Wondering what are the best penny stocks 2022 has to offer?

The market is at unprecedented highs, and a massive influx of new individual traders and investors are sending the normally quiet penny stock world into overdrive.

According to data compiled by Themis Trading LLC, 6 of the 10 most active penny stocks traded on Monday were priced under $1 per share. This volume on these 6 stocks accounted for 18% of all shares trade in the entire stock market.

If you are wondering what the best penny stocks 2022 are, here are some of the hottest plays in the market right now…

Ozop Energy Solutions, Inc. (OTC Pink: OZSC), which ran from under 1 cent to over 6 cents, designs and manufactures power electronic equipment for power conversion use.

Charlie’s Holdings, Inc. (OTC Pink: CHUC) spiked from ½ cent to 4½ cents in just three days. The company is in the e-cigarette business.

Transportation and Logistics Systems, Inc. (OTC Pink: TLSS), which rose over 500% in the past month, provides freight deliveries up and down the east coast.

Tesoro Enterprises, Inc. (OTC Pink: TSNP) spiked from under a penny to 35 cents from November to December. The contractor installs a variety of floors for home owners and new-home builders.

Artificial Intelligence Technology Solutions Inc. (OTC Pink: AITX) was another sub-penny stock spiked to 5 cents on New Year’s Eve. The company focuses on artificial intelligence and robotic solutions for operational, security, and monitoring needs.

Alpine 4 Technologies, Ltd. (OTCQB: ALPP) surged an incredible 9,000% in about a month and a half from mid-November to the end of the year. It manufactures a host of different electrical and building parts.

SunHydrogen, Inc. (OTC Pink: HYSR) is up about 1,000% in the past two months. The business focuses on developing more efficient solar panels.

CloudCommerce, Inc. (CLWD) ran from under a penny to more than 18 cents in 5 days. The analytics company has customers in everything from retail to politics.

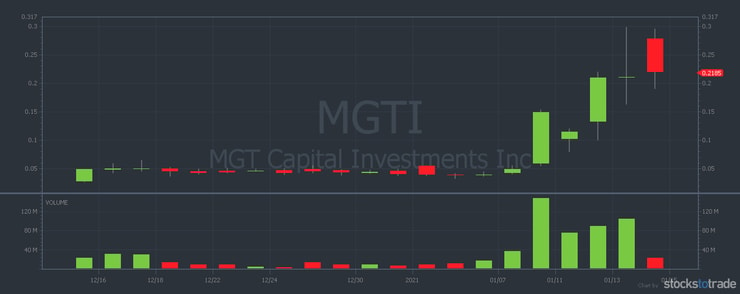

MGT Capital Investments, Inc. (MGTI) touched 30 cents yesterday and today, up from 5 cents last week. This company mines bitcoin.

BTCS Inc. (OTCQB: BTCS) is also in the cryptocurrency space. It focuses on digital currency ecosystems. It’s risen more than 1,500% as bitcoin spiked.

More Breaking News

- GMS Inc.: Surprising Turn of Events

- Rigetti Computing’s Stock Surges Amid Quantum Optimism

- Cipher Mining’s Bitcoin Boost: Buying Opportunity?

Bitcoin Services, Inc. (OTC Pink: BTSC) has run 500% in the past few days. It also engages in mining bitcoin, among other cryptocurrencies.

Enzolytics Inc. (OTC Pink: ENZC) is trading between 12 and 15 cents today, up from 1 cent two months ago. This franchise-based business offers specialty antimicrobial coatings.

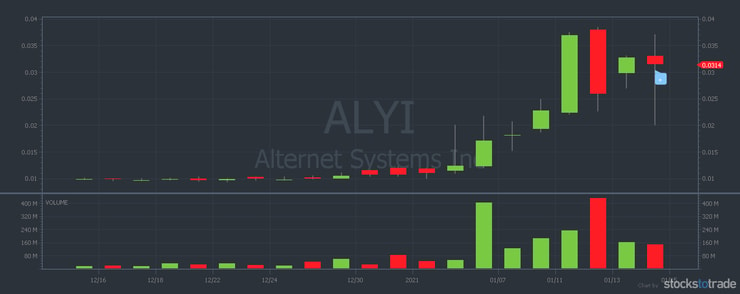

Alternet Systems, Inc. (OTC Pink: ALYI) rose over 200% in the past month. The electric vehicle manufacturer just announced it’s currently accepting pre-orders for a new all-electric motorcycle.

SolarWindow Technologies, Inc. (OTC Pink: WNDW) climbed more than 500% in the past three months. The company is developing a window coating that captures solar energy.

Digital Locations, Inc. (OTC Pink: DLOC) is spiking for the third time in three months, previous highs were 5-cents, 7-cents, and it’s currently trading near 4 cents. The business is focusing on 5G cell towers.

It’s not unusual to find one or two low priced OTC stocks in play on any given day. But the sheer volume of shares traded and the number of stocks in play hasn’t been seen in decades.

This is just a brief overview of the best penny stocks 2022 has in store.

How long will the demand for penny stocks stay this high? No one can say for sure.

But if the past is any indicator, major bull runs can run longer and go higher than anyone expects. Just understand that no trend lasts forever.

Posts contain affiliate links. Timothysykes.com may get compensated for affiliate posts and purchases through links.

Image: Branding Pot/Shutterstock.com

Leave a reply