I hope you’re having a good weekend, but also remember take some time and reflect on recent trades/trends, as that is the key to becoming my next Millionaire Trading Challenge student!

Friday was a good example of a tough trade for me on CDXC and it brought about SO many questions, so I wanted to answer them in the videos below. I use this scanning tool for big % gainers over various time-frames and its invaluable real-time Twitter scanner too:

And yes, we transcribed the first video below too as I value my deaf Trading Challenge students too!

What’s up? Tim Sykes here. It is the weekend, and I want you to get used to using the weekends properly. Study recent trades, study recent patterns, always be looking to adapt and see what is working best in the markets. I’m going to review my latest trade here on CDXC in a second, but first, I’ve also got to give props to my student, John Papa.

I love that his profile is me and him at my Orlando conference. He is closing in on $12,000 in profits for the month,** and if you haven’t read his guest blog posts, where he basically turned his losses into profits, I highly suggest you do. You know, he has a great little… a great few tips here, and he has a great profit chart where he was just down-trending, and then, by studying, everything really started clicking. It’s not random that he was losing so much and now he’s making so much. It is a process.**

So, a lot of you guys, especially in the first month, two months, three months, six months, if you’re not understanding everything, guess what? That’s normal. It takes time to put everything together. And now, Papa John, I love that they’re advertising on his page. You know, he has turned it around, and as he’s documenting, you know, he doesn’t win every day, but it adds up, and now he’s making $10,000-plus per month.** So, props to you, John Papa. I will link his blog post underneath this video. But, I want you getting in the habits of studying on weekends. That’s a big part of his success. He has been constantly studying and learning to cut losses quickly. That is an important tool, okay.

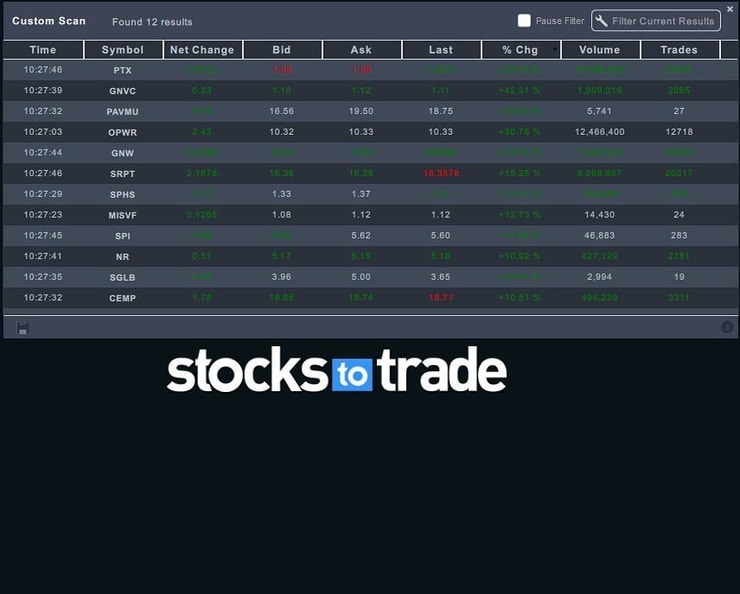

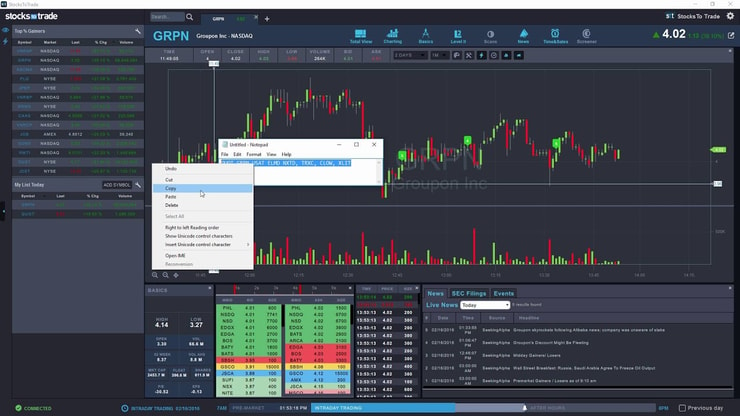

I was wrong about CDXC on Friday. This was the spike. There was news that Mark Zuckerberg, through one of his investment funds, was investing in CDXC. A lot of you guys are asking, how did I find it? You need to use StocksToTrade, okay. You should be using this software every single day. If you look right here, let me just show you, there are news scans, there are watchlists. We have big-percent scans. I mean, if you look at… Ugh, where am I going? Right here. You know, we have all these different scans built into StocksToTrade.

A lot of you guys are like, “What scans do I use?” Why do you think we created this software? These are scans that I have been using for the past two decades. So, click this little half-moon thing, or full moon, this half-moon thing, and you can see, you know, the different scans. Earnings winners have not really been working lately, so you have to adapt. But, the biggest percent winners over three days, over five days, and inter-day, and, you know, under $10 a share, under $5 a share, use these scans.

The way that I found CDXC, though, was not due to any of those big-percent gains. It was this spike, and the spike was due to news. So, several different people highlighted the fact that Mark Zuckerberg and his investment fund got into CDXC. Let me pull up some tweets. Hold on. Let me find them, real quick.

Here are some tweets. As I filmed this video lesson on a Saturday, it was less than 24 hours ago. All these different promoter accounts started tweeting about CDXC. It’s on volume watch. You know, you can sort, search through, and try to find like hot stocks with big volume, but there’s a lot of stocks with big volume. What interested me more was when they started saying this: “Mark Zuckerberg, through his investment fund, Iconiq, has invested in Chromatix.” So, that interests me, when you have the volume watch and you have the news, and then everyone starts talking about it, because when you have, you know, basically, a very well-known billionaire investing in this small piece-of-crap company, that’s interesting. And then, you know, more and more people start buying it, and the Zuckerberg effect can really spike the stock, and that’s exactly what happened.

I found this through using the Twitter scan. Look at this. StocksToTrade doesn’t just search through big-percent winners, it also searches through Twitters. And you can create your own Twitter scan. This is, right now, like it’s just searching through all of Twitter, and you can filter it. Ugh, sorry. Ugh, too many buttons! Filter results.

So, I like putting stocks under $6 a share, really under $10 a share. And so, you filter different tweets. I’m not on great Wi-Fi right now. Normally, it’s faster. Load. Hold on. Let me fix my Internet. Ugh.

More Breaking News

- Roblox Stock Surges After Strong Financial Performance Reports

- DealFlow Discovery Conference Unveils Corporate Opportunities

- AppLovin’s Stock Jumps Amid Optimistic Analyst Upgrades

- Microbot Medical Eyes Expansion with Key Milestones in 2026

Here are some tweets, okay. You’re basically just searching through Twitter for low-priced stocks that start getting talked about, and as it came up yesterday, on Friday, as I’m filming this on a Saturday, I know, by the time I publish it on Sunday, it’s going to be confusing. But, as I am looking for these stocks that are getting hyped up, I start noticing Mark Zuckerberg and CDXC, okay, so that alerts me. Anytime a famous billionaire starts talking about a small CAP company, I am interested, and you know, especially when it seems to be new news. So, everyone thinks that it is new news, and that’s why it starts spiking.

On the contrary, what it turns out is that it’s not new news, and that is what made it so tough. I didn’t know that it wasn’t new news when the thing was breaking. I was just trying to get in on the run-at because when the news, seemingly, is new, guess what? This thing can sky-rocket very fast. So, I am kind of this guy where I am like, “Oh my God, this is the kind of perfect catalyst. ” This stock is nicely off of its highs, so it’s not like I’m buying the stock right near its highs. ” I mean, this is what it’s been doing, so this stock is actually… Let me get rid of these. This stock is actually nearing its lows recently. And as it turned out… Where was the tweet? Somebody tweeted in there, my Challenge chatroom, that it wasn’t new news. Hold on. Let me find that.

So, here was the actual news tweeted from November, so roughly two and a half months ago, where CDXC did get the backing from Zuckerberg and Iconiq Capital. The problem is, is that it is old news. So, this entire spike is due to old news. The good news, though, you know, is that sometimes old news can still move stocks. This is a very inexact science. So, it’s actually pretty amazing that you know, that happened in November, okay, so it had a nice run, up from four to seven, and the volume never really got above a million shares. Now, for the first time, volume is getting to 3 million, and the stock is really around 5.**

So, this is all happening very quickly. I know that this video is kind of scatterbrained, but that’s kind of what the situation is. The good news is, Zuckerberg’s investment fund did invest in this company. The bad news is that its old news. The good news is that the stock is way off its highs. The bad news is that, frankly, it was tough to play. I thought that it would keep spiking. First of all, I bought it when I thought that it was new news. I thought that this spike would keep going. So, perhaps, I probably could have… I don’t know. You know you want to say, “Okay, I could have waited.” But, if I had waited, what if it had been breaking news, and then the stock is in the sevens or eights by the time I say, “Oh!” And then, next time, I say, “Oh, I shouldn’t have waited, I should have just bought.”

I think that I did, probably, the best thing, which bought it, you know, alert it, saying like, “Look, this thing can really spike,” and then simply exit when the price action wasn’t going my way. You know, part of the reason why I brought up John Papa making $12 grand in a month is that he had losses in the beginning, and he still has a few losses here and there, but you basically have to just control your losses when you’re wrong.

And I’m replaying the whole trade, you know, in my head again. I don’t think I would have done anything differently, you know. I would not have waited because then I might have missed out on this perfect play. I would not have not cut my losses because once more and more people started figuring out that it was old news, you know, the stock could just keep going down. You know, maybe, I… I don’t know. Like, should I have sold half? But, I don’t… You know, if the stock is going right, then I want to sell half, maybe take profits and let the other half go, but if the stock isn’t going right, I don’t want to just sell half, hold, and hope. You know, hope is not a strategy.

So, I’m perfectly fine with this. I’m protecting my account. I’m protecting my profits overall, on the week, on the month, on the year, forever. And this is the kind of speculative trade that, frankly, just didn’t go my way because it’s not as simple as we would like. If the news was brand-new, like I thought it was initially when I first got in, you know, this would be a huge profit, and this lesson would not be questioning how I traded or anything, it would just be about how to spot it, and that would be using, you know, StocksToTrade Twitter scans. I wish that was the lesson, but sometimes stuff doesn’t go your way and you have to learn to deal with it.

So, this could still spike on day two. You know, it was up-trending up to the close. It’s up-trending after hours to the 5.50. So, I didn’t have to cut my losses, but I like getting out of trades when they don’t go my way. I like getting out of trades when my initial thesis is busted. You know, if you understand this video, watch it maybe a few times, because of it kind of, you know… I don’t have enough time to plan this. Like, I’m just, I’m telling you exactly the sequence of events, where I saw it spiking, I saw the tweets, why I bought it, why I cut my losses. I want you to see everything.

But, long story short, when in doubt, get out. So, if you understand this lesson, leave that comment underneath this video, saying, “When in doubt, get out.” You know, there’ll be other plays when the news is brand-new, and the news will keep spiking the stock. Could this come back and get back to its highs of 5.75? Yes. Will I regret getting out? No, because my thesis was busted. I don’t care if I win or lose 5, or 10, or 15 cents a share on a $5 stock. I specifically got into this thinking that this thing, you know, was a rocket ship and this thing could really spike. And when that was not what was happening, who cares? Who cares if I make 5 or 10 cents a share? Who cares if I lose 5 or 10 cents a share? My thesis is busted. I have doubts.**

So, I follow that rule: when in doubt, get out. And in this case, so far, I didn’t have to, but in many cases and in most cases, you will have to get out to protect yourself from a bigger loss. This market is very forgiving. This market is kind of crazy. Like, it spoils a lot of newbies, where you don’t have to be so conservative in loss cutting. You don’t have to be so quick to get out. I mean, POTN is a good example. When I alerted this thing and I bought it, you know, in the 30s, it was a perfect breakout. This is what POTN has done. I mean, right here, when it broke 30, this is when I bought it several days ago, and now the thing, you know, has tripled to 90 cents. And guess what? I bought it at 30, and I sold it, like, you know, at 33. I made my 10%.**

As it turned out, it was a triple over two weeks, so a lot of people were like, “Oh, Tim, you so underestimated it.” I still made $1,500.** I was teaching a few students in person there. But, also, you have to understand, I mean, this is the single hottest stock in the entire market. I got a little lucky being in the right place at the right time, but the chart was perfect, the breakout was perfect, and it was a hot sector, so it wasn’t totally random.

But, what you need to understand about this market is that it’s okay to get out a little too early, or very early in the case of POTN. With CDXC, with my kind of play, it’s okay to play it overly safe. I know you don’t see it, but this market has a habit of spoiling a lot of you newbies, and the lessons that I teach won’t necessarily matter right now, but in a different market, you will want to protect yourselves. So, I’m going to teach you good habits. I’m going to teach you overly safe habits. I would greatly prefer you guys to be overly safe. I would greatly prefer you guys to lock in 10%, to cut in the gains on POTN, on speculative stocks like this, and so a little too soon, or very soon, way too soon, and just be safe. If you learn bad habits and trade overly aggressively, right now you might be getting rewarded, but in a different market, you will get crushed.

So, for me, I’ll get a little more aggressive every now and then, but deep down, the reason why I’ve been successful over the past two decades, the reason why I’m in this game, the reason why I’ve made millions, the reason why my big losses have really been compacted down, the reason why I have the most millionaire students is, I prefer safety over gun-slinging. So, if your number one complaint with me is that I take profits too quickly, I cut losses too quickly, I play overly safe, I will take that complaint as a compliment because, again, in a different market, you will get destroyed if you do not follow my kinds of safety rules. But, it’s your choice. All I can do is try to show you, and I’ll show you exactly how to manage losses. I’ll show you exactly how to take the risk and reduce it in penny stocks. You know, we’re trading the most volatile stocks in the world.

So, anyway, I’m happy with it. You know, I’m happy with this month, roughly $1,000 a day in profits.** And I really encourage you guys to use StocksToTrade, use the scans, you know, use these big-percent gain scans and big-dollar gains scans. Earnings win, not so much, right now at least. Use these custom news scans and custom Twitter scans. You know, I’ll include some video lessons underneath this video, too, on how to filter news scans and Twitter scans. We have the videos. We have the software. Too many of you guys just aren’t using it.

But, long story short, the best lesson from this video: when in doubt, get out. If you understand that, leave a comment underneath this video. I’ll see you in the chatroom tomorrow. We’ve got another busy week or Monday. Here’s to finding the next hot stocks!

Leave a reply