Small Account Challenge Key Takeaways

- Learn how I train students with small accounts to be self-sufficient and trade through anything.

- See the first 2 trades I made with my new small account.

- Could a small account be your ticket to a gift from me? Learn more now!

Many day traders start with small trading accounts.

If this sounds like you, keep reading … I can teach you to grow your small account.

The stock market’s a high-risk/high-reward environment. The more money I use to trade, the more money I can win. But that also means I could lose more.

That’s why I think starting with a small account is better. You won’t lose as much in the beginning.

If you want to survive in the penny stock niche, you’ll need to learn the ropes ASAP. That’s where I come in.

I opened a small account with TradeZero to show students how to maximize a small account in the market.

I want to show you what’s possible. Check this out…

Table of Contents

What You Must Know at the Very Beginning

Learning to day trade penny stocks might be the most frustrating thing you’ll ever do. I remember when I first started out…

Stocks would spike hundreds of percentage points, but I had no idea how to predict their massive runs. But I kept at it. (Read more about my trading journey — get your no-cost copy of my autobiography here.)

Long story short, I cracked the code and became a millionaire.

Since then, I’ve started teaching. Now I have over 20+ millionaire students and counting! It’s been crazy the last few years.

My top students all forged their own paths in the markets, but there’s something they can all agree on…

Trading can be really frustrating in the beginning.

People get into stocks to make money. But that’s the wrong mindset! I know. It’s counterintuitive, I know. But the best traders I know learn the importance of focusing on the process first.

So forget about the profits and work to find your strategy.

And remember — small gains add up. That’s part of why I’m doing this small-account challenge. Again, I want traders like you to see what’s possible.

Read on to see how I’m growing my newest small account with the first two trades I’ve made…

Small-Account Challenge Trade #1

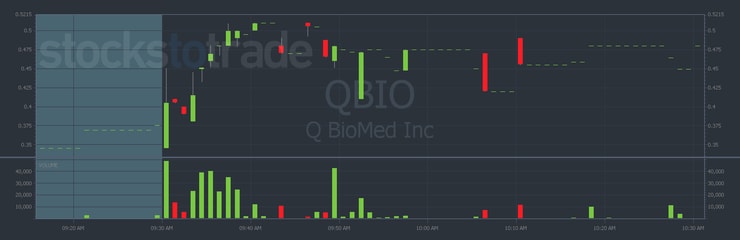

On December 16, Q BioMed Inc. (OTCQB: QBIO) released news of increased revenue. A classic earnings winner. I have a lot of experience with these.

I safely bought on a dip, then sold into strength as it broke out. It was a beautiful trade for a 15% profit from $0.425 to $0.49.

Notice this stock’s price. It was trading at half a cent.

That’s the beauty of penny stocks — their low price. You don’t need a big account to load up on shares.

My gain was just under $450. A lot of big traders look down on that kind of money. I don’t. The whole point of a small-account challenge is to grow your account with small gains and get over the PDT.

It’s how you gain experience, so when you’re ready, and your account is large enough, you can then start slowly scaling up over time.

More Breaking News

- Mullen Automotive’s Robust Quarter: Soaring Expectations or Volatile Forecast?

- Is GRAB on the Verge of a Breakout? Analyzing the Latest Market Moves

- Bright Minds Biosciences’ Shares Skyrocket: Untangling the Puzzle Behind the Dramatic Surge

And my percent gain was incredible! Most blue-chip stocks only move a few percentage points every day. I took the meat of the move.

Small-Account Challenge Trade #2

Not every trade will be a winner. Get used to it.

I’ve made over $7.3 million in profits trading penny stocks. But I still lose about a third of the time. (Check out all my trades on Profit.ly here.)

I’m not afraid to show my failures. Each trade — win or lose — is a lesson and an opportunity to grow. Let’s take a look…

My second small-account trade was later in the day on December 16. Illustrato Pictures International Inc. (OTCPK: ILUS) released news related to electric vehicles. That’s been a hot sector for a while.

In the afternoon, I bought it on a dip at $0.385 and ended up cutting it at $0.38 for a small loss.

This is the key to penny stock trading…

Wait for the best setups and cut losses if they fail.

I only lost about 1% on that trade. That’s critical! Keep your losses smaller than your wins. That’s how you grow a small account. Cutting losses quickly is my #1 rule for a reason.

Join Me

If you always wanted to learn how to trade penny stocks … now’s your chance.

I can teach you the ins and outs of the stock market. I always share my experiences to help my students. But I’m warning you … this isn’t for the faint of heart.

Think you have what it takes?

Apply here for my Trading Challenge. Already a student? Join my small account challenge here.

Time to start studying!

Are you excited about this small account challenge? Comment below and share how much you’re starting out with. There are no wrong answers!

Leave a reply