It makes investors sick to their stomachs…

The talking heads only see the downside of it…

But for us traders, it’s the key to financial freedom.

Without volatility, we wouldn’t get the chance to score 20%, 50%, or even 200% winners in a single day.

To win in this market, you must embrace it.

Say it out loud with me: “Volatility Equals Opportunity.”

The most recent action in SOBR Safe Inc. (NASDAQ: SOBR) proves it.

In just a moment, I’ll share why this has been one of the best traders this month…

But first, a word of caution…

Many of you know I stopped short-selling several years ago when it got too crowded.

I saw too many folks pressing the short side and realized the potential squeezes could obliterate my account.

That decision kept me away from huge losses and generating consistent profits.

You’ve heard recent horror stories about traders getting squeezed in BBBY, HKD, and ILAG…

Instead of shorting high-flyers, I’ve tweaked my strategy to dip buy into panics.

Year-to-date, its helped me generate just shy of $125,000 in trading profits.

See all my trades out in the open right here.

Now, back to the setup in SOBR.

There were many ways to profit from this one over the last week, and I want to show you how you could have.

I feel many more of them will pop up, and I want to ensure you’re ready to capitalize on them.

Stack the Odds

I want to put myself in the best position to make a profit on every trade I take, whether it’s just a few shares or a few thousand.

All it takes is a little common sense.

For example, would you rather buy a stock in an uptrend or a downtrend?

The answer should be pretty obvious.

When I buy into an uptrend, I have the bigger-picture stock momentum work with me.

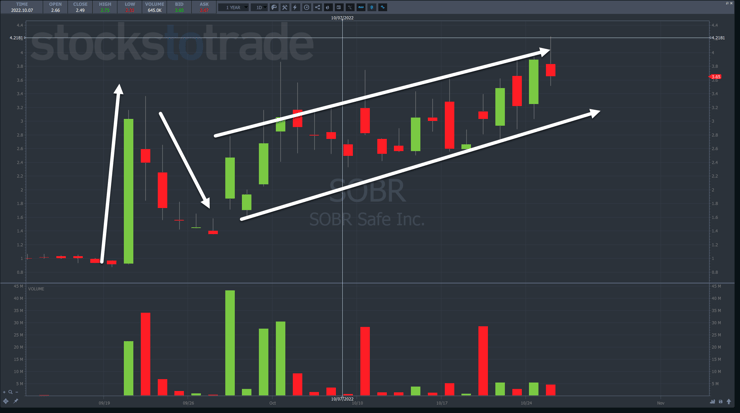

Here’s what that looked like in SOBR.

This daily chart shows the initial push made back in September.

Shares rose from a little less than $1 to over $3.

That immediately put this stock on my watchlist.

Over the next several days, SOBR faded as most runners do.

However, it rebounded and began trading higher in a clear channel, which changed everything.

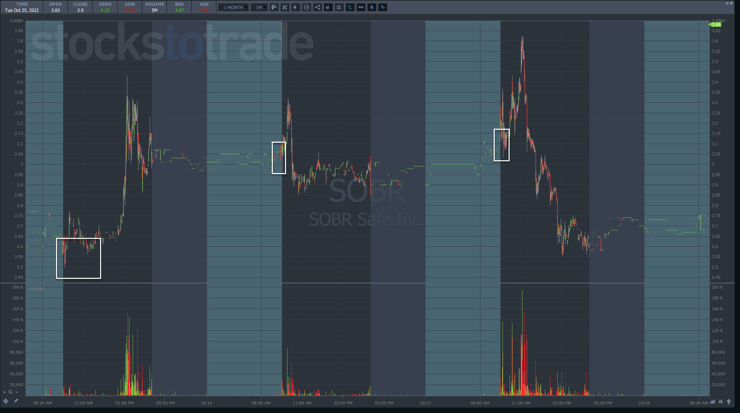

Something very interesting emerges when I dig down into the intraday price action.

I picked three days at random to show you where potential trades existed.

What I want to focus on are the white boxes.

Nearly every day, SOBR dips at the open in a bit of a panic, reverses, and shoots back up.

This creates the perfect opportunity for morning panic dip buys.

Let’s dig into one of the most recent occasions.

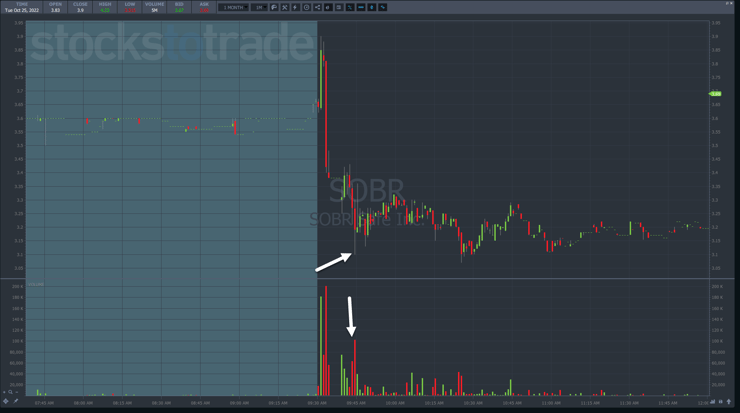

Here is the 1-minute chart from Tuesday.

You can see the same sell-off at the open preceded a huge spike.

I drew two white lines at potential support areas defined by the post-market low from the day before, and the low of a consolidation right before the close.

Once you know to look for this setup, then it’s a matter of timing the trade.

When to Jump in

Many people think I know exactly what number the stock will stop at before it gets there.

The truth is I have a list of possibilities in my mind.

I supplement that with price action and Level 2 analysis.

For example, you’ll notice at the bottom that the morning panic dip volume isn’t great.

I’d like to see heavy volume and a clean reversal to trade against.

This is a better example where the temporary low came on decent volume.

I can also use Level 2 data to look at where buyers begin to step into the market.

Level 2 data displays the current bids and asks from market makers.

I look to see the number of buyers at the bid and sellers at the ask.

The more buyers at the bid, the more likely a stock is to tick higher.

Plus, if I start to see more volume occur at the asking price, I know that buyers are willing to pay more to own the stock, typically a bullish sign.

More Breaking News

- Coca-Cola’s CEO Sells Shares: Market Reactions and Financial Insights

- DealFlow Discovery Conference Unveils Corporate Opportunities

- Datadog Sees Price Target Shifts Amid Market Changes

- SoFi Technologies Stock Surges: Q4 Wins Spark Analyst Upgrades

None of these individually gets me into a trade. But taken together, they help me decide when to jump in.

The Bottom Line

SOBR was a great trading vehicle this month because every selloff was met with buyers.

That trapped shorts in the trade so that every time we broke through an important resistance level, they got squeezed just a little more.

Remember, one stock can create multiple opportunities.

—Tim

Leave a reply