Most traders will hear about fast-moving stocks with massive spikes after they’ve happened…

But what good is that?

I like to find out about them as they’re happening…and in the best scenario… right before they ramp up.

Case in point – National Asset Recovery Corp (OTC: REPO) ran +400% yesterday.

A lot of traders were too late … not me.

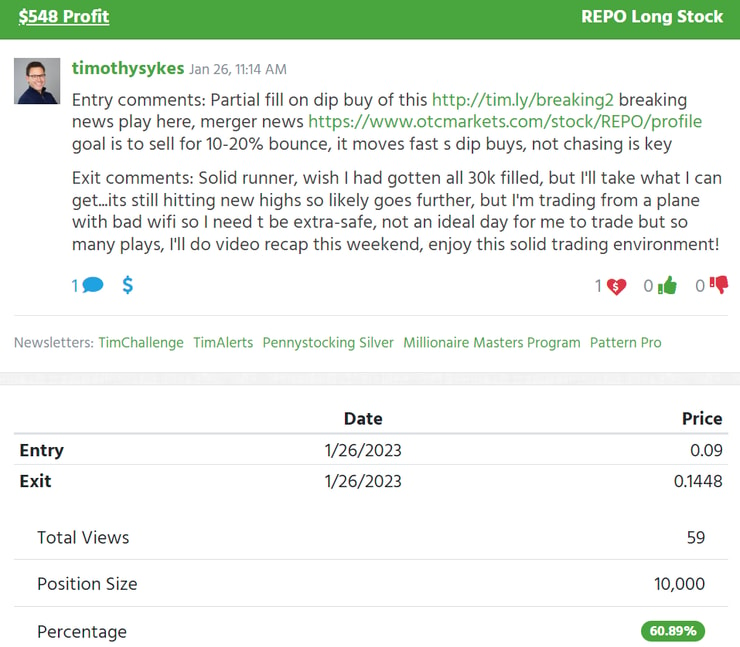

I was able to sit back, watch the spike, and plan a perfect entry for a +60% profit. While everybody else scrambled to get shares after finding the ticker too late.

I can show you how to access these plays before they get off the ground …

And I’m sure you’ve already heard me say; “these patterns repeat over and over”.

As long as I keep using this tool to find stocks before they spike, I can trade until the cows come home

Here’s how …

How I Profited

Like I typed in my trade review, it’s a shame I only got filled 10,000 shares. Otherwise, this trade would be a +$1,000 profit.

No matter. I was able to recognize the pattern and take a decent profit at a high percentage. Nothing wrong with that.

Here’s my trade …

I record all my trades on Profit.ly

All the props go to the boys at Breaking News.

More Breaking News

- Bitfarms Plans for U.S. Redomiciliation and Debt Repayment Spark Investor Interest

- Jumia Faces Market Headwinds Amid Rising Costs and Strategic Challenges

- Nektar Therapeutics Set to Discuss New Study Results

- Morgan Stanley’s Bold Moves Boost Cipher Mining’s Prospects

I said this in yesterday’s letter, maybe 50% of my profitable trades come from this one tool.

They alerted the news of a merger before the price even spiked.

I watched as it ran +170% before cooling off and falling just below $0.10.

That’s when I bought, waited for the price to move higher, and sold.

Here’s an image that helps …

The whole trade took less than five minutes.

I’m telling you. The Breaking News tool completely changes the way you see the market and helps uncover so many profit opportunities.

If I were you, I’d at least give it a try.

“Yeah but Tim, it costs money.”

We talked about this, in order to succeed you’ve got to get engaged and commit. Sometimes you’ve got to spend money to make money.

Also, this isn’t the pre-2000s anymore. Stocks can spike really fast. Computers have increased the market’s speed dramatically.

If I want an edge, the best way to do it is with a tool like the Breaking News scan.

You can start taking yourself seriously as a trader, or you can sit on the sideline.

To your success,

— Tim

Leave a reply