first, the playbook for trading bull markets is different.

That means you may have to change some things about your trading if you want to take advantage of the upcoming opportunities.

Table of Contents

#1 Cut Losses Quickly

The best part of bull markets is you have many more trading opportunities coming your way.

I think it’s easier to trade if you’re account is up.

If you’re trading with a lead, you’ll likely feel more comfortable taking good opportunities when you see them.

However, if you’re account is down. Then you might be more focused on not losing money vs. paying attention to the opportunities in front of you.

That’s why my number one rule is always to cut losses quickly.

If you can cut your losses quickly, I think you have a better chance of winning in the long term.

#2 Be Prepared

If you told me last year that you decided to trade one time a week, I wouldn’t have blinked an eye.

Why?

Cause trading sucked last year.

You see, there is a time for learning and a time for earning.

The last two years were rough for most traders.

But you couldn’t have asked for a better market if you were a newbie.

You want to improve your skills under harder, less forgiving market conditions and develop good trading habits.

Not the best time to make money…but an excellent one to learn.

If you’ve been studying hard the last two years…then there’s a chance you may see that hard work pay off over the coming months.

Definitely read https://t.co/bLHj3MhHU2 as I review the patterns that have worked best for me during a tough time for traders 2022-2023 so it's good to see & hopeful you can apple these tips in your own trading too!

— Timothy Sykes (@timothysykes) June 12, 2023

If you feel you are still behind…and missing some skills… I would step on the gas now…before this market heats up.

That said, as we start to get more trading opportunities…

You’ll want to:

- Have your morning watchlist ready

- Dedicate more screen time to trading

- Spend each day reviewing your trades

- Study trades you missed and the latest trends moving stocks

- Get up earlier and stay later

- Have the right tools

The stock market isn’t a 9-to-5 job. You could go weeks, months, or even years without making money.

That’s why being prepared is important when the market is giving you opportunities.

More Breaking News

- Roblox Stock Surges After Strong Financial Performance Reports

- Coty Faces Uncertainties with Earnings Miss and Strategy Revisions

- Clear Channel Outdoor’s Strategic Move: Major Acquisition Unfolds

- Sezzle Inc. Sets New CFO, Anticipates Financial Empowerment Initiatives

#3 Refine Your Process

For months I’ve been telling my students to take profits quickly. That’s because many stocks were trading choppily, making it difficult to manage risk.

However, you may not want to do that in a bull market. You may want to trade smaller and play for bigger moves.

You may have a rule where you only allow yourself to trade two symbols a day. But now that there are more opportunities, you may want to increase that number.

In addition, you’ll find certain strategies working better than others.

For example, one strategy that’s worked well in previous bull markets is trading on the way up.

You can still make gains on pumps…even if the stock price has already risen…just as long as you get out before the pump ends.

Who’s still up studying/working hard to gain the knowledge required to build your dream life over time? Most people wouldn’t dare study at a time like this & that’s why most people only dream about achieving their goals instead of turning their dreams into reality! YOU CHOOSE!

— Timothy Sykes (@timothysykes) June 10, 2023

Again, there are no hard rules here.

You’ll discover what adjustments you’ll need to make by reviewing your trades and trying to fix your mistakes.

#4 Focus On Good Setups

I love celebrating my students because I want others to see what’s possible when they dedicate themselves to studying and learning how to trade.

Please retweet and congratulate my hardworking/dedicated https://t.co/occ8wKmlgm students who are nailing $IDEX today! DON_JUAN: all out on $IDEX .. +$930 on it.. +$1700 on the day for it, Desertrader: beautiful $IDEX +$300 saved my day, amy_red: $IDEX in .088, sold .0941, .097,…

— Timothy Sykes (@timothysykes) June 13, 2023

But make no mistake about it.

You are running your own race.

You don’t want to envy someone else’s success or think you are a failure because you are not at the same level as someone else who started at the same time as you.

That’s why I tell my students not to focus on making money and profits.

Instead, I tell them to focus on finding good setups—like my weekend trade.

After reviewing your trades over time and finding you have success trading a specific pattern or setup, you’ll have the confidence to size up in the future.

Bottom Line

It might not feel like it…but we’re in a bull market.

The stock market isn’t the economy…so it shouldn’t be that surprising.

But after months of brutal trading conditions, I expect to see more opportunities open up.

If you’re still looking for someone to help you along your journey…then look no further.

Leave a reply