People love to freak out when the markets take a tumble.

The thing is, that’s when some of the BEST trade opportunities arise.

And finding them is easier than you think.

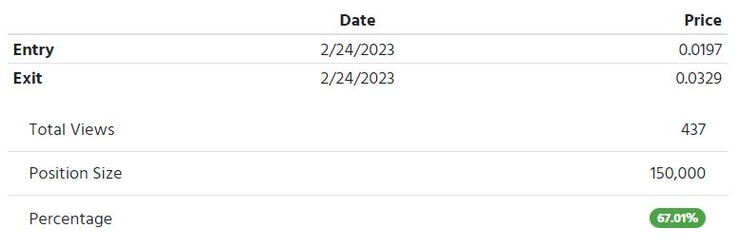

Despite a nasty sell-off on Friday and the major averages having their worst decline in 2023, I managed to execute a perfect trade that netted me nearly $2,000 in trading profits. (I risked $2,955 in capital to make $1,980).

Yes, good opportunities still exist…

Even on days, the overall market is getting walloped.

But you’ve got to be super-selective and patient.

Especially when 3 out of 4 stocks follow the market.

That’s how I nailed a 67% winner in the ticker symbol FAGI utilizing this strategy.

Let me show how I did it…

Ugly Market, No Problem

Investing and trading are two different things. When the market sells off, it strikes fear into investors because it creates uncertainty about the future.

But as traders, we know opportunities exist when the market is ripping higher or tanking hard.

You want to focus on how the stocks you’re trading are reacting.

For example, my main focus is on trading penny stocks. And one thing I’ve seen lately is that we do not see a lot of follow-throughs.

In other words, after a stock has a strong up-move, it doesn’t follow through the next day.

In a little bit, I’ll explain why it’s important and how it helped me manage my trade in the ticker symbol FAGI.

Trading One Of My Favorite Setups

I love trading this setup on Fridays.

And that’s what I saw in the ticker symbol FAGI last Friday.

At around 11ish, I saw that there was an SEC filing on a merger.

And the stock quickly reacted to it…moving from $0.02 to $0.024.

Now, when I typically trade this strategy, I’m looking to take these plays much later in the afternoon, about an hour or so before the close.

A lot of choppiness occurs during the mid-day, and it’s hard sometimes to hold through it. And that was one of the main reasons why I didn’t jump on it right away.

That’s where patience comes in.

I’m comfortable with the idea that I might miss a trade.

On the other hand, newbie traders will see the catalyst, see the stock trading higher, get excited, and buy because they have FOMO.

I know better.

So while I missed the initial spike, the stock actually sold off a few moments later, dipping to around $0.02.

Not knowing when or if the press release would follow the SEC filing, I decided to take a small position.

More Breaking News

- GTM Stock Gains: Strategic Moves Pave Way for Future Growth

- Bitmine’s Massive Holdings Propel Ethereum Market Dominance

- Exponent Sees Promising Growth with Dividend Increase and Upbeat Q4 Earnings

- Banco Santander Seals Major Acquisition, Enhances Market Position

I took a small position because it was still early for this type of trade.

Good thing I did because a few hours later, the stock dipped to around $0.02. It was after 1 PM, so I decided to add to my position.

That’s one of the benefits of starting a position small. If you’re unsure of your timing, you have room to add later on.

My goal was to wait for the press release from the catalyst, believing it would push the stock higher.

However, the stock started raging…

And although I wanted to wait for the press release…it was trading at $0.03.

That’s a 50% gain in about 3 hours!

I had to take some profits off the table, so I sold a little bit more than half of my position with the idea that I would hold the rest for the weekend.

I see many newbie traders get excited when they see profits on their screens. They want to grab them right away.

And that’s something you’ve got to learn to fight. You want to focus on the trade and stick to your plan.

But you know what?

This stock kept raging higher…

And when it hit $0.0361…I had to get out and take my profits.

Yes, I initially wanted to hold on and follow my plan all the way through.

However, I know that a 67% winner on this strategy is above average.

And when the market gives you a gift, you don’t ask questions—you take it.

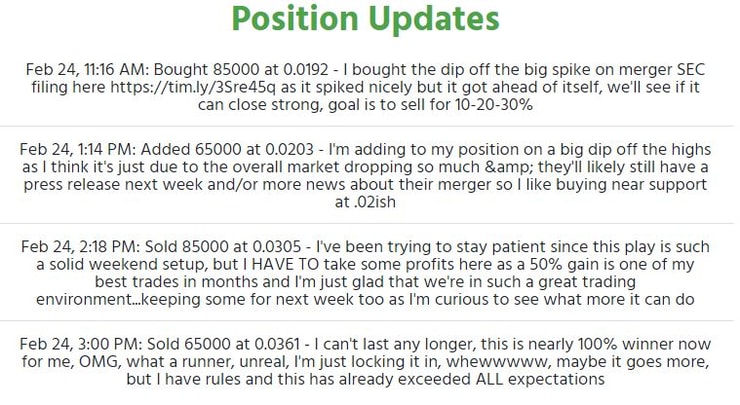

Here is my play-by-play that was sent out to subscribers:

Source: Profit.ly

Bottom Line

I was able to capitalize on FAGI for a couple of reasons:

- Strong catalyst

- Good entry price

- Patience

Although I initially planned to hold it longer, the market gave me a gift, and I couldn’t refuse it. If you’re patient and you know what setups work, you can even find trades on heavy-down days like last Friday.

The key is to stay disciplined and patient. If I had gotten too excited and bought at $0.024 after the initial spike, I would have gotten stopped when it dipped below $0.02.

I wasn’t upset that I missed the trade, and when the stock sold off, it allowed me to enter at a price I liked.

If you want to learn more about this strategy and how it works…Click here to get started.

Leave a reply